Get the free AUSTRALIAN CUSTOMS NOTICE NO. 2005/48 - customs gov

Show details

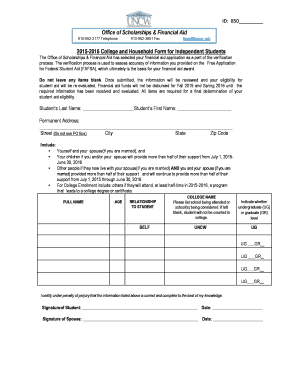

This document outlines the provisions of the Trade Marks Act 1995 regarding the objections to the importation of goods that infringe registered trademarks. It provides details on how registered owners

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign australian customs notice no

Edit your australian customs notice no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australian customs notice no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit australian customs notice no online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit australian customs notice no. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out australian customs notice no

How to fill out AUSTRALIAN CUSTOMS NOTICE NO. 2005/48

01

Obtain a copy of Australian Customs Notice No. 2005/48.

02

Read the introduction to understand the purpose and relevance of the notice.

03

Gather necessary details regarding your shipment or import.

04

Fill out the required fields accurately, including consignee information.

05

Ensure that you have the correct tariff classification for your items.

06

Provide any supporting documents that may be requested.

07

Review the completed notice for accuracy and completeness.

08

Submit the completed Australian Customs Notice No. 2005/48 to the appropriate customs authority.

Who needs AUSTRALIAN CUSTOMS NOTICE NO. 2005/48?

01

Importers who are bringing goods into Australia that are subject to customs regulations.

02

Businesses that need to comply with Australian customs laws.

03

Individuals shipping personal items that require customs clearance.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I forgot to declare something at customs?

Seizure of Items: Customs agents have the authority to confiscate undeclared items, even if they were brought into the country innocently. Fines and Penalties: Civil penalties can be significant. For example, not declaring currency over $10,000 can result in a fine equal to or greater than the amount.

How do I clear personal effects through customs Australia?

Clearing personal effects To clear your UPEs, you must complete and lodge an Unaccompanied Personal Effects Statement (B534 Form) (290KB PDF). This statement is a legal declaration to both the Department of Home Affairs and Department of Agriculture, Water and the Environment (Agriculture).

How do you know if customs seizes your package in Australia?

If you have imported prohibited or restricted goods, we will send you an Information Sheet (Seizure of Prohibited/Restricted Imports) advising that we are holding your goods and why, what you need to do, and who to contact for assistance.

What is a customs notice?

Customs Notices are issued to inform clients about proposed changes to customs programs and procedures. They are not intended as an ongoing reference. Note: Customs Notices are maintained online for the current and previous year.

What happens if you don't declare at customs in Australia?

You can be penalised if you don't declare goods or provide an incorrect declaration. You could: receive a fine of up to A$5,500. have your visa cancelled.

Do Australian customs check every package?

All imported goods are screened by the Australian Border Force and the Department of Agriculture, Fisheries and Forestry (DAFF).

What happens if you don't declare in Australia?

If you don't declare an item If you provide false or misleading information to a biosecurity officer or on your incoming passenger declaration, or if you fail to answer questions about the goods or comply with directions given by a biosecurity officer, you may be: issued with an infringement notice.

How strict are Australian customs?

Australia's customs laws prevent you from bringing drugs, steroids, weapons, firearms and protected wildlife into Australia. Penalties may apply, so before travelling, check the Australian Government website for information on prohibited goods, item declaration and penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AUSTRALIAN CUSTOMS NOTICE NO. 2005/48?

AUSTRALIAN CUSTOMS NOTICE NO. 2005/48 is a regulatory document issued by the Australian Customs and Border Protection Service that provides guidance on specific customs requirements and procedures.

Who is required to file AUSTRALIAN CUSTOMS NOTICE NO. 2005/48?

Individuals and businesses involved in the import and export of goods to and from Australia are required to file AUSTRALIAN CUSTOMS NOTICE NO. 2005/48.

How to fill out AUSTRALIAN CUSTOMS NOTICE NO. 2005/48?

To fill out AUSTRALIAN CUSTOMS NOTICE NO. 2005/48, the filer must provide accurate information as requested on the form, including details about the goods, parties involved, and compliance with relevant customs laws.

What is the purpose of AUSTRALIAN CUSTOMS NOTICE NO. 2005/48?

The purpose of AUSTRALIAN CUSTOMS NOTICE NO. 2005/48 is to ensure compliance with customs regulations and to facilitate the smooth processing of goods entering or leaving Australia.

What information must be reported on AUSTRALIAN CUSTOMS NOTICE NO. 2005/48?

The information that must be reported includes the nature of the goods, value, origin, recipient details, and any applicable licenses or permits.

Fill out your australian customs notice no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Australian Customs Notice No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.