Get the free Dealing with Debt Collectors

Show details

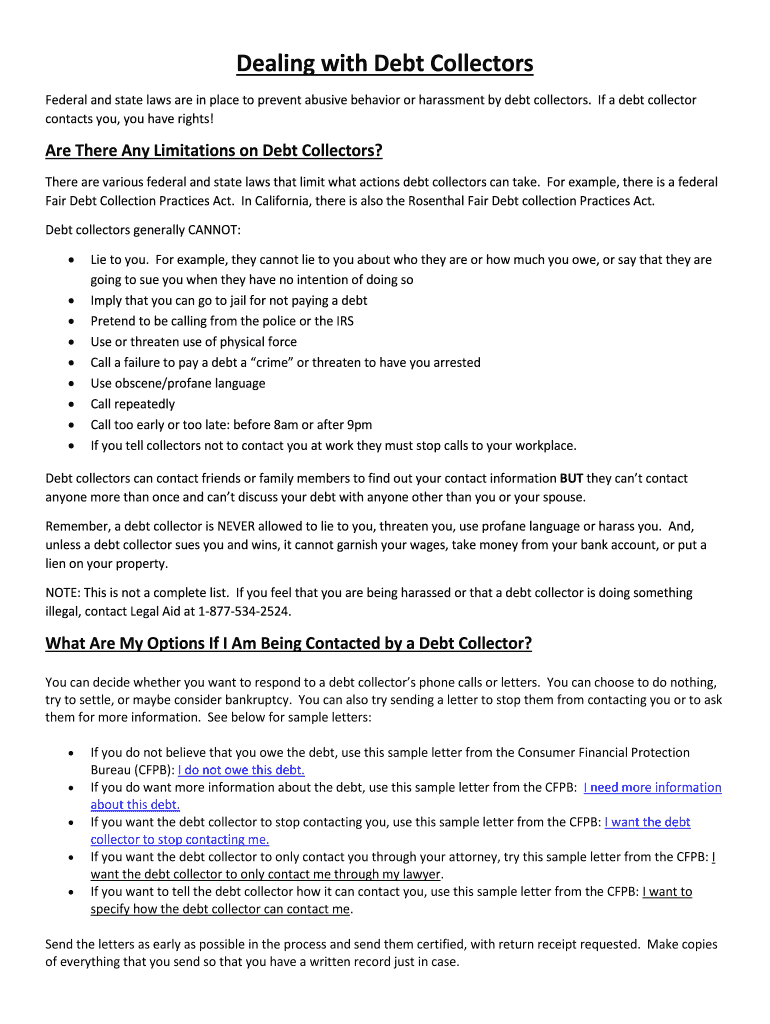

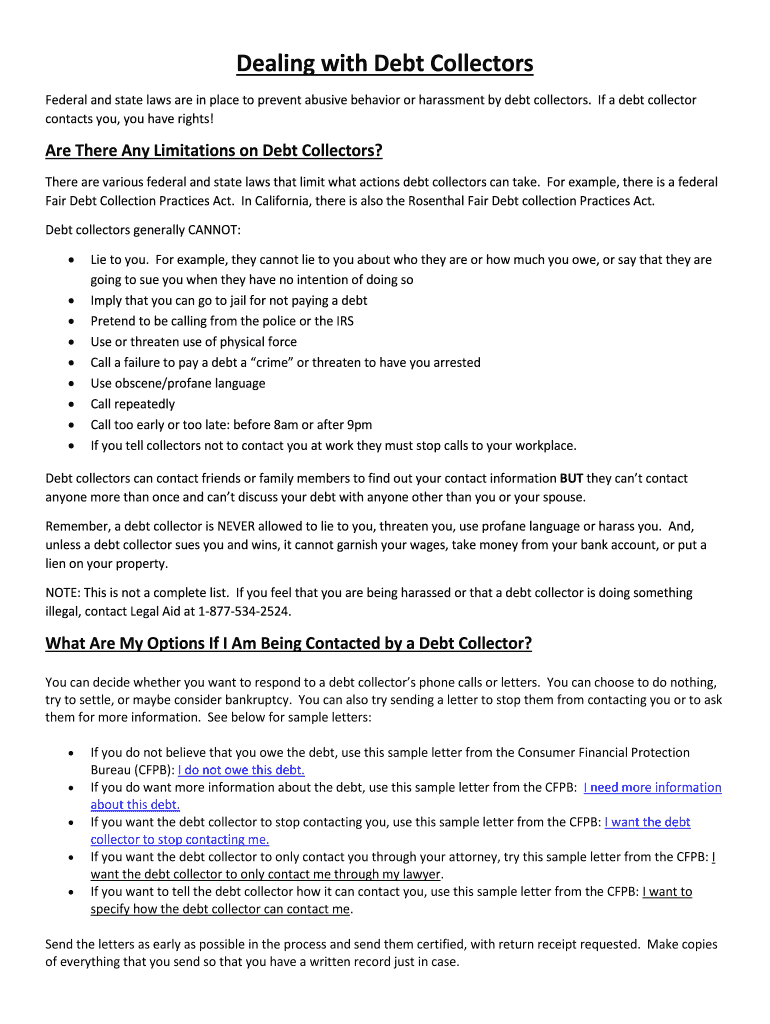

Dealing with Debt Collectors Federal and state laws are in place to prevent abusive behavior or harassment by debt collectors. If a debt collector contacts you, you have rights! Are There Any Limitations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dealing with debt collectors

Edit your dealing with debt collectors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dealing with debt collectors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dealing with debt collectors online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dealing with debt collectors. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dealing with debt collectors

How to Deal with Debt Collectors:

01

Understand your rights: It is important to educate yourself about your rights as a consumer when dealing with debt collectors. Familiarize yourself with the Fair Debt Collection Practices Act (FDCPA) to know what collectors can and cannot do legally. This will help you navigate the process more effectively and protect yourself from unfair practices.

02

Communicate in writing: When first contacted by a debt collector, it's advisable to request all communication to be in writing. This will provide a paper trail and ensure that you have a record of all interactions. Send a certified letter requesting that they cease all phone calls and communicate only through written correspondence.

03

Validate the debt: As a consumer, you have the right to request verification of the debt. Within 30 days of receiving the initial notice, send a written request for validation to the debt collector. They are legally obligated to provide you with documentation proving the debt is legitimate. If they fail to do so, they must stop collection efforts.

04

Keep records: Throughout the process, keep thorough records of all communication with debt collectors. Note down dates, times, names, and any relevant details from each encounter. Save copies of any written correspondence as evidence. This will be useful in case you need to dispute inaccurate information or file a complaint against a collector.

05

Negotiate payment options: If the debt is legitimate and you are in a position to repay it, consider negotiating a payment plan with the debt collector. Be prepared to discuss your financial situation honestly and provide evidence if necessary. Exploring payment options can help you establish a mutually agreeable arrangement, which may include reduced payments or waiving additional fees.

06

