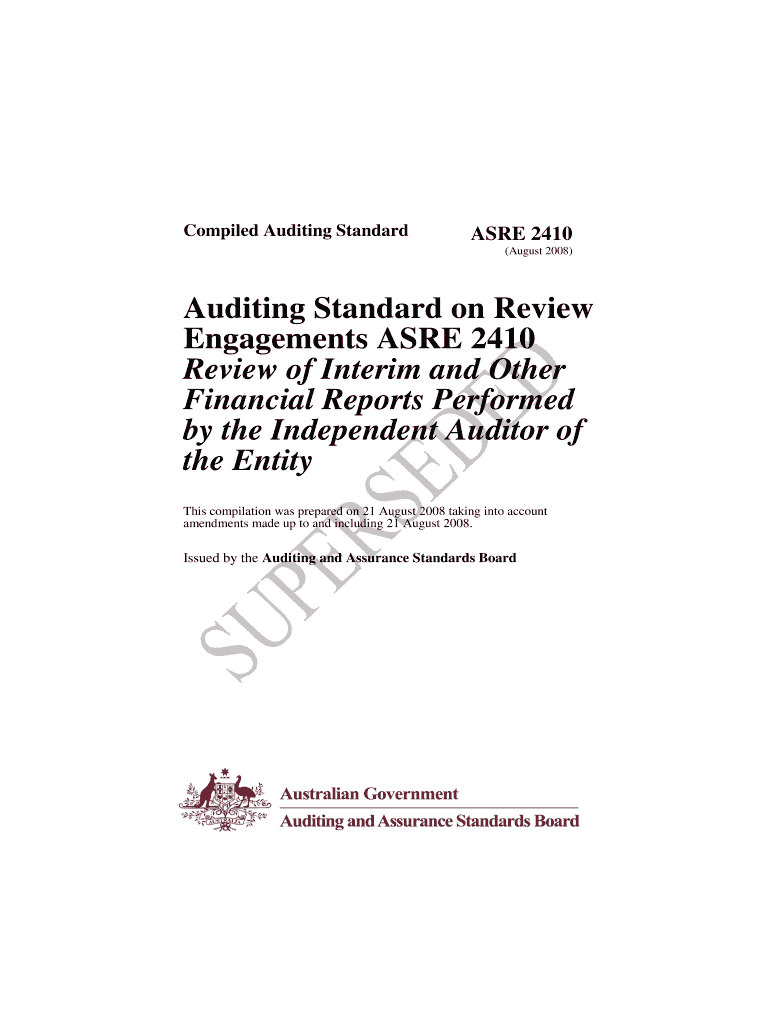

Get the free Compiled Auditing Standard

Show details

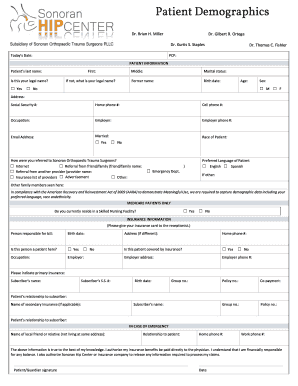

This document outlines the Auditing Standard on Review Engagements ASRE 2410 for conducting reviews of interim financial reports by independent auditors.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign compiled auditing standard

Edit your compiled auditing standard form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your compiled auditing standard form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing compiled auditing standard online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit compiled auditing standard. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out compiled auditing standard

How to fill out Compiled Auditing Standard

01

Gather all relevant financial records and documents.

02

Organize the financial statements you need to compile.

03

Ensure that the information is complete and accurate.

04

Fill out the necessary sections of the Compiled Auditing Standard form, including introduction and scope.

05

Provide a summary of accounting principles used.

06

Document any significant assumptions or estimates.

07

Prepare notes to financial statements that add context.

08

Review the completed document for any errors or omissions.

09

Submit the completed standard to the relevant authority or stakeholders.

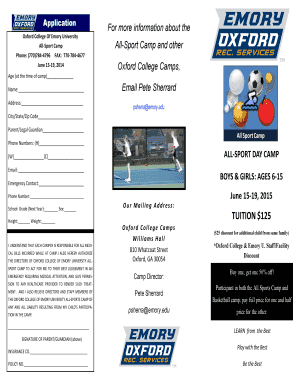

Who needs Compiled Auditing Standard?

01

Business owners seeking to comply with financial reporting requirements.

02

Accountants needing a structured approach for financial statement preparation.

03

Investors looking for reliable financial information about a company.

04

Regulatory agencies that require adherence to auditing standards.

05

Organizations needing transparency in financial reporting.

Fill

form

: Try Risk Free

People Also Ask about

What is an ISO audit in English?

ISO Audit: meaning and definition It is an essential part of an organization's management system that helps to assess the effectiveness of its ISO standards implementation and identify areas for improvement.

What are the three types of ISO audits?

There are three types of ISO audits: internal audits (first-party audits), supplier audits (second-party audits), and external audits (third-party audits). Your choice of audit type will alter depending on your compliance and certification goals, scope, scale, and budget.

What is meant by ISO audit?

Often these are referred to by the appropriate ISO standard numbers such as ISO 9001, ISO/IEC 27001, ISO 14001 and ISO 45001 respectively. An ISO audit is a systematic process for obtaining audit evidence and evaluating it objectively to determine the extent to which audit criteria are met.

What is the ISA 315 standard of auditing?

Scope of this ISA (Ireland) This International Standard on Auditing (Ireland) (ISA (Ireland)) deals with the auditor's responsibility to identify and assess the risks of material misstatement in the financial statements.

How to compile an audit?

10 Best Practices for Writing a Digestible Audit Report Reference everything. Include a reference section. Use figures, visuals, and text stylization. Contextualize the audit. Include positive and negative findings. Ensure every issue incorporates the five C's of observations. Include detailed observations.

What is the CAS 315 audit standard?

From CPA Canada Canadian Auditing Standard (CAS) 315, Identifying and Assessing the Risks of Material Misstatement, includes requirements related to the auditor's understanding of the IT environment and the identification of GITCs.

What is the objective of ISO audit?

What is an ISO audit? An ISO audit is an activity that companies conduct to evaluate, confirm, and verify processes related to the quality, security and safety of products and services so that companies are able to ensure the management system has been effectively implemented.

What is the role of the ISO auditor?

An ISO 9001 Auditor checks to ensure everything meets the highest standards. They look at how work is done and talk to people to make sure quality is irreproachable. Think about having no worries about the standard of products you are delivering to your dedicated customers. That's what an auditor can help achieve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Compiled Auditing Standard?

Compiled Auditing Standards are guidelines outlining the procedures and steps necessary for the preparation of financial statements, ensuring they are compliant with applicable accounting principles.

Who is required to file Compiled Auditing Standard?

Organizations, including corporations and partnerships, that need to present financial statements to stakeholders, such as investors and creditors, are typically required to file under Compiled Auditing Standards.

How to fill out Compiled Auditing Standard?

To fill out Compiled Auditing Standards, organizations must gather relevant financial data, ensure accuracy and completeness, and follow the prescribed format to present their financial information clearly.

What is the purpose of Compiled Auditing Standard?

The purpose of Compiled Auditing Standards is to provide a consistent framework for the presentation of financial statements, ensuring accuracy, transparency, and compliance with regulatory requirements.

What information must be reported on Compiled Auditing Standard?

Compiled Auditing Standards require the reporting of financial position, results of operations, cash flows, and disclosures regarding accounting policies and practices.

Fill out your compiled auditing standard online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Compiled Auditing Standard is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.