Get the free Openended Equity Schemes

Show details

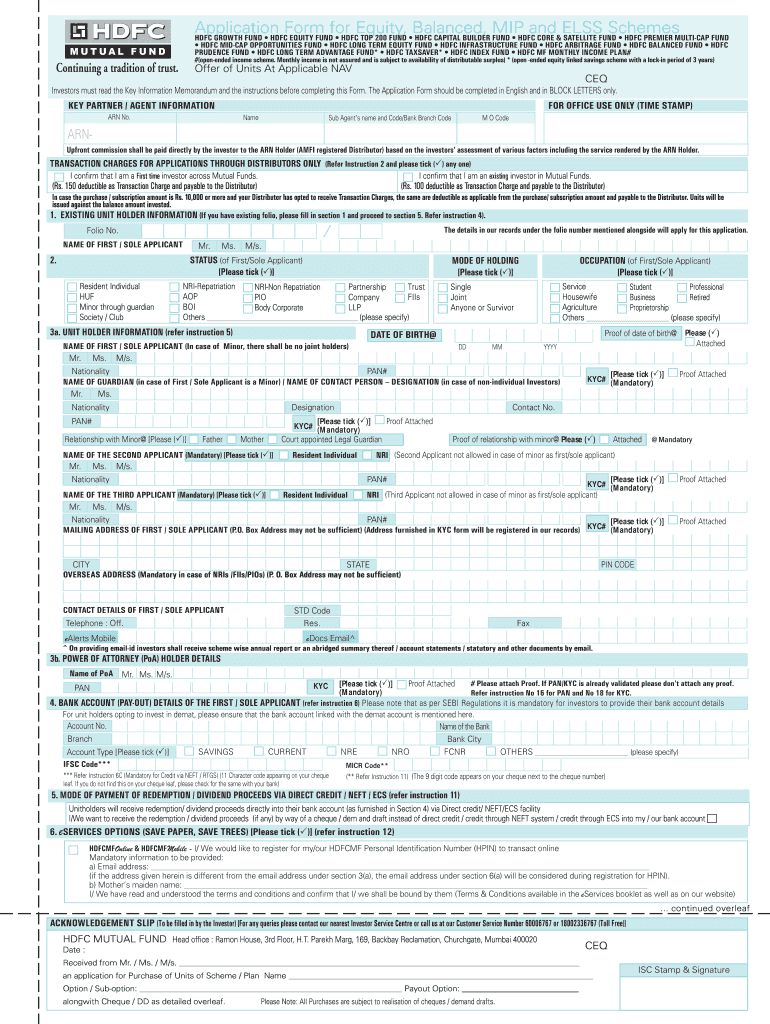

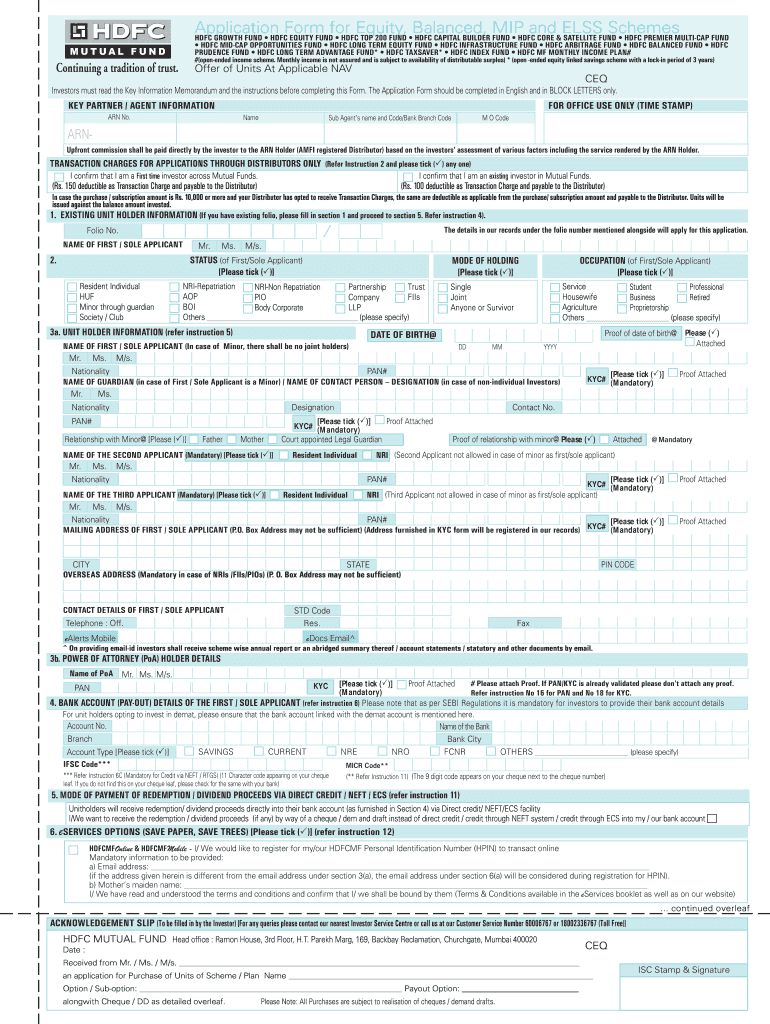

Open-ended Growth Schemes Open ended Equity Schemes Open ended Balanced Schemes Open ended Equity Linked Savings Schemes Open ended Index Linked Scheme Open ended Monthly Income Scheme Sponsors :

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign openended equity schemes

Edit your openended equity schemes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your openended equity schemes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit openended equity schemes online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit openended equity schemes. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out openended equity schemes

How to fill out openended equity schemes:

01

Start by researching and understanding different openended equity schemes available in the market. Familiarize yourself with their investment objectives, risks, and past performance.

02

Assess your financial goals and risk appetite. Determine the amount of money you are willing to invest in openended equity schemes and the investment duration.

03

Identify reputed asset management companies or mutual fund houses that offer openended equity schemes. Look for their track record, fund management team, and the overall reputation of the company.

04

Once you have selected the openended equity scheme(s) that align with your investment goals, approach the respective asset management company or mutual fund house for the application form.

05

Fill out the application form with accurate and complete information. Provide details such as your personal information, bank account details for transactions, and nominee details if applicable.

06

Carefully read the terms and conditions mentioned in the application form. Understand the minimum investment amount, expense ratio, exit load charges, and any other relevant charges associated with the scheme.

07

Attach the necessary documents as mentioned in the application form. This may include your PAN card copy, address proof, and bank account proof.

08

Submit the filled-out application form along with the documents to the designated office of the asset management company or mutual fund house. Alternatively, some companies also provide online application facilities.

09

After the submission of the application, you will be allotted the units of the openended equity scheme based on the prevailing Net Asset Value (NAV) of the scheme on the date of receipt.

