Get the free Property Damage Coverage Extension - ctunderwriterscom

Show details

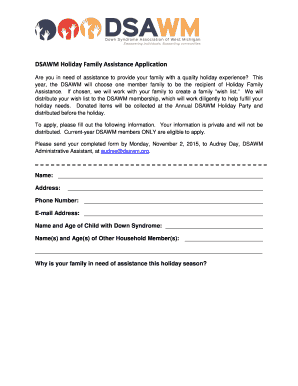

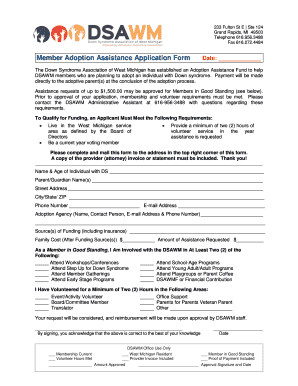

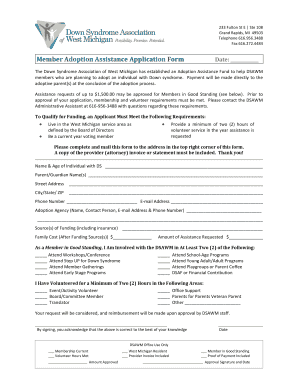

1. Name of applicant Street address City State Corporation Partnership Zip 2. Individual Other (Explain) 3. Please show number of: 4. No. of years in business No. of years experience License class/number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property damage coverage extension

Edit your property damage coverage extension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property damage coverage extension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property damage coverage extension online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property damage coverage extension. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property damage coverage extension

How to fill out property damage coverage extension:

01

Start by gathering all relevant information and documents related to the property damage. This may include photographs, repair estimates, or any other evidence of the damage.

02

Review your insurance policy to understand the coverage limits and conditions for property damage. Pay close attention to any specific requirements for filing a claim or extending the coverage.

03

Contact your insurance provider to notify them about the property damage and express your intention to file a claim or extend your coverage. They will guide you through the process and provide you with the necessary forms or documents to fill out.

04

Carefully fill out the property damage coverage extension form provided by your insurance provider. Provide accurate details about the damaged property, including the location, description of the damage, and estimated cost of repairs.

05

Attach any supporting documents or evidence you have gathered in step 1 to the property damage coverage extension form. This will help your insurance provider assess the claim or consider the extension.

06

Double-check all the information you have provided for accuracy and completeness. Any errors or missing details may delay the processing of your claim or extension request.

07

Submit the completed property damage coverage extension form and supporting documents to your insurance provider. Follow their instructions on how to submit the documents – it may be through mail, email, or an online portal.

08

Keep copies of all the documents you submitted, including the filled-out form and supporting evidence. This will serve as proof of your claim or extension request, in case any issues arise.

Who needs property damage coverage extension:

01

Property owners: If you own a property, whether residential or commercial, you may consider getting property damage coverage extension. This will provide additional protection against unexpected damage to your property, such as from natural disasters, vandalism, or accidents.

02

Landlords: If you are a landlord or property manager, having property damage coverage extension can be valuable. It can help cover repairs or replacements for damages caused by tenants or unexpected events.

03

Renters: While property damage coverage extension is typically for property owners or landlords, renters may also benefit from having their own renter's insurance policy that includes property damage coverage. This can protect your personal belongings in case of damage or loss caused by events like fire, theft, or water damage.

In conclusion, filling out a property damage coverage extension involves gathering relevant information, accurately completing the required forms, and submitting them to your insurance provider. Property owners, landlords, and even renters may consider getting this extension to protect against unexpected property damage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is property damage coverage extension?

Property damage coverage extension is a provision in insurance policies that allows for additional coverage to be provided for certain types of property damage.

Who is required to file property damage coverage extension?

It depends on the specific insurance policy and the circumstances surrounding the property damage. Generally, the policyholder or the insured party is required to file the property damage coverage extension.

How to fill out property damage coverage extension?

To fill out a property damage coverage extension, the insured party typically needs to provide information about the property that was damaged, the cause of the damage, and the estimated cost of repair or replacement.

What is the purpose of property damage coverage extension?

The purpose of property damage coverage extension is to ensure that the insured party is adequately covered in the event that their property is damaged.

What information must be reported on property damage coverage extension?

The information that must be reported on a property damage coverage extension typically includes details about the damaged property, the cause of the damage, and the estimated cost of repair or replacement.

How can I get property damage coverage extension?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the property damage coverage extension in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the property damage coverage extension in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your property damage coverage extension in seconds.

Can I edit property damage coverage extension on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign property damage coverage extension right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your property damage coverage extension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Damage Coverage Extension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.