Get the free application for a child to transfer an NS&I Easy Access Savings Account to an NS&I I...

Show details

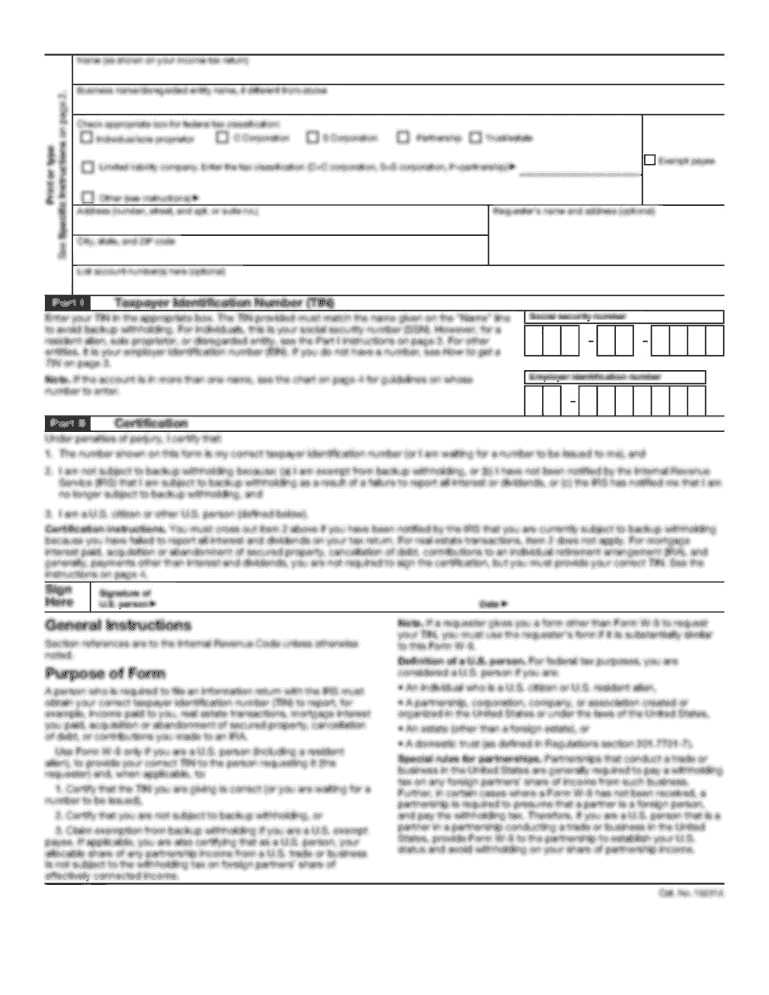

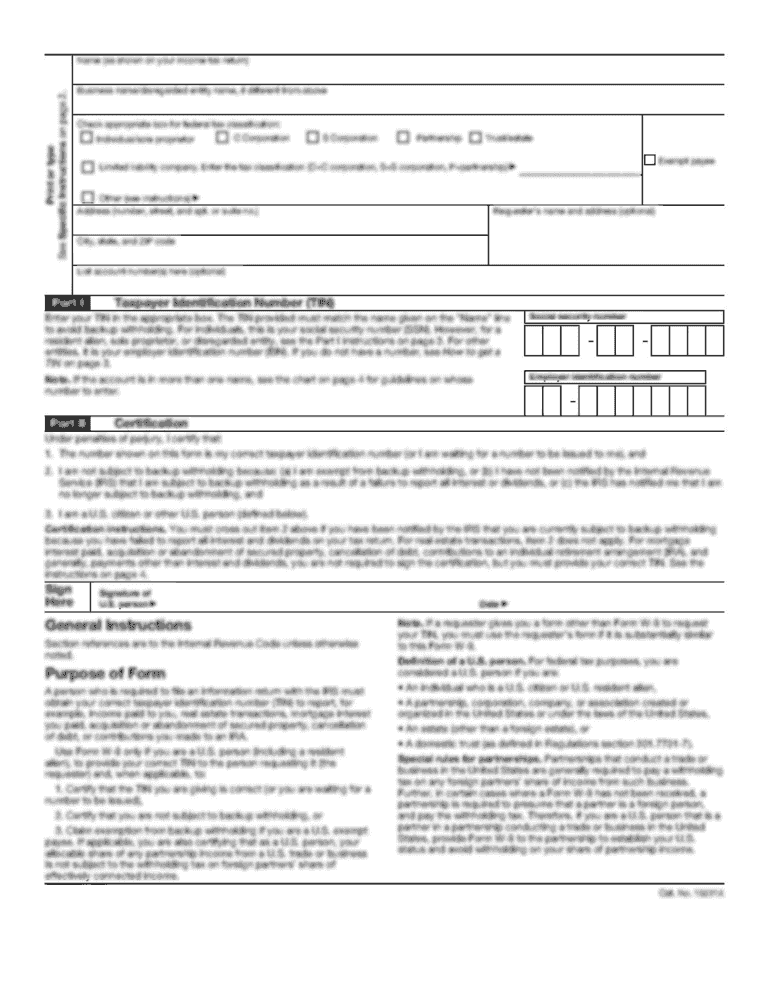

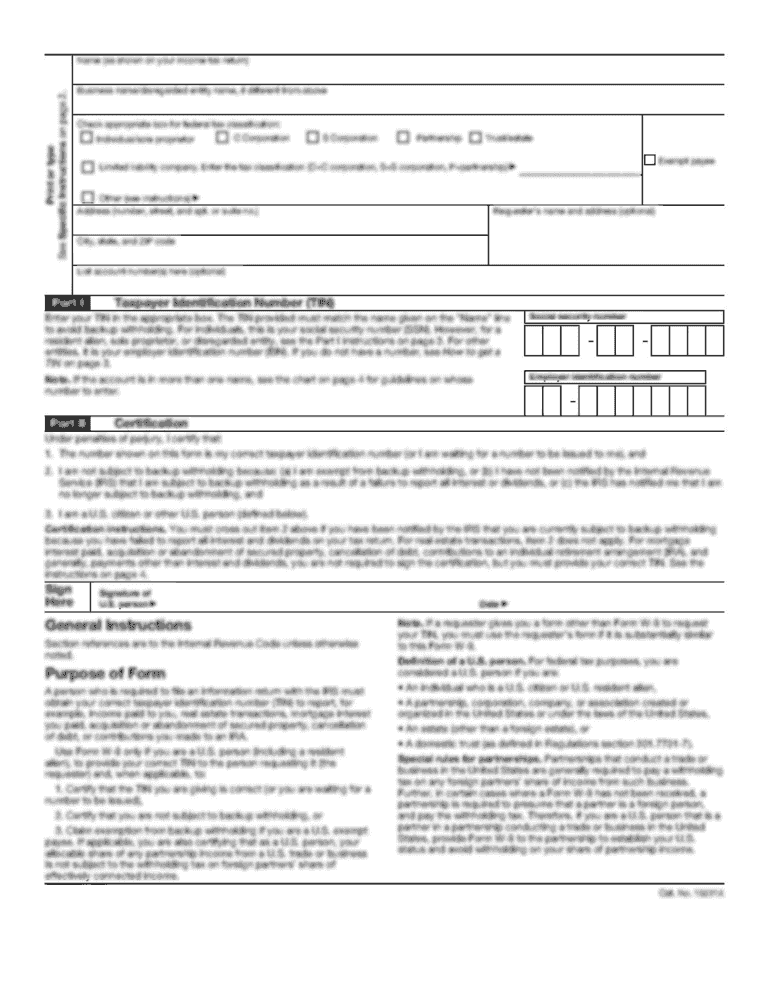

This form is used by children under 16 to transfer their Easy Access Savings Account to an NS&I Investment Account managed by their parent or guardian.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for a child

Edit your application for a child form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for a child form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for a child online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for a child. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for a child

How to fill out application for a child to transfer an NS&I Easy Access Savings Account to an NS&I Investment Account

01

Obtain the application form for transferring the NS&I Easy Access Savings Account to an NS&I Investment Account. This can be downloaded from the NS&I website or requested directly from NS&I customer service.

