Get the free IRS 1B

Show details

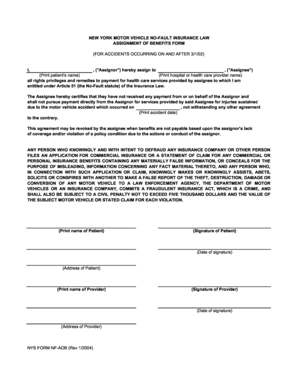

This document provides information on how to request an independent review of social fund grants and loans, including testimonials, instructions for application, and personal details section.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs 1b

Edit your irs 1b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs 1b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs 1b online

To use the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs 1b. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs 1b

How to fill out IRS 1B

01

Gather your personal information, including your Social Security number and filing status.

02

Obtain the IRS 1B form from the official IRS website or a local IRS office.

03

Fill out the top section with your name, address, and identifying information.

04

Complete the income section, ensuring to report all applicable income sources.

05

Follow the instructions for deductions and credits, filling them out in the allocated sections.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the IRS 1B form either electronically or by mail, following the instructions provided.

Who needs IRS 1B?

01

Individuals who are required to file a tax return and wish to report their income or claim deductions or credits may need IRS 1B.

02

Taxpayers who have specific income types or deductions that need to be reported on the IRS 1B form.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS P5 satellite used for?

IRS-P5 is a stereoscopic Earth observation satellite which generates Digital Elevation Models (DEMs) and other value added products.

When was the irs1 launched?

IRS-1A, the first of the series of indigenous state-of-art remote sensing satellites, was successfully launched into a polar sun-synchronous orbit on March 17, 1988 from the Soviet Cosmodrome at Baikonur.

What are IRS CDS satellites used for?

Option 4 is the correct answer: IRS series of Indian Satellites are used for Remote Sensing. Remote Sensing Satellites are used to collect data about spatial features on earth.

What is the purpose of the IRS 1B satellite?

IRS-1B was the second remote sensing mission to provide imagery for various land-based applications, such as agriculture, forestry, geology, and hydrology.

What are the IRS satellites used for?

IRS satellites are the mainstay of the National Natural Resources Management System, for which the Department of Space is the nodal agency, providing operational remote sensing data services. Data from the IRS satellites are received and disseminated by several countries all over the world.

What is the purpose of the IRS 1B?

The core purpose behind IRS-1B was to Operational remote sensing for resource management. ISRO also designed IRS-1B to support additional goals such as Agriculture, forestry, geology, hydrology applications; continuity to IRS-1A. As per ISRO documentation, the mission is Successful, Mission completed.

What are the bands of IRS-1A?

It has four spectral bands in the range of 0.45 to 0.86 μm (0.45 to 0.53 μm to 0.59 μm, 0.62 to 0.68 μm and 0.77 to 0.86 μm) in the visible and near infrared range with two different spatial resolutions of 72.5 m. and 36.25 meter from one no. of open LISS-1 and two nos.

What is the IRS satellite used for?

The IRS system is to provide remotely sensed data for applications in the areas of agriculture, hydrology, geology, drought and flood monitoring, marine studies, snow studies and land use and thus is central towards the establishment of the National Natural Resources Management System.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS 1B?

IRS 1B refers to a specific form or document used for tax reporting and compliance purposes, though its specific details may vary by tax year and situation.

Who is required to file IRS 1B?

Individuals or entities that meet certain criteria outlined by the IRS and are engaged in activities that require reporting on IRS 1B must file it.

How to fill out IRS 1B?

To fill out IRS 1B, you must provide accurate information as required by the form, including personal details, financial information, and any other relevant data to comply with IRS guidelines.

What is the purpose of IRS 1B?

The purpose of IRS 1B is to facilitate the accurate reporting of tax-related information needed by the IRS to assess tax liability and compliance.

What information must be reported on IRS 1B?

Information that must be reported on IRS 1B typically includes taxpayer identification, income details, deductions, credits, and any other specific financial data as required by the form.

Fill out your irs 1b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs 1b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.