Stay vigilant against scams: Unfortunately, there are fraudulent debt collectors out there. Always verify the legitimacy of a debt collector by requesting their identification information, such as their name, company, and contact details. Research the company and check for any complaints or negative reviews before engaging further. Be cautious about sharing personal and financial information.

Who needs dealing with debt collectors?

Individuals who have outstanding debts and are being contacted by debt collectors need to deal with them appropriately. Debt collectors are typically hired by creditors or collection agencies to recover outstanding balances. It's important for consumers to understand their rights, communicate effectively, validate debts, negotiate payment options if applicable, and be cautious of scams to handle the debt collection process effectively and protect themselves legally.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dealing with debt collectors for eSignature?

When you're ready to share your dealing with debt collectors, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get dealing with debt collectors?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the dealing with debt collectors. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in dealing with debt collectors without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing dealing with debt collectors and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is dealing with debt collectors?

Dealing with debt collectors involves interacting with individuals or agencies who are attempting to collect on outstanding debts, either on behalf of the original creditor or after purchasing the debt.

Who is required to file dealing with debt collectors?

Individuals who have outstanding debts and are being contacted by debt collectors are required to handle dealing with debt collectors.

How to fill out dealing with debt collectors?

Dealing with debt collectors should be done by responding to their communications, verifying the debt, and negotiating payment options if necessary.

What is the purpose of dealing with debt collectors?

The purpose of dealing with debt collectors is to address and resolve outstanding debts in a way that is fair to both the debtor and the creditor.

What information must be reported on dealing with debt collectors?

Dealing with debt collectors may require reporting personal information, details of the debt, payment history, and any communications with the debt collector.

Fill out your dealing with debt collectors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dealing With Debt Collectors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.