Get the free Annual Tax Savings

Show details

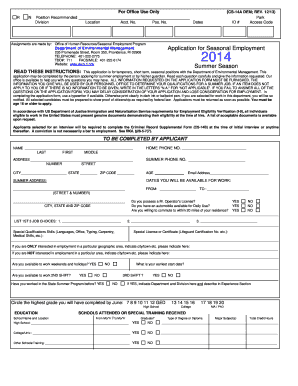

CONTRIBUTIONSRetirement Planning Calculator 234ContributionsActual Continual Tax Savings1Contribution PercentageAnnual Pay 10,000 3%15,000 20,000 25,000 30,000 35,000 40,000 50,000 75,000 100,000AnnualMonthlySingleMarriedSingleMarried45037.5031.8833.756845advantage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual tax savings

Edit your annual tax savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual tax savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual tax savings online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual tax savings. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual tax savings

How to fill out annual tax savings:

01

Gather all necessary documents: Start by collecting all the relevant documents, such as your tax forms from the previous year, any receipts or invoices for deductible expenses, and any other financial records that can help you accurately calculate your tax savings.

02

Review your financial situation: Take a close look at your financial situation to identify any opportunities for tax savings. This may include evaluating your investments, retirement contributions, charitable donations, and any other potential deductions or credits you may be eligible for.

03

Familiarize yourself with tax laws and regulations: Stay updated on the latest tax laws and regulations to ensure that you are aware of any changes that may impact your tax savings. Consult resources such as the Internal Revenue Service (IRS) website or seek advice from a tax professional if needed.

04

Determine your filing status: Understand the different filing statuses available (such as single, married filing jointly, or head of household) and choose the one that suits your situation to optimize your tax savings. This decision can significantly impact your tax liability.

05

Maximize your deductions: Identify all the deductions you may be eligible for, such as mortgage interest, student loan interest, medical expenses, and state or local taxes. Keep accurate records of these expenses and ensure you claim them correctly on your tax return.

06

Consider tax credits: Explore the various tax credits available, such as the Child Tax Credit, Earned Income Tax Credit, or Education Credits. These credits can directly reduce your tax liability, so make sure you understand the eligibility criteria and claim them appropriately.

07

Use tax planning tools: Utilize tax planning tools such as online tax calculators, tax software, or consult with a tax professional to help you accurately calculate your tax savings and ensure you haven't missed any potential deductions or credits.

Who needs annual tax savings?

01

Individuals: Any individual taxpayer can benefit from annual tax savings. By properly organizing their finances, claiming eligible deductions and credits, and staying informed about tax laws, individuals can reduce their tax liability and potentially increase their refund or decrease the amount they owe.

02

Small business owners: Small business owners, including self-employed individuals and freelancers, should pay particular attention to annual tax savings. They may have access to additional deductions and credits specifically designed for business expenses, such as home office deductions, business mileage deductions, and self-employment tax deductions.

03

Families: Families with children may be eligible for various tax credits and deductions, such as the Child Tax Credit or Dependent Care Credit. Understanding these benefits and taking advantage of them can significantly reduce a family's overall tax burden.

04

Investors: Investors, especially those involved in the stock market or real estate, should consider annual tax savings strategies. These may include taking advantage of tax-efficient investment accounts like IRAs or 401(k)s, understanding capital gains tax rules, and maximizing deductions related to investment expenses.

Remember, it's always advisable to consult with a qualified tax professional or accountant for personalized advice based on your specific financial situation and tax goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit annual tax savings from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including annual tax savings, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I edit annual tax savings on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as annual tax savings. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out annual tax savings on an Android device?

On an Android device, use the pdfFiller mobile app to finish your annual tax savings. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is annual tax savings?

Annual tax savings refers to the amount of money a person or business saves on their taxes in a year by taking advantage of deductions, credits, and other tax-saving strategies.

Who is required to file annual tax savings?

Anyone who earns income and has tax obligations is required to file annual tax savings.

How to fill out annual tax savings?

Annual tax savings can be filled out by gathering all relevant financial information, including income, expenses, deductions, and credits, and reporting them accurately on the appropriate tax forms.

What is the purpose of annual tax savings?

The purpose of annual tax savings is to help individuals and businesses reduce their tax liabilities and keep more of their money.

What information must be reported on annual tax savings?

Annual tax savings must report income, expenses, deductions, credits, and any other relevant financial information.

Fill out your annual tax savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Tax Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.