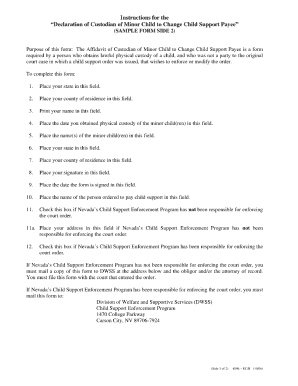

Get the free Who Pays What in Your County

Show details

Who Pays What in Your County

AlamedaEscrow Charges

Buyer particle Fees

(Owners Policy)

Buyer account Transfer Tax

(per thousand)

Seller pay$1.10

Except in the City of Alameda

BuyerSeller 50/50City

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign who pays what in

Edit your who pays what in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your who pays what in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing who pays what in online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit who pays what in. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out who pays what in

How to fill out who pays what in:

01

Start by gathering all the necessary information, such as the names of the parties involved, the date of the agreement, and the specific expenses to be divided.

02

Clearly define the responsibilities of each party in terms of who will pay for what. This may include rent, utilities, groceries, or any other shared expenses.

03

Assign a method of payment for each expense. Determine whether it will be split equally among all parties or if the amounts will vary depending on factors such as income or usage.

04

Create a clear and detailed list of the expenses, including the specific amounts and the due dates. This will help ensure that everyone understands their obligations and can plan their finances accordingly.

05

Agree on a method of communication and record-keeping. This could be through a shared document, a designated person responsible for tracking expenses, or a digital platform that allows for easy access and updates.

Who needs who pays what in:

01

Anyone who shares expenses with others, such as roommates, family members, or business partners, may need to determine who pays what in order to maintain financial transparency and fairness.

02

It is especially important for individuals living in shared households or cohabitating relationships to establish clear guidelines for sharing expenses. This helps avoid misunderstandings, conflicts, and financial strain.

03

In business partnerships, determining who pays what is crucial to maintaining a healthy financial balance and ensuring that each party fulfills their responsibilities.

Ultimately, the need for determining who pays what arises in any situation where multiple parties are involved in sharing expenses. It is essential to establish clear guidelines and maintain open communication to foster a harmonious and financially balanced environment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my who pays what in in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your who pays what in along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send who pays what in for eSignature?

Once your who pays what in is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out who pays what in using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign who pays what in. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is who pays what in?

Who pays what in is a document that outlines who is responsible for paying for particular expenses or bills in a group or partnership.

Who is required to file who pays what in?

The individuals or parties involved in the financial arrangement are typically required to file who pays what in.

How to fill out who pays what in?

To fill out who pays what in, you will need to list the specific expenses or bills, along with the corresponding responsible party.

What is the purpose of who pays what in?

The purpose of who pays what in is to clarify financial responsibilities and ensure that all parties are aware of who is responsible for paying which expenses.

What information must be reported on who pays what in?

Information that must be reported on who pays what in includes the names of the parties involved, the specific expenses or bills, and the payment schedule.

Fill out your who pays what in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Who Pays What In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.