Get the free Fundamentals of Operational Risk Management

Show details

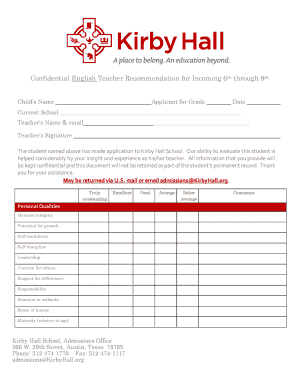

Fundamentals of Operational Risk Management This is an intensive course on Operational Risk Management & Mitigation from assessing the operational risks to how to implement a working, viable operational

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fundamentals of operational risk

Edit your fundamentals of operational risk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fundamentals of operational risk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fundamentals of operational risk online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fundamentals of operational risk. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fundamentals of operational risk

How to fill out fundamentals of operational risk:

01

Start by gathering all relevant information and data related to your organization's operational activities. This can include details on processes, systems, technologies, human resources, and any other factors that contribute to operational risk.

02

Identify and assess potential risks associated with each operational area. Conduct a thorough analysis to determine the likelihood and potential impact of these risks on your business. This step can involve brainstorming sessions, risk mapping exercises, and data analysis.

03

Develop a risk management framework that outlines your organization's approach to mitigating, managing, and monitoring operational risks. This framework should include clear policies, procedures, and controls to address identified risks.

04

Implement risk mitigation measures by assigning responsibilities to relevant individuals or departments, establishing monitoring mechanisms, and conducting regular risk assessments. This step ensures that operational risks are actively managed and controlled.

05

Provide proper training and awareness programs to employees regarding operational risk management. This will help in creating a risk-aware culture within the organization and enable employees to identify and report potential risks.

06

Continuously monitor and review the effectiveness of your operational risk management strategies. Regularly update and refine your risk management framework based on new insights, emerging risks, and changes in your operational environment.

07

Document all risk management activities, including risk assessments, controls, and mitigation efforts. This will help in maintaining a thorough record of your organization's operational risk management practices and also demonstrate compliance with regulatory requirements.

Who needs fundamentals of operational risk:

01

Risk Managers: Professionals responsible for identifying, assessing, and managing operational risks within an organization. They need a solid understanding of the fundamentals of operational risk to effectively carry out their responsibilities.

02

Compliance Officers: Individuals tasked with ensuring that the organization adheres to applicable laws, regulations, and internal policies. A sound knowledge of operational risk fundamentals is crucial for identifying compliance risks and implementing necessary controls.

03

Business Owners and Managers: Those in leadership positions need to be aware of operational risks that may affect their departments or business units. Understanding the fundamentals of operational risk enables them to make informed decisions and allocate resources effectively.

04

Internal Auditors: Professionals responsible for evaluating the effectiveness of an organization's risk management practices. A comprehensive understanding of operational risk fundamentals helps them assess the adequacy of controls and identify areas of improvement.

05

Board of Directors and Executives: These individuals have ultimate responsibility for overseeing the organization's risk management efforts. Familiarity with operational risk fundamentals allows them to provide strategic guidance, set risk appetite, and make informed decisions related to risk management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fundamentals of operational risk?

The fundamentals of operational risk focuses on identifying, assessing, monitoring, and controlling risks arising from people, processes, systems, and external events.

Who is required to file fundamentals of operational risk?

Financial institutions such as banks, insurance companies, and investment firms are required to file fundamentals of operational risk.

How to fill out fundamentals of operational risk?

Fundamentals of operational risk can be filled out by providing detailed information on risk identification, assessment, mitigation strategies, and monitoring processes.

What is the purpose of fundamentals of operational risk?

The purpose of fundamentals of operational risk is to ensure that financial institutions have effective risk management practices in place to identify and control operational risks.

What information must be reported on fundamentals of operational risk?

Information such as risk assessment methodologies, key risk indicators, incident reporting processes, and risk mitigation strategies must be reported on fundamentals of operational risk.

How do I execute fundamentals of operational risk online?

pdfFiller makes it easy to finish and sign fundamentals of operational risk online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out fundamentals of operational risk using my mobile device?

Use the pdfFiller mobile app to complete and sign fundamentals of operational risk on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit fundamentals of operational risk on an iOS device?

Create, modify, and share fundamentals of operational risk using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your fundamentals of operational risk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fundamentals Of Operational Risk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.