02

Fill in the child's details as the account holder, including their name, date of birth, and address.

03

Provide your details if you are the parent or guardian completing the application, including your name, relationship to the child, and contact information.

04

Indicate the details of the current NS&I Easy Access Savings Account, including the account number.

05

Specify the NS&I Investment Account type you wish to transfer to and include any necessary investment options or preferences.

06

Review the completed application form carefully to ensure all information is accurate and complete.

07

Sign and date the application form, confirming that you authorize the transfer on behalf of the child.

08

Send the completed application form to NS&I via the address provided on the form or submit it online if applicable.

Who needs application for a child to transfer an NS&I Easy Access Savings Account to an NS&I Investment Account?

01

Parents or guardians who manage a child’s financial accounts and wish to transfer the child’s funds from an NS&I Easy Access Savings Account to an NS&I Investment Account.

Fill

form

: Try Risk Free

People Also Ask about

How do I transfer premium bonds to my child?

You can apply online or by post. You can ask us to send you an electronic or paper gift card for you to pass on to the child. We'll also send you an acknowledgement of your investment. But only the nominated parent or guardian will be able to manage and cash in the Bonds.

Can you put Premium Bonds in a child's name?

Remember, although you can buy Premium Bonds for someone else's child as a gift, you won't be able to look after the investment on their behalf or have the Bonds to be repaid to you.

Can I open an NS&I account for a child?

Children under 16 are eligible to hold Premium Bonds, Junior ISA and Investment Account. While Junior ISAs can only be opened and managed by the child's parent or guardian, there are some different rules for other products.

Can a child have an investment account?

How old does my child have to be to buy stocks? To start investing in stocks on their own, your kid will need a brokerage account, and they must be at least 18 years old to open one. They can start earlier than this, but they'll need a parent or guardian to open a custodial account for them.

Can a child have an NS&I account?

Children under 16 are eligible to hold Premium Bonds, Junior ISA and Investment Account. While Junior ISAs can only be opened and managed by the child's parent or guardian, there are some different rules for other products.

What is the best investment account for a child in the UK?

Open a Junior ISA with Fidelity or Hargreaves Lansdown - both are free of platform fees. Set up a regular monthly payment into the account. Whatever you can afford. Invest it into a global equity tracker fund - they are low cost, and simply follows the performance of basically every listed company in the world.

How to download NS&I app?

You can download our Premium Bonds prize checker app on the Apple App Store or Google Play for Android devices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is application for a child to transfer an NS&I Easy Access Savings Account to an NS&I Investment Account?

The application is a formal request process through which a child or their guardian can transfer funds from an NS&I Easy Access Savings Account to an NS&I Investment Account, allowing for different investment opportunities.

Who is required to file application for a child to transfer an NS&I Easy Access Savings Account to an NS&I Investment Account?

The application must be filed by the child's parent or legal guardian who manages the child's financial affairs.

How to fill out application for a child to transfer an NS&I Easy Access Savings Account to an NS&I Investment Account?

To fill out the application, you need to provide the child's details, including their name, date of birth, the current account details, and select the desired NS&I Investment Account. Ensure all required information is accurately completed and submitted as per the guidelines.

What is the purpose of application for a child to transfer an NS&I Easy Access Savings Account to an NS&I Investment Account?

The purpose of the application is to facilitate the transfer of savings, enabling the funds to be utilized in investment opportunities that may yield higher returns compared to a standard savings account.

What information must be reported on application for a child to transfer an NS&I Easy Access Savings Account to an NS&I Investment Account?

The application must include the child's personal information, details of the current Easy Access Savings Account, details of the chosen Investment Account, and any necessary consent from the guardian.

Fill out your application for a child online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For A Child is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.