Get the free RESIDENT PSDCODE

Show details

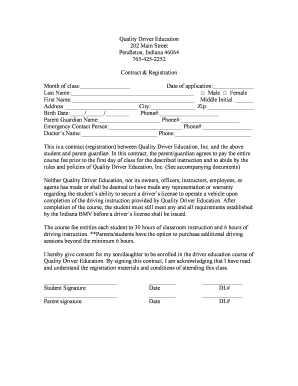

Local Earned Income Tax Withholding. EMPLOYEE INFORMATION — RESIDENCE LOCATION. TO EMPLOYERS/TAXPAYERS: This form is to be used by ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign resident psdcode

Edit your resident psdcode form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your resident psdcode form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing resident psdcode online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit resident psdcode. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out resident psdcode

How to fill out resident psdcode?

01

Make sure you have all the necessary information before starting. You will need your address, including the street name, city, and ZIP code.

02

Locate the application form or online portal where you need to provide your resident psdcode. Different states or regions may have different platforms for collecting this information.

03

Begin by entering your address details accurately. Double-check the spelling and formatting to avoid any errors. Ensure you include any apartment numbers or unit identifiers if applicable.

04

Find the field or section specifically asking for the resident psdcode. It may be labeled as "psdcode" or "resident code." This code helps to identify your specific location within a particular taxing district.

05

Locate your resident psdcode using the resources provided by your local government. In some cases, they may have an online lookup tool where you can input your address to obtain the correct psdcode. Alternatively, you can contact your local tax office for assistance.

06

Once you have determined your resident psdcode, carefully enter it into the appropriate field or section on the form. Take your time to ensure accurate input.

07

Review all the information you have provided before submitting the form. Make sure there are no typos or mistakes in your address or resident psdcode.

Who needs resident psdcode?

01

Individuals residing within certain tax districts or municipalities often need to provide their resident psdcode. This code helps local governments accurately assess and allocate taxes.

02

Homeowners or tenants who are required to pay property taxes typically require a resident psdcode. This code ensures that their tax payments go to the correct jurisdiction based on their residence.

03

Individuals filing income tax returns may also need to provide their resident psdcode. This information helps tax authorities determine the applicable local tax rates or exemptions.

04

Businesses that operate within specific districts may require a resident psdcode for tax purposes. This helps determine the appropriate tax obligations and compliance requirements for those establishments.

05

Individuals or organizations applying for certain licenses, permits, or government benefits may be asked to provide their resident psdcode. This information assists in determining eligibility criteria and jurisdictional requirements.

Note: The specific need for a resident psdcode may vary depending on the country, state, or region. It is essential to consult the relevant authorities or guidelines to determine whether you need to provide this code in a particular context.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is resident psdcode?

Resident psdcode is a unique code assigned to residents by the government for identification purposes.

Who is required to file resident psdcode?

All residents are required to file resident psdcode.

How to fill out resident psdcode?

Residents can fill out resident psdcode by submitting the necessary information online or through a designated government office.

What is the purpose of resident psdcode?

The purpose of resident psdcode is to accurately identify and track residents for various administrative and statistical purposes.

What information must be reported on resident psdcode?

Residents must report their personal information, address, and other relevant details on resident psdcode.

Where do I find resident psdcode?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific resident psdcode and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my resident psdcode in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your resident psdcode right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the resident psdcode form on my smartphone?

Use the pdfFiller mobile app to complete and sign resident psdcode on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your resident psdcode online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Resident Psdcode is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.