Get the free DFRDB and MSBS Members Contributions Surcharge Remittance Advice

Show details

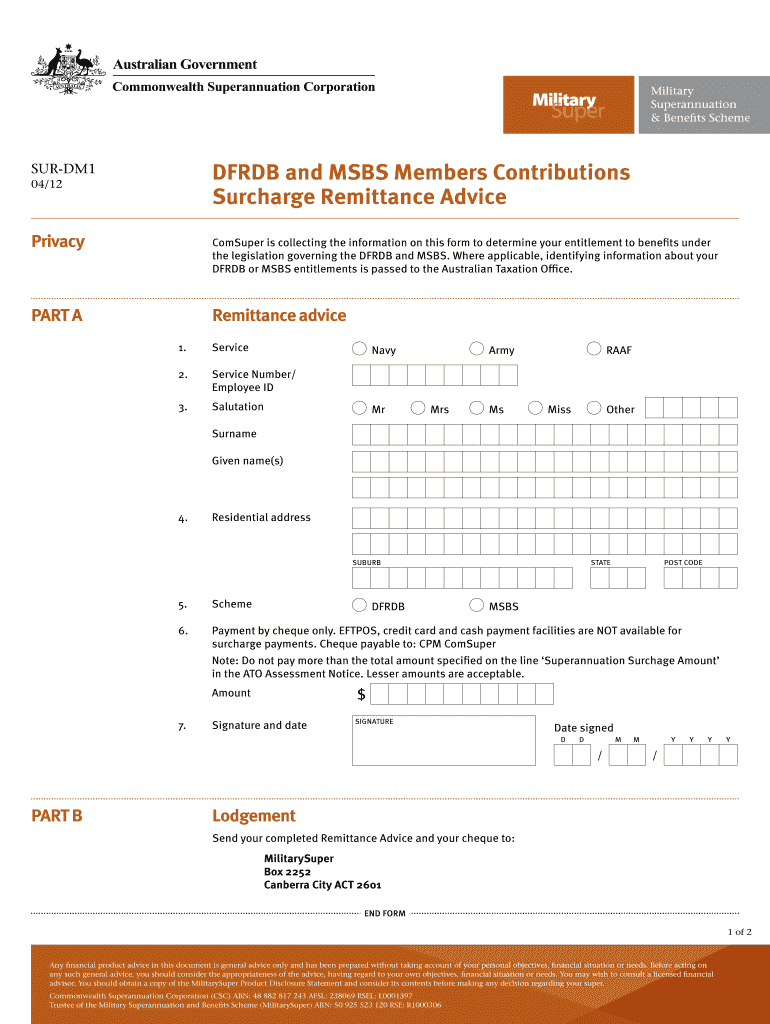

This document is used for members of the DFRDB and MSBS to remit surcharge payments, collecting necessary information to determine benefit entitlements under relevant legislation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dfrdb and msbs members

Edit your dfrdb and msbs members form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dfrdb and msbs members form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dfrdb and msbs members online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit dfrdb and msbs members. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dfrdb and msbs members

How to fill out DFRDB and MSBS Members Contributions Surcharge Remittance Advice

01

Step 1: Obtain the DFRDB and MSBS Members Contributions Surcharge Remittance Advice form from the relevant authority or website.

02

Step 2: Fill in your personal details including your name, member number, and contact information at the top of the form.

03

Step 3: In the contributions section, input the total contributions you have made for the specified period.

04

Step 4: Calculate the surcharge amount based on the guidelines provided.

05

Step 5: Include any adjustments or corrections in the designated section if required.

06

Step 6: Review the completed form for accuracy and completeness.

07

Step 7: Sign and date the form at the bottom.

08

Step 8: Submit the completed form to the relevant authority via the specified method (mail, email, online portal).

Who needs DFRDB and MSBS Members Contributions Surcharge Remittance Advice?

01

Members of the DFRDB (Defence Force Retirement and Death Benefits) scheme who have made contributions.

02

Members of the MSBS (Military Superannuation and Benefits Scheme) who need to report their contributions.

03

Employers or payroll officers responsible for processing member contributions on behalf of their employees.

Fill

form

: Try Risk Free

People Also Ask about

What happens to DB pension on death?

Death-in-service lump sum If you die while an active member of your defined benefit pension scheme, your beneficiaries might get a lump sum. This is often a multiple of your salary. This is paid tax-free if you die before your 75th birthday, unless the amount wasn't paid out within two years.

What is a concessional contribution for MSBS?

Concessional contributions are contributions that are paid into the fund before tax, and tax is withheld at 15% on entry. The general concessional cap is $30,000 for the 2025–2026 financial year; however, you may have a larger personal cap by using the 'carry-forward' rule.

Is dfrdb pension indexed?

DFRDB/DFRB associate pensions receive CPI indexation regardless of age. For DFRDB/DFRB pension recipients aged 55 or older on the relevant indexation date, the indexed portion of the DFRDB/DFRB pension will be increased by the better of: the CPI increase.

Is a DB pension better than DC?

DC plans can give you more flexibility when it comes to how you take your money. But a DB plan comes with benefits and guarantees you don't get with a DC plan. Overall, these plans might be different, but they have one big thing in common: they're both a way to help you fund your life after work.

What is a DFRDB pension?

The Defence Force Retirement and Death Benefits (DFRDB) Scheme is a defined benefit superannuation scheme that was available to members of the ADF between 1972 and 1991.

What replaced dfrdb?

The DFRDB Scheme was itself replaced by the Military Superannuation and Benefits Scheme (MSBS) on 1 October 1991. At that time, existing members of the DFRDB Scheme were permitted to elect to join the MSBS or to stay in the DFRDBS.

What type of fund is MSBs?

The Military Superannuation and Benefits Scheme (MSBS) is designed for eligible Australian Defence Force (ADF) personnel.

Can I contribute to MSBs?

Ancillary contributions can also be made to your MSBS fund. This includes salary sacrifice, spouse contributions, transfer amounts and personal contributions. These contributions will form your Ancillary Benefit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DFRDB and MSBS Members Contributions Surcharge Remittance Advice?

DFRDB stands for the Defence Force Retirement and Death Benefits Scheme, while MSBS refers to the Military Superannuation and Benefits Scheme. The Members Contributions Surcharge Remittance Advice is a document used to report and remit contributions that are subject to a surcharge on behalf of members of these schemes.

Who is required to file DFRDB and MSBS Members Contributions Surcharge Remittance Advice?

Employers or organizations that manage the payroll for members of the DFRDB and MSBS are required to file the Members Contributions Surcharge Remittance Advice when they have surchargeable contributions to report.

How to fill out DFRDB and MSBS Members Contributions Surcharge Remittance Advice?

To fill out the Advice, one must provide accurate details of the members' contributions, including personal information, contribution amounts, and any applicable surcharges. Specific fields in the form must be filled out according to the instructions provided by the administering authority.

What is the purpose of DFRDB and MSBS Members Contributions Surcharge Remittance Advice?

The purpose of the Remittance Advice is to ensure that surcharges on member contributions are accurately calculated, reported, and remitted to the relevant authorities to maintain the integrity of the superannuation schemes.

What information must be reported on DFRDB and MSBS Members Contributions Surcharge Remittance Advice?

The information that must be reported includes member identification details, the amounts of contributions made, the calculation of any surcharges, the period to which the contributions pertain, and the total amount due.

Fill out your dfrdb and msbs members online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dfrdb And Msbs Members is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.