Get the free Debt Arrangement Scheme (Scotland) Regulations 2004 - legislation gov

Show details

These Regulations provide a scheme for repayment of multiple debts in Scotland, outlining the procedure and forms necessary for approval of a debt payment programme, as well as the roles of money

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt arrangement scheme scotland

Edit your debt arrangement scheme scotland form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt arrangement scheme scotland form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit debt arrangement scheme scotland online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit debt arrangement scheme scotland. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt arrangement scheme scotland

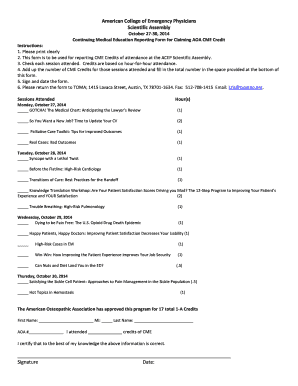

How to fill out Debt Arrangement Scheme (Scotland) Regulations 2004

01

Gather all necessary financial documents, including income statements, expenses, and details of your debts.

02

Complete the Debt Arrangement Scheme (Scotland) application form with accurate information about your financial situation.

03

List all of your debts in the application form, including creditor names, amounts owed, and any payment terms.

04

Calculate your disposable income by subtracting your essential living expenses from your total income.

05

Propose a reasonable payment plan based on your disposable income to repay your debts over time.

06

Submit the completed application to the Accountant in Bankruptcy along with any required documentation.

07

Await approval of your application from the Debt Arrangement Scheme, which will notify all your creditors of the proposal.

08

Make payments according to the agreed plan once it has been approved.

Who needs Debt Arrangement Scheme (Scotland) Regulations 2004?

01

Individuals in Scotland who are struggling with unmanageable debt and are looking for a formal repayment plan.

02

People who have multiple creditors and need assistance in consolidating their payments.

03

Those seeking legal protection from creditors while they work to repay their debts.

Fill

form

: Try Risk Free

People Also Ask about

Can you have a DMP in Scotland?

DMP – Informal debt solution DMPs are also available in Scotland, unlike IVAs. If you are wondering whether you should use a formal or informal debt solution to repay what you owe, you should seek debt advice to help you come to the best decision for you.

What is the Debtors Scotland Act 2007?

(Scotland) Act 2007 (“the 2007 Act”), all applications for bankruptcy were made by petition to the court. The 2007 Act made provision for an application for bankruptcy by a debtor to be made by debtor application to AiB rather than by petition to the court.

What is the debt arrangement scheme in Scotland?

The Debt Arrangement Scheme (DAS) is a scheme set up by the Scottish government. It helps you pay back your debts in a manageable way without the threat of court action from the people you owe money to (creditors). Under DAS you can make 1 regular payment into a debt payment programme (DPP).

How long can you be in a debt management plan?

There is no set time for a debt management plan to last. It will simply go on for as long as it takes you to pay off your debts.

How long is the debt arrangement scheme?

Unlike Trust Deeds, there is no set amount of time a Debt Arrangement Scheme can run for; however, the average length of this type of repayment plan is around six and a half years.

How long does DAS stay on a credit file?

As the fact that you've entered into a DAS remains on your credit record for six years, your inability to borrow could remain the case for some time. Once you are able to secure borrowing, the terms may be unfavourable, such as high interest rates and restricted products being available to you.

How long is a debt agreement?

Under a Debt Agreement you agree to repay an amount to your creditors over a set period of time, up to 3 or 5 years. This repayment amount is based on what you can reasonable afford to pay and has to be agreed upon by your creditors.

How long does a debt arrangement scheme last?

Your arrangement scheme will last as long as it takes for you to pay back your debts to creditors. A major advantage of a DAS when compared to other debts solutions is that setting up a debt payment plan allows you to repay your debt over a reasonable period of time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Debt Arrangement Scheme (Scotland) Regulations 2004?

The Debt Arrangement Scheme (Scotland) Regulations 2004 is a legal framework that allows individuals in Scotland to set up a payment plan to repay their debts over time while protecting them from creditors.

Who is required to file Debt Arrangement Scheme (Scotland) Regulations 2004?

Individuals who are struggling with debt in Scotland and wish to enter a debt payment plan under the Debt Arrangement Scheme are required to file the regulations.

How to fill out Debt Arrangement Scheme (Scotland) Regulations 2004?

To fill out the Debt Arrangement Scheme (Scotland) Regulations 2004, individuals must complete the application form providing personal details, financial information, and the details of their debts, along with a payment proposal.

What is the purpose of Debt Arrangement Scheme (Scotland) Regulations 2004?

The purpose of the Debt Arrangement Scheme (Scotland) Regulations 2004 is to provide a structured and legally-binding way for people in debt to repay their creditors while avoiding legal action and providing them with financial protection.

What information must be reported on Debt Arrangement Scheme (Scotland) Regulations 2004?

The information that must be reported includes personal details of the debtor, details of their income, expenses, assets, liabilities, and the proposed repayment plan for their debts.

Fill out your debt arrangement scheme scotland online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Arrangement Scheme Scotland is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.