Get the free PRIVATE EQUITY SAVED - SECA - seca

Show details

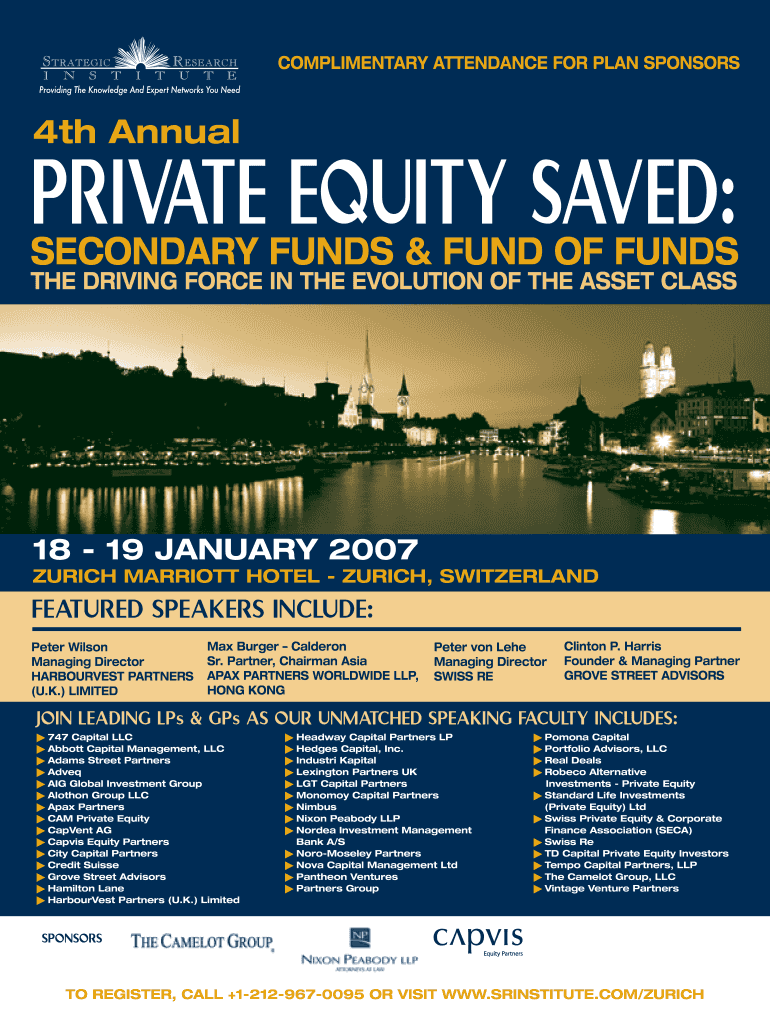

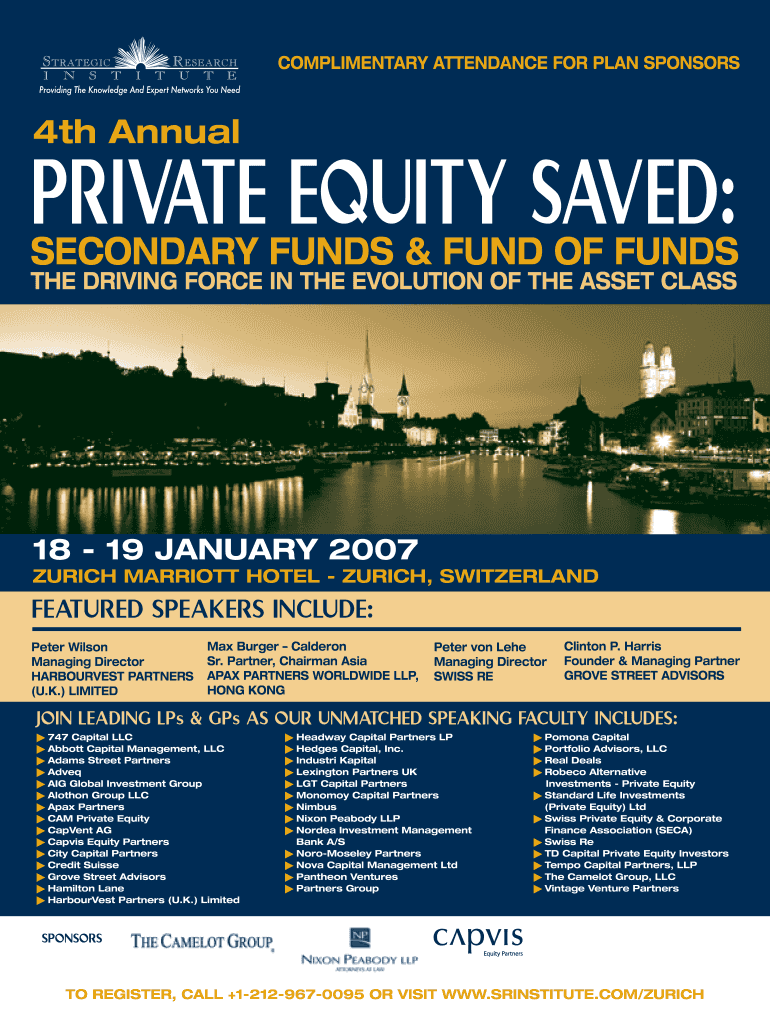

COMPLIMENTARY ATTENDANCE FOR PLAN SPONSORS 4th Annual PRIVATE EQUITY SAVED: SECONDARY FUNDS & FUND OF FUNDS THE DRIVING FORCE IN THE EVOLUTION OF THE ASSET CLASS 18 19 JANUARY 2007 ZURICH MARRIOTT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private equity saved

Edit your private equity saved form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private equity saved form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private equity saved online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit private equity saved. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private equity saved

How to fill out private equity saved:

01

Identify your financial goals: Determine what you want to achieve with your private equity savings. Are you looking for long-term investment growth or short-term income generation? Clarifying your objectives will help guide your investment decisions.

02

Assess your risk tolerance: Understand your comfort level with investment risk. Private equity investments can be more volatile compared to traditional assets. Consider factors such as your age, financial obligations, and time horizon to determine how much risk you are willing to bear.

03

Conduct thorough research: Before investing in private equity, educate yourself about the industry and different investment opportunities. Understand the risks, potential returns, and the liquidity of these investments. Consider seeking advice from financial professionals who specialize in private equity.

04

Determine your investment horizon: Private equity investments typically have longer lock-in periods compared to other investment options. Evaluate whether you can commit your funds for the required time frame, as early withdrawals may result in penalties or reduced returns.

05

Evaluate investment options: Explore different private equity funds or direct investment opportunities. Consider factors such as the fund's track record, investment strategy, management team, and fee structure. Compare several options to find the one that aligns with your financial goals and risk tolerance.

06

Consider diversification: It's generally advisable to diversify your investment portfolio to mitigate risk. Allocate your private equity savings alongside other asset classes such as stocks, bonds, and real estate. Diversification can help reduce the overall volatility of your portfolio.

Who needs private equity saved?

01

High net worth individuals: Private equity investments often require a substantial initial investment and are suitable for individuals with significant financial resources. High net worth individuals can benefit from the potential high returns and long-term growth that private equity offers.

02

