Get the free YOUR INTERNATIONAL PAYMENT PARTNER

Show details

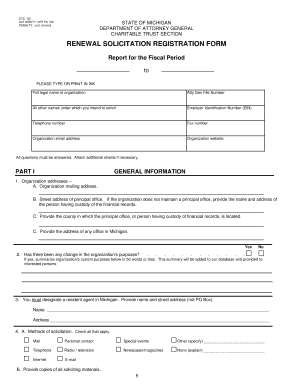

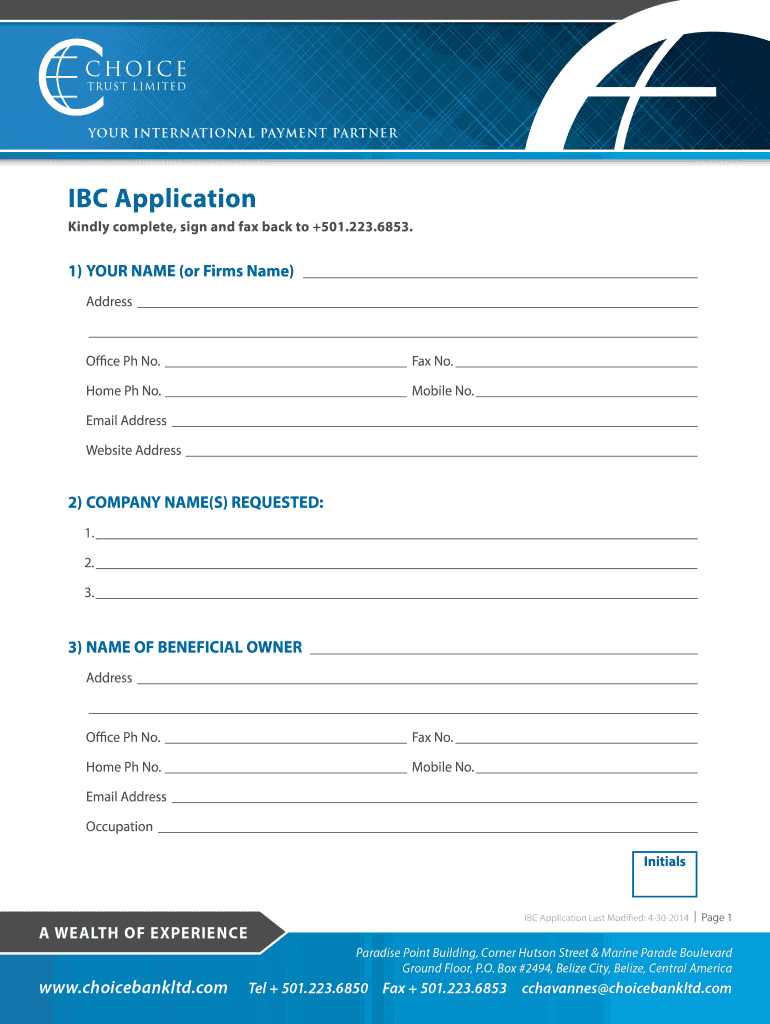

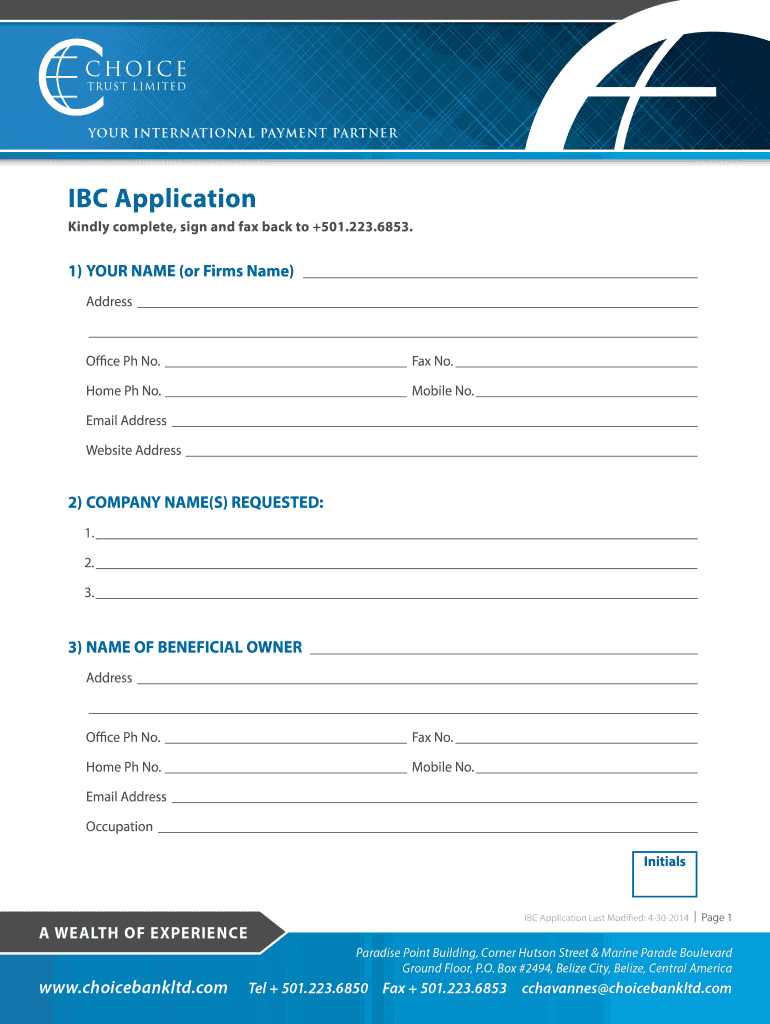

YOUR INTERNATIONAL PAYMENT PARTNER IBC Application Kindly complete, sign and fax back to +501.223.6853. 1) YOUR NAME (or Firms Name) Address Office pH No. Fax No. Home pH No. Mobile No. Email Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your international payment partner

Edit your your international payment partner form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your international payment partner form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing your international payment partner online

To use the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit your international payment partner. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your international payment partner

How to fill out your international payment partner:

01

Research and identify potential international payment partners that align with your business needs and goals. Look for partners that have experience working with businesses in your industry and have a strong reputation for secure and reliable payment processing.

02

Evaluate the features and capabilities of each potential payment partner. Consider factors such as the currencies they support, their payment processing fees, the ease of integration with your existing systems, and any additional value-added services they offer.

03

Contact the selected payment partners to request more information and clarify any questions you may have. Ask about their onboarding process, the required documentation, and any specific requirements or restrictions that may apply to your business.

04

Gather and prepare the necessary documentation required by the payment partner. This may include business registration documents, proof of identity, financial statements, and any relevant legal or compliance documentation.

05

Review the terms and conditions of the selected payment partner's agreement thoroughly. Pay attention to any contractual obligations, fees, and dispute resolution processes. Seek legal advice if necessary to ensure that the agreement is fair and reasonable.

06

Complete and submit the application or onboarding forms provided by the payment partner. Double-check all the information provided to ensure accuracy and completeness.

07

Follow up with the payment partner to confirm that your application has been received and is being processed. Stay in regular communication to address any outstanding questions or requests for additional information.

08

Once approved, work closely with your international payment partner to integrate their payment processing solutions into your business operations. Test the integration to ensure smooth and seamless payment transactions.

Who needs your international payment partner:

01

