IRS 4F FAQs Limitations free printable template

Show details

Free File Fillable Forms FAQs & Limitations Search this document for the answer to your question(s): 1. Select Ed t” and “Find” from the drop-down menu 2. Type in your search word or phrase

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs tax forms

Edit your fillable irs forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 3949 a online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs gov fillable forms. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out you form template

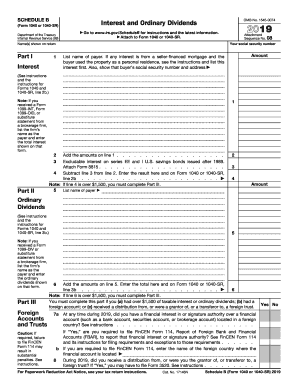

How to fill out IRS 4F FAQs & Limitations

01

Review the guidelines provided by the IRS for Form 4F.

02

Gather all necessary financial documents relevant to the FAQs.

03

Ensure that you understand the limitations stated in the instructions for Form 4F.

04

Complete each section of the form accurately, addressing any FAQs according to your specific circumstances.

05

Double-check your entries for completeness and accuracy before submission.

06

Submit the form electronically or via mail as instructed.

Who needs IRS 4F FAQs & Limitations?

01

Taxpayers who are required to file IRS Form 4F.

02

Individuals seeking clarification on tax obligations as outlined in the FAQs.

03

Tax professionals assisting clients with IRS Form 4F.

Fill

form

: Try Risk Free

People Also Ask about

Can I fill out tax forms electronically?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

What tax forms Cannot be electronically filed?

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Can I download and print tax forms?

Download Income Tax Forms You can e-file directly to the IRS and download or print a copy of your tax return. Federal tax filing is free for everyone with no limitations, and state filing is only $14.99.

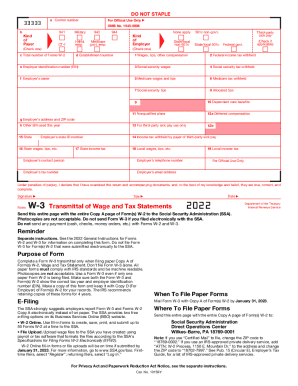

What forms do I need to file my taxes 2022?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

Can you fill out tax forms digitally?

How does the e-signature option work? Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an e-signature to sign and electronically submit these forms to their Electronic Return Originator (ERO).

How do I do my own personal tax return?

Steps to File a Tax Return Gather your paperwork, including: Choose your filing status. Decide how you want to file your taxes. Determine if you are taking the standard deduction or itemizing your return. If you owe money, learn how to make a tax payment, including applying for a payment plan.

How do I file my Income Tax Return online?

Select 'Assessment Year' Select 'ITR Form Number' Select 'Filing Type' as 'Original/Revised Return' Select 'Submission Mode' as 'Prepare and Submit Online'Choose any one of the following option to verify the Income Tax Return: I would like to e-Verify. I would like to e-Verify later within 120 days from date of filing.

How can I fill my own Income Tax Return?

Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill in your details in the Downloaded File. Step 6: Validate the Information Entered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 4F FAQs Limitations in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your IRS 4F FAQs Limitations and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit IRS 4F FAQs Limitations online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your IRS 4F FAQs Limitations to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete IRS 4F FAQs Limitations on an Android device?

On Android, use the pdfFiller mobile app to finish your IRS 4F FAQs Limitations. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IRS 4F FAQs & Limitations?

The IRS 4F refers to a set of Frequently Asked Questions (FAQs) and limitations associated with specific tax provisions managed by the IRS, addressing common inquiries and clarifying rules on eligibility and application.

Who is required to file IRS 4F FAQs & Limitations?

Individuals or entities who meet certain criteria outlined by the IRS, particularly related to specific tax provisions, are required to file IRS 4F. This typically includes taxpayers engaging in particular transactions or claiming certain tax benefits.

How to fill out IRS 4F FAQs & Limitations?

To fill out IRS 4F, taxpayers need to carefully follow the instructions provided by the IRS, ensuring that all required information is accurately completed, including personal details and specific transaction data relevant to the FAQ and limitation queries.

What is the purpose of IRS 4F FAQs & Limitations?

The purpose of IRS 4F FAQs & Limitations is to provide clear guidance and information to taxpayers on how to interpret and comply with various tax rules and limitations, ensuring proper filing and adherence to tax laws.

What information must be reported on IRS 4F FAQs & Limitations?

The information that must be reported typically includes taxpayer identification details, type and amount of transactions, and specific tax benefits being claimed, alongside any other required disclosures as specified in the FAQs.

Fill out your IRS 4F FAQs Limitations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 4f FAQs Limitations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.