Get the free VAT No LOV1000219858

Show details

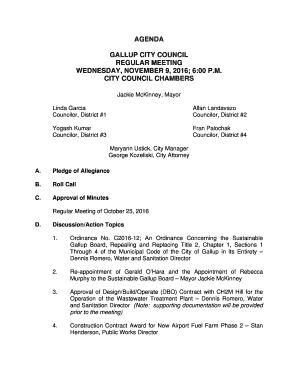

THE CHARTERED INSTITUTE OF BANKERS OF NIGERIA (Incorporated in 1976 and Chartered by Decree 12 of 1990 Now Act No 5 of 2007) BANKERS HOUSE PC 19, ADELA HOPEWELL STREET, P. O. BOX 72273, VICTORIA ISLAND,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vat no lov1000219858

Edit your vat no lov1000219858 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat no lov1000219858 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vat no lov1000219858 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vat no lov1000219858. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vat no lov1000219858

How to fill out vat no lov1000219858:

01

Start by ensuring that you have all the necessary information and documents required to fill out the VAT number. This may include your company's details, tax registration number, and any relevant financial records.

02

Visit the official website or tax authority's portal where you need to register the VAT number lov1000219858.

03

Look for the designated section or form specifically designed for VAT registration or VAT number application.

04

Fill in the required fields accurately. This typically includes providing your company's name, address, contact details, and tax identification number.

05

Double-check all the information you have entered to avoid any errors or mistakes. Make sure the VAT number lov1000219858 is entered correctly.

06

Submit the completed form or application through the online portal. Some tax authorities may also require you to send physical copies of the application by mail or in person.

07

After submitting the application, wait for a response from the tax authority. They may require additional documents or information before approving the VAT number.

08

Once the VAT number lov1000219858 is approved, make sure to keep a record of it for future reference. Update your business information accordingly and start using the VAT number for any relevant financial transactions.

Who needs vat no lov1000219858:

01

Businesses that are required to charge and collect value-added tax (VAT) on their goods or services need a VAT number. This includes companies engaged in trading, manufacturing, or providing services subject to VAT.

02

Individuals or freelancers who exceed the annual turnover threshold set by the tax authority may also need to register for a VAT number lov1000219858, depending on the jurisdiction's regulations.

03

Any entity planning to engage in cross-border transactions within the European Union (EU) or other countries that enforce VAT must have a valid VAT number.

04

Even if not compulsory, some businesses may voluntarily choose to register for a VAT number to benefit from VAT reclaims, simplified invoicing procedures, or to enhance their credibility with partners or customers.

05

It is important to consult with a tax advisor or check the specific regulations of your jurisdiction to determine if your business needs a VAT number lov1000219858 and what the requirements are for registration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vat no lov1000219858?

The VAT number lov1000219858 is a unique identification number assigned to a business for tax purposes.

Who is required to file vat no lov1000219858?

Businesses that are registered for VAT are required to file VAT returns using the VAT number lov1000219858.

How to fill out vat no lov1000219858?

To fill out VAT returns using the VAT number lov1000219858, businesses need to report the total sales, purchases, and VAT collected or paid.

What is the purpose of vat no lov1000219858?

The purpose of the VAT number lov1000219858 is to track and collect Value Added Tax from businesses.

What information must be reported on vat no lov1000219858?

Businesses must report total sales, purchases, and VAT transactions when filing VAT returns using the VAT number lov1000219858.

How do I complete vat no lov1000219858 online?

Filling out and eSigning vat no lov1000219858 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the vat no lov1000219858 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign vat no lov1000219858 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out vat no lov1000219858 on an Android device?

Use the pdfFiller app for Android to finish your vat no lov1000219858. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your vat no lov1000219858 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vat No lov1000219858 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.