Get the free Ontario Innovation Tax Credit b2015b and later tax bb - CCH Site Builder

Show details

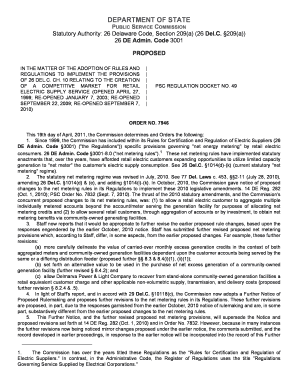

Clear Data Help Schedule 566 Code 1501 Ontario Innovation Tax Credit (2015 and later tax years) Corporation's name Protected B when completed Business number Year Tax yearend Month Day Use this schedule

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ontario innovation tax credit

Edit your ontario innovation tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ontario innovation tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ontario innovation tax credit online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ontario innovation tax credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ontario innovation tax credit

How to fill out the Ontario Innovation Tax Credit:

01

Start by gathering all relevant information and documentation required to complete the application. This may include financial statements, project descriptions, eligible expenditures, and supporting documents.

02

Access the Ontario Innovation Tax Credit application form from the official government website or any authorized platform. Make sure you have the most up-to-date form to avoid any discrepancies.

03

Carefully read the instructions provided on the application form, as well as any related guides or resources available on the website. Familiarize yourself with the eligibility criteria, required information, and deadlines.

04

Begin filling out the application form by providing general information such as your business name, address, contact details, and tax account information.

05

Provide details about the innovative projects or activities for which you are claiming the credit. This may include explaining the nature of the project, its objectives, anticipated outcomes, and technical innovations involved.

06

Indicate the eligible expenditures associated with each project or activity. Include costs such as research and development expenses, salaries and wages, materials, and subcontractor fees.

07

Prove the eligibility of your claimed expenses with supporting documentation. This may include purchase invoices, payroll records, contracts, or any other relevant proof of expenditure.

08

Calculate the amount of the tax credit you are claiming. Follow the instructions on the form to ensure accurate calculations. Make sure to double-check your work to avoid any errors.

09

Review the completed form and ensure that all sections are filled accurately and completely. Check for any missing information or errors in calculations.

10

Keep a copy of the completed and signed application form for your records. Submit the form to the appropriate government department or tax authority as specified in the instructions.

11

Follow up on the progress of your application as required. It may be beneficial to keep track of deadlines, and if necessary, seek assistance from a professional tax advisor or consultant.

Who needs the Ontario Innovation Tax Credit?

01

Small to medium-sized businesses (SMEs) located in Ontario that are engaged in eligible innovation projects or activities can benefit from the Ontario Innovation Tax Credit.

02

Startups and companies that are actively working on research and development (R&D) initiatives, technological advancements, or innovative solutions are encouraged to apply.

03

Businesses operating in sectors such as software development, biotechnology, manufacturing, and clean technology are often eligible for the tax credit.

04

The Ontario Innovation Tax Credit is intended to support businesses that are investing in innovation and technological advancements, helping them to grow, compete globally, and contribute to the provincial economy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ontario innovation tax credit?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the ontario innovation tax credit in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit ontario innovation tax credit online?

The editing procedure is simple with pdfFiller. Open your ontario innovation tax credit in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete ontario innovation tax credit on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your ontario innovation tax credit. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is ontario innovation tax credit?

Ontario Innovation Tax Credit is a refundable tax credit designed to support innovation in Ontario by providing tax incentives to eligible corporations.

Who is required to file ontario innovation tax credit?

Eligible corporations that have conducted scientific research and experimental development in Ontario may be required to file for Ontario Innovation Tax Credit.

How to fill out ontario innovation tax credit?

To fill out the Ontario Innovation Tax Credit, corporations must provide detailed information about their scientific research and experimental development activities in Ontario.

What is the purpose of ontario innovation tax credit?

The purpose of Ontario Innovation Tax Credit is to encourage innovation and support research and development activities in Ontario by providing tax incentives to eligible corporations.

What information must be reported on ontario innovation tax credit?

Companies must report detailed information about their eligible scientific research and experimental development activities in Ontario, including expenditures and eligible projects.

Fill out your ontario innovation tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ontario Innovation Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.