Who needs openended equity schemes:

01

Individuals who have a long-term investment horizon and are willing to take on higher risks with the potential for higher returns may consider openended equity schemes.

02

Investors who believe in the potential of the stock market to deliver higher returns compared to other asset classes over the long term often choose openended equity schemes.

03

Those who want professional management of their investments and access to a diversified portfolio of stocks can benefit from openended equity schemes.

04

Investors who do not have the time or expertise to directly invest in individual stocks but wish to participate in the growth potential of the equity markets often opt for openended equity schemes.

05

Individuals who want the flexibility to enter or exit their investment at any time can benefit from the liquidity offered by openended equity schemes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit openended equity schemes from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including openended equity schemes, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out openended equity schemes using my mobile device?

Use the pdfFiller mobile app to fill out and sign openended equity schemes. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete openended equity schemes on an Android device?

On an Android device, use the pdfFiller mobile app to finish your openended equity schemes. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is openended equity schemes?

Open-ended equity schemes are mutual funds that do not have a fixed maturity date and can issue an unlimited number of units.

Who is required to file openended equity schemes?

Mutual fund companies and fund managers are required to file open-ended equity schemes.

How to fill out openended equity schemes?

Open-ended equity schemes can be filled out by providing information on fund performance, asset allocation, and investor reports.

What is the purpose of openended equity schemes?

The purpose of open-ended equity schemes is to provide investors with a vehicle to invest in a diversified portfolio of equities.

What information must be reported on openended equity schemes?

Information such as NAV, fund manager details, asset allocation, and fund performance must be reported on open-ended equity schemes.

Fill out your openended equity schemes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Openended Equity Schemes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.