Get the free UNACCOMPANIED PERSONAL EFFECTS STATEMENT - customs gov

Show details

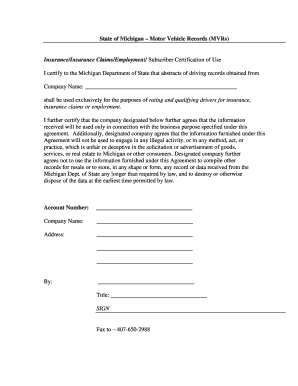

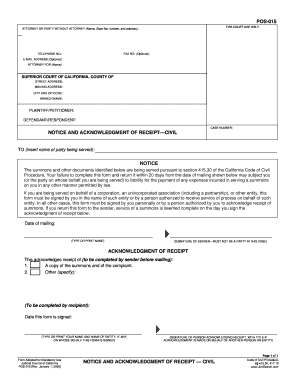

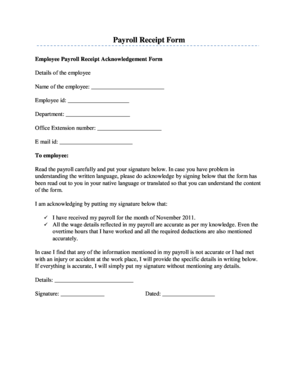

A statement form related to the declaration of unaccompanied personal effects.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unaccompanied personal effects statement

Edit your unaccompanied personal effects statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unaccompanied personal effects statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unaccompanied personal effects statement online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit unaccompanied personal effects statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unaccompanied personal effects statement

How to fill out UNACCOMPANIED PERSONAL EFFECTS STATEMENT

01

Start by obtaining the UNACCOMPANIED PERSONAL EFFECTS STATEMENT form.

02

Fill out your personal information, including your name, address, and contact details.

03

Provide information about your travel details, including flight numbers and dates.

04

List all personal effects you are claiming as unaccompanied, including descriptions and values.

05

Specify the reason for shipping these items separately.

06

Include any relevant documentation that supports your claim (e.g., receipts, inventory lists).

07

Sign and date the form to certify that the information is complete and accurate.

08

Submit the completed form along with any required documents to the appropriate authorities or shipping company.

Who needs UNACCOMPANIED PERSONAL EFFECTS STATEMENT?

01

Individuals traveling internationally who need to send personal belongings separately from their travel.

02

Military personnel or government employees moving to new assignments.

03

Students studying abroad who are shipping home excess personal items.

Fill

form

: Try Risk Free

People Also Ask about

What is the unaccompanied baggage declaration form in Australia?

A B534 form, also known as an "Unaccompanied Personal Effects Statement", is a mandatory customs declaration document that allows eligible visitors to ship belongings to Australia without paying customs duty or Goods and Services Tax (GST).

What is upe income?

You can deduct unreimbursed partnership expenses (UPE) if you were required to pay partnership expenses personally under the partnership agreement. Don't include any expenses you can deduct as an itemized deduction. Don't combine these expenses with — or net them against — any other amounts from the partnership.

What is the UPE tax in Australia?

An unpaid present entitlement (UPE) is where a beneficiary is made presently entitled to trust income but where the trustee does not discharge its obligation to pay that amount out to the beneficiary, either by transfer or set-off. There are a number of separate taxation considerations when it comes to UPEs.

Is a UPE a Division 7A loan?

Earlier this year, the Full Federal Court overturned the ATO's long-standing view that a UPE is a loan for the purposes of Division 7A in the decision of the Commissioner of Taxation v Bendel [2025] FCAFC 15 (“Bendel”).

What is the unaccompanied personal effects statement?

An Unaccompanied Personal Effects Statement (also known as Personal Effects Statement B534) is a document required when importing personal items into Australia that arrive separately from the person.

What is upe in Australia?

Overview. Unaccompanied Personal Effects (UPEs) are your household and personal items that you import into Australia but that arrive separately to you. UPEs may arrive in Australia by air, sea cargo or by international mail (post).

What is an unpaid present entitlement in Australia?

Division 7A may apply where there is a UPE – for example, where a private company is a beneficiary of a trust and is made presently entitled to income of the trust, but does not receive payment of the distribution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is UNACCOMPANIED PERSONAL EFFECTS STATEMENT?

The UNACCOMPANIED PERSONAL EFFECTS STATEMENT is a document required by customs authorities to declare personal goods that are being shipped separately from the owner, typically when traveling or relocating.

Who is required to file UNACCOMPANIED PERSONAL EFFECTS STATEMENT?

Individuals who are moving or traveling internationally and shipping their personal belongings separately from themselves are required to file the UNACCOMPANIED PERSONAL EFFECTS STATEMENT.

How to fill out UNACCOMPANIED PERSONAL EFFECTS STATEMENT?

To fill out the UNACCOMPANIED PERSONAL EFFECTS STATEMENT, individuals should provide specific details about their personal items, including descriptions, values, and the purpose of the shipment.

What is the purpose of UNACCOMPANIED PERSONAL EFFECTS STATEMENT?

The purpose of the UNACCOMPANIED PERSONAL EFFECTS STATEMENT is to inform customs about the nature of the shipped items and ensure compliance with regulations, helping to facilitate the importing process.

What information must be reported on UNACCOMPANIED PERSONAL EFFECTS STATEMENT?

Information that must be reported includes a detailed list of all items being shipped, their estimated values, and any relevant documentation such as invoices or proof of ownership.

Fill out your unaccompanied personal effects statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unaccompanied Personal Effects Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.