E-commerce businesses that cater to a global customer base and need a secure and efficient way to accept international payments.

02

Small and medium-sized enterprises (SMEs) that conduct cross-border transactions and require access to multiple currencies for seamless payment processing.

03

Freelancers and independent professionals who work with clients from different countries and need a reliable method to receive payments in different currencies.

04

Travel and tourism businesses that serve international customers and need a flexible payment solution to accept bookings and payments from different countries.

05

International retailers or brands that want to expand their customer reach and provide a smooth and localized payment experience for customers in different regions.

06

Service providers, such as software developers or consultants, who offer their services globally and need a secure and efficient way to receive payments from clients worldwide.

Remember, choosing the right international payment partner is crucial for your business success, so take the time to research and evaluate your options before making a decision.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my your international payment partner directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your your international payment partner along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit your international payment partner in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing your international payment partner and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit your international payment partner on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as your international payment partner. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is your international payment partner?

Our international payment partner is XYZ Bank.

Who is required to file your international payment partner?

All customers who have made international payments through our platform are required to file their international payment partner.

How to fill out your international payment partner?

You can fill out your international payment partner by logging into your account on our platform and entering the required information about your international payment partner.

What is the purpose of your international payment partner?

The purpose of our international payment partner is to ensure transparency and compliance with international regulations regarding cross-border payments.

What information must be reported on your international payment partner?

The information required to be reported on your international payment partner includes the name of the partner bank, account number, and transaction details.

Fill out your your international payment partner online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your International Payment Partner is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.