Institutional investors: Organizations like pension funds, insurance companies, and university endowments often allocate a portion of their portfolios to private equity. These institutions have the necessary resources, knowledge, and long-term investment horizons to engage in private equity investments.

03

Entrepreneurs and business owners: Private equity can be a source of funding for entrepreneurs and business owners looking to grow their companies. Private equity firms invest in promising businesses and help them expand, often in exchange for an equity stake.

04

Accredited investors: Private equity investments are typically available to accredited investors who meet certain income or net worth criteria. Accredited individuals have access to opportunities not available to the general public and can benefit from the potentially higher returns generated by private equity.

In summary, filling out private equity saved requires careful consideration of your financial goals, risk tolerance, and investment horizon. Thorough research and due diligence are crucial in identifying suitable investment options. Private equity is often sought after by high net worth individuals, institutional investors, entrepreneurs, and accredited investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find private equity saved?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the private equity saved in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I sign the private equity saved electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your private equity saved.

Can I create an electronic signature for signing my private equity saved in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your private equity saved and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is private equity saved?

Private equity saved refers to funds that are invested in private companies or projects with the aim of generating returns for investors.

Who is required to file private equity saved?

Investment firms, private equity funds, and other entities involved in managing private equity investments are typically required to file private equity saved.

How to fill out private equity saved?

Private equity saved is usually reported through financial statements, investment reports, and other documentation that outline the details of the investments and returns.

What is the purpose of private equity saved?

The purpose of private equity saved is to track and report on the performance of private equity investments, as well as to provide transparency to investors and regulatory authorities.

What information must be reported on private equity saved?

Information such as the amount of funds invested, the rate of return, the duration of the investment, and other relevant details must be reported on private equity saved.

Fill out your private equity saved online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Equity Saved is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.