Get the free pdffiller

Show details

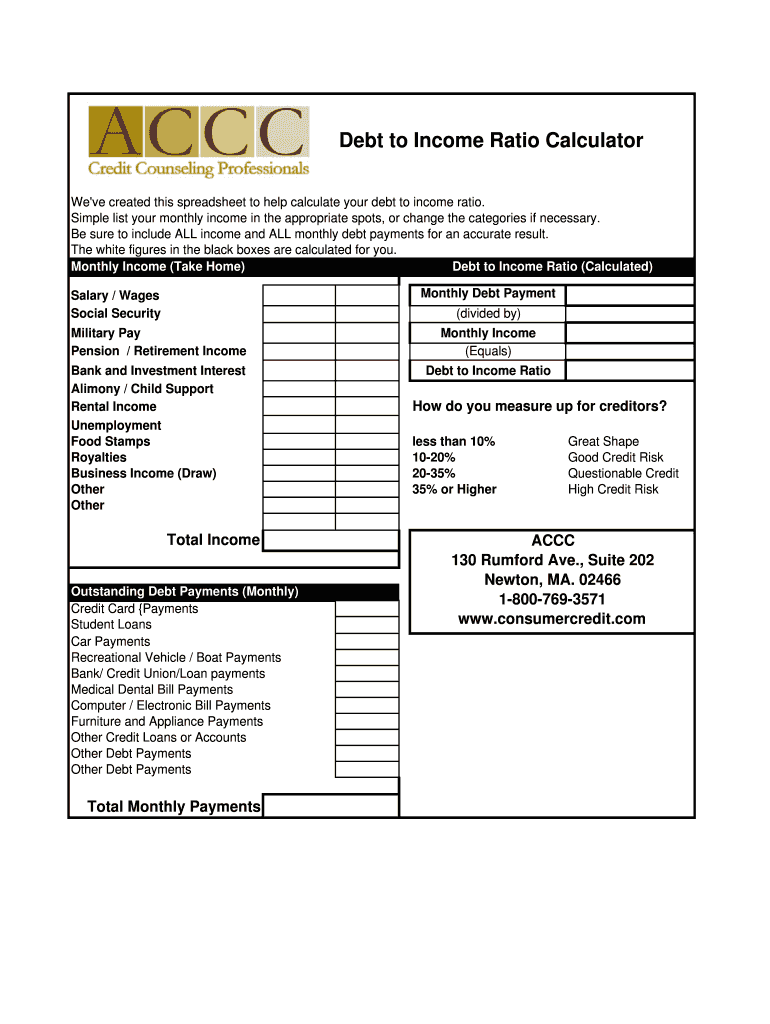

Debt to Income Ratio Calculator

We\'ve created this spreadsheet to help calculate your debt to income ratio.

Simple list your monthly income in the appropriate spots, or change the categories if necessary.

Be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pdffiller form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out debt to income ratio:

01

Gather your financial information: Start by collecting all of your financial information, including your income, monthly debt payments, and any additional expenses or liabilities that may affect your ability to pay off debt.

02

Calculate your monthly income: Determine your total monthly income, including wages, self-employment income, rental income, and any other sources of regular income. This will give you a clear picture of your financial capacity.

03

Identify your monthly debt payments: Make a list of all your monthly debt payments, including credit card bills, loan payments, and any other outstanding debts. Include both minimum payment amounts and any additional payments you make.

04

Calculate your debt-to-income ratio: Divide your total monthly debt payments by your total monthly income and multiply by 100 to get a percentage. This is your debt-to-income ratio.

05

Interpret the results: Generally, a lower debt-to-income ratio is considered favorable, as it indicates a lower level of debt compared to your income. Lenders and financial institutions often use this ratio to assess your creditworthiness and determine your repayment capacity.

06

Take necessary steps: If your debt-to-income ratio is high, it may be an indication that you have too much debt relative to your income. Consider implementing strategies to reduce your debt, such as creating a budget, cutting expenses, or exploring debt consolidation options.

Who needs debt to income ratio?

01

Individuals applying for loans: Lenders use the debt-to-income ratio to assess a borrower's ability to manage additional debt and make timely loan payments. This ratio helps them determine the level of financial risk associated with lending to a particular individual.

02

Homebuyers: Mortgage lenders often require potential homebuyers to provide their debt-to-income ratio as part of the loan application process. This helps them determine the borrower's eligibility for a mortgage and the maximum loan amount they can afford.

03

Individuals monitoring their financial health: Calculating and tracking your debt-to-income ratio can provide insights into your overall financial health. It can help you identify areas where you may need to reduce debt, adjust your spending habits, or improve your income to achieve a more stable financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete pdffiller form online?

pdfFiller makes it easy to finish and sign pdffiller form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit pdffiller form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your pdffiller form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit pdffiller form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share pdffiller form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is debt to income ratio?

Debt to income ratio is a financial metric used to measure an individual's monthly debt payments relative to their monthly income.

Who is required to file debt to income ratio?

Individuals applying for loans or mortgages are typically required to provide their debt to income ratio.

How to fill out debt to income ratio?

To calculate your debt to income ratio, add up all your monthly debt payments and divide by your gross monthly income. Multiply by 100 to get a percentage.

What is the purpose of debt to income ratio?

The purpose of debt to income ratio is to help lenders determine an individual's ability to manage additional debt and make payments on time.

What information must be reported on debt to income ratio?

Debt to income ratio typically includes all monthly debt payments such as credit cards, student loans, car loans, and mortgages.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.