Get the free Membership Audit - flumc

Show details

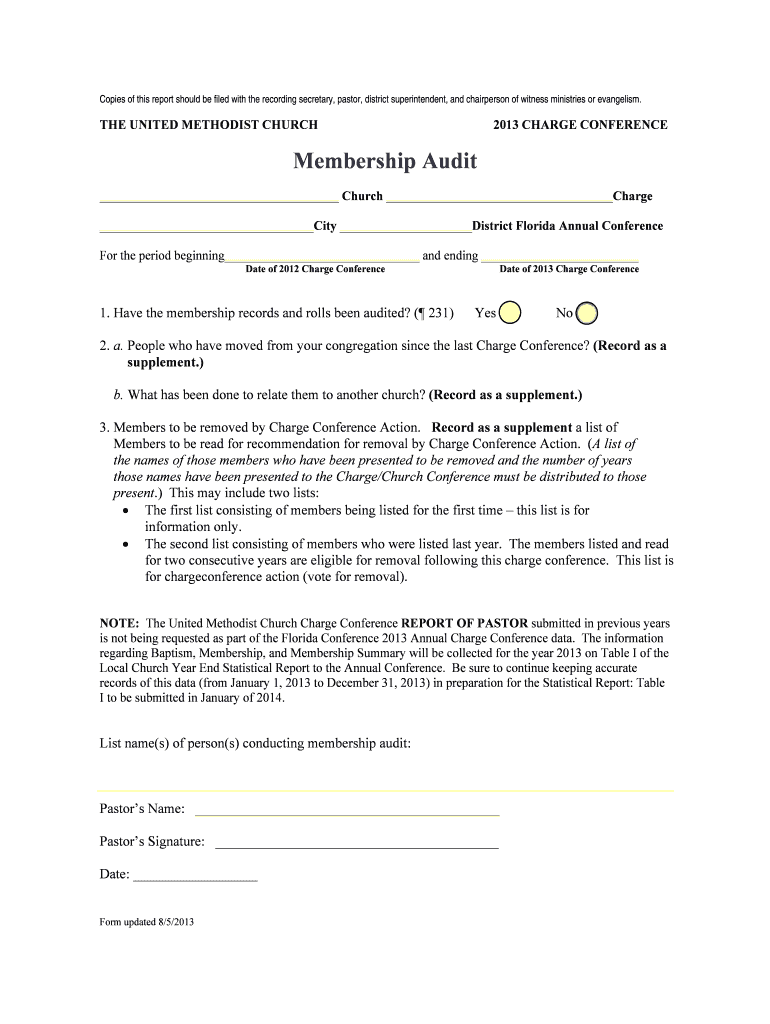

Copies of this report should be filed with the recording secretary, pastor, district superintendent, and chairperson of witness ministries or evangelism. THE UNITED METHODIST CHURCH 2013 CHARGE CONFERENCE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign membership audit - flumc

Edit your membership audit - flumc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your membership audit - flumc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing membership audit - flumc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit membership audit - flumc. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out membership audit - flumc

How to fill out membership audit:

01

Gather all necessary documentation and forms. This may include membership records, financial statements, and any relevant policies or procedures.

02

Review the requirements and guidelines for the audit. Familiarize yourself with the specific criteria and standards that need to be met.

03

Conduct a thorough examination of the membership records. Verify the accuracy and completeness of the data, ensuring that all necessary information is included.

04

Assess the financial statements provided. Check for any discrepancies, errors, or irregularities in the financial records. Make sure all income and expenses are properly documented.

05

Evaluate the compliance with membership policies and procedures. Ensure that all necessary protocols are being followed, such as the collection of membership fees or the proper handling of member information.

06

Prepare a detailed report of your findings. Document any issues or areas of concern that you come across during the audit process.

07

Communicate your findings to the relevant parties. This may include the organization's leadership, board members, or other stakeholders.

08

Make any necessary recommendations for improvement. Offer suggestions on how to address any identified deficiencies or areas that need attention.

09

Follow up on the audit process. Monitor the implementation of any recommended changes or improvements to ensure that they are properly implemented and effective.

Who needs membership audit?

01

Nonprofit organizations: Membership audits are often required for nonprofit organizations that have a membership base. This ensures transparency and accountability in the management of the organization's membership records and finances.

02

Professional associations: Professional associations often perform membership audits to maintain the integrity of their membership base. This helps ensure that individuals qualify for membership and adhere to the association's standards and regulations.

03

Clubs and societies: Social clubs, sports organizations, and other similar groups may conduct membership audits to verify the eligibility and active status of their members. This helps maintain accurate records and ensure fair membership practices.

04

Trade unions: Trade unions frequently carry out membership audits to confirm the accuracy of their membership lists and to verify that all members are up to date with their dues and contributions.

05

Co-operatives: Co-operative organizations may conduct membership audits to ensure that all members are in good standing, that membership records are accurate, and that membership fees or shares have been appropriately dealt with.

06

Professional licensing bodies: Membership audits are often required for professional licensing bodies to verify the competency and compliance of their members with the required standards and regulations.

07

Educational institutions: Educational institutions with a membership structure, such as alumni associations, may perform membership audits to maintain accurate records and facilitate communication with their members.

08

Charitable organizations: Charitable organizations may carry out membership audits to ensure that their members meet certain criteria, such as making regular donations or participating in volunteer activities.

In summary, membership audits are necessary for various types of organizations and associations to ensure compliance, accuracy, and accountability in managing their membership records and related activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my membership audit - flumc directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your membership audit - flumc and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send membership audit - flumc to be eSigned by others?

When you're ready to share your membership audit - flumc, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get membership audit - flumc?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific membership audit - flumc and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

What is membership audit?

A membership audit is a review of the membership records and financial statements of an organization to ensure accuracy and compliance with regulations.

Who is required to file membership audit?

Non-profit organizations and clubs that have members are typically required to file a membership audit.

How to fill out membership audit?

To fill out a membership audit, organizations need to review their membership records, financial statements, and any other relevant documents to ensure accuracy.

What is the purpose of membership audit?

The purpose of a membership audit is to verify the accuracy of an organization's membership records and financial statements.

What information must be reported on membership audit?

Membership audit typically includes information such as the number of members, membership fees, financial transactions, and any discrepancies found during the audit.

Fill out your membership audit - flumc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Membership Audit - Flumc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.