Get the free TOOLS FOR FINANCIAL COUNSELING INCLUDING FAITH-BASED - nacsw

Show details

TOOLS FOR FINANCIAL COUNSELING INCLUDING FATHEADED ACTIONS By: Flora Williams Presented at: NAC SW Convention 2015 November 2015 Grand Rapids, Michigan www.nacsw.org info NASA.org 8884264712 Tools

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tools for financial counseling

Edit your tools for financial counseling form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tools for financial counseling form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tools for financial counseling online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tools for financial counseling. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

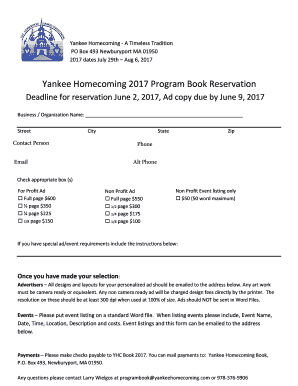

How to fill out tools for financial counseling

How to fill out tools for financial counseling:

01

Start by gathering all necessary financial documents, such as bank statements, pay stubs, tax returns, and bills.

02

Organize these documents in a systematic manner, either by creating folders or using digital tools such as spreadsheets or financial management software.

03

Analyze your income and expenses to get a clear picture of your financial situation. Categorize your expenses into essential and non-essential items to identify areas where you can save or cut back.

04

Calculate your debt-to-income ratio by dividing your total monthly debt payments by your gross monthly income. This will help you understand how much of your income is going towards debt and whether it is manageable or not.

05

Evaluate your spending habits and identify any areas where you may need to make adjustments. Look for opportunities to save money, such as reducing discretionary spending or finding ways to lower monthly bills.

06

Set financial goals based on your current situation and long-term objectives. This could include creating an emergency fund, paying off debts, saving for retirement, or investing for future expenses.

07

Create a budget that aligns with your goals. Allocate your income towards different categories such as housing, transportation, groceries, entertainment, and savings. Consider using budgeting tools or apps to help track your expenses and stay on target.

08

Review your insurance coverage, including health, auto, home, or any other policies you may have. Ensure you have adequate coverage to protect yourself and your assets.

09

Seek professional advice if needed. Financial counselors or advisors can provide personalized guidance and help you develop a comprehensive financial plan tailored to your needs.

10

Regularly monitor your progress and make adjustments as necessary. Revisit your financial tools, update your information, and reassess your goals as your circumstances change.

Who needs tools for financial counseling?

01

Individuals who want to gain better control over their finances and improve their financial literacy.

02

People facing debt or financial hardships who need guidance on budgeting, debt management, and financial planning.

03

Young adults who are starting their financial journey and want to develop good money habits.

04

Individuals planning major life events, such as buying a home, starting a family, or retiring, who need help in managing their finances during these transitions.

05

Anyone interested in optimizing their financial situation, setting realistic goals, and achieving financial independence.

Remember, the tools for financial counseling are not limited to any specific demographic or financial situation. They are essential for anyone seeking to improve their financial well-being and make informed decisions about their money.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tools for financial counseling?

Tools for financial counseling are resources, strategies, and techniques used to help individuals manage their finances better.

Who is required to file tools for financial counseling?

Anyone seeking financial counseling or advice may use tools for financial counseling to enhance their financial knowledge and skills.

How to fill out tools for financial counseling?

To fill out tools for financial counseling, individuals can use online resources, worksheets, or work with a financial counselor to create a customized financial plan.

What is the purpose of tools for financial counseling?

The purpose of tools for financial counseling is to help individuals make informed financial decisions, budget effectively, set financial goals, and improve their overall financial well-being.

What information must be reported on tools for financial counseling?

Information reported on tools for financial counseling may include income, expenses, debts, assets, financial goals, and a budget plan.

Can I sign the tools for financial counseling electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your tools for financial counseling in minutes.

Can I edit tools for financial counseling on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tools for financial counseling on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out tools for financial counseling on an Android device?

Use the pdfFiller Android app to finish your tools for financial counseling and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your tools for financial counseling online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tools For Financial Counseling is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.