Get the free Notes Clear Data 2014 Simplified Individual Tax Return for RRSP, SPP and PRPP Excess...

Show details

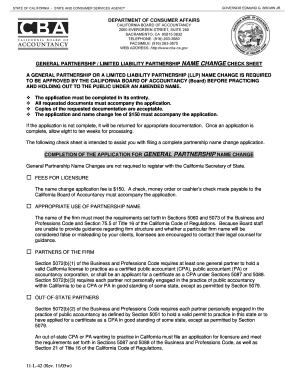

Notes Clear Data 2014 Simplified Individual Tax Return for RESP, SPP and PROP Excess Contributions Protected B when completed 2. Complete the chart below to determine the amount to enter on line 1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notes clear data 2014

Edit your notes clear data 2014 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notes clear data 2014 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notes clear data 2014 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notes clear data 2014. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notes clear data 2014

01

To fill out notes clear data 2014, start by gathering all relevant information and documents related to the notes and data from the year 2014. This could include financial records, invoices, receipts, and any other relevant documents.

02

Review the notes clear data form carefully to understand the specific information and details required. This form is typically used to provide a summary or breakdown of financial transactions and activities during a specific time period, in this case, 2014.

03

Begin filling out the form by entering the necessary details in the appropriate sections. This could include information such as the date of each transaction, a description or purpose of the transaction, the amount involved, and any other relevant information.

04

Verify the accuracy and completeness of the information provided. Double-check all numerical values, spellings, and other details to ensure there are no errors or omissions. Accuracy is crucial for maintaining the integrity and reliability of the notes clear data.

05

If required, consult any supporting documentation to ensure the information provided aligns with the actual records. This could include cross-referencing the form with bank statements, invoices, or other financial documents.

06

Once you have filled out the form entirely, review it once again for any mistakes or missing information. Take the time to make any necessary corrections or additions before finalizing the document.

07

Keep a copy of the completed notes clear data form for your records. It is essential to have a backup for future reference or in case of any disputes or audits.

Who needs notes clear data 2014?

01

Businesses and organizations: Notes clear data 2014 is typically necessary for businesses and organizations to maintain accurate and organized financial records. These records are vital for tax purposes, auditing, budgeting, and financial analysis.

02

Accountants and financial professionals: Accountants and financial professionals often require notes clear data 2014 to assist in preparing financial statements, performing audits, and providing advisory services for their clients. These professionals rely on accurate and comprehensive data to analyze financial trends and make informed decisions.

03

Tax authorities and auditors: Government tax authorities and auditors may request notes clear data 2014 during tax audits or investigations. This information ensures compliance with tax laws and regulations and helps assess the accuracy of reported financial information.

In summary, filling out notes clear data 2014 involves gathering relevant documents, carefully reviewing the form requirements, accurately entering the necessary information, verifying the accuracy of the data, and keeping a copy for future reference. This process is essential for businesses, accountants, and tax authorities to maintain accurate financial records and ensure compliance with regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit notes clear data 2014 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including notes clear data 2014, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete notes clear data 2014 online?

pdfFiller has made it easy to fill out and sign notes clear data 2014. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit notes clear data 2014 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing notes clear data 2014.

What is notes clear data simplified?

Notes clear data simplified is a simplified form required to be filed by certain individuals and businesses to report financial information to the authorities.

Who is required to file notes clear data simplified?

Individuals and businesses meeting certain criteria, such as having a specified level of income or expenses, are required to file notes clear data simplified.

How to fill out notes clear data simplified?

Notes clear data simplified can be filled out online or in paper form, following the instructions provided by the relevant authorities.

What is the purpose of notes clear data simplified?

The purpose of notes clear data simplified is to enable individuals and businesses to report their financial information in a streamlined and simplified manner.

What information must be reported on notes clear data simplified?

Information such as income, expenses, assets, liabilities, and other financial details must be reported on notes clear data simplified.

Fill out your notes clear data 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notes Clear Data 2014 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.