Get the free Excess Insurance Policy - bprotectivespecialtycomb

Show details

Excess Insurance Policy NOTICE: UNLESS OTHERWISE PROVIDED IN THE UNDERLYING INSURANCE, THIS POLICY SHALL ONLY APPLY TO Claim FIRST MADE DURING THE POLICY PERIOD. THE LIMIT OF LIABILITY AVAILABLE TO

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign excess insurance policy

Edit your excess insurance policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your excess insurance policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing excess insurance policy online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit excess insurance policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

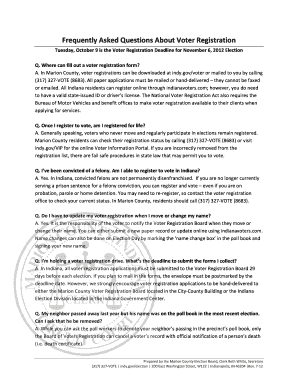

How to fill out excess insurance policy

How to fill out excess insurance policy:

01

Begin by carefully reading the insurance policy document. Familiarize yourself with the terms, conditions, and exclusions associated with the excess insurance policy. It is essential to understand what is covered and what is not.

02

Gather all the necessary information and documents required to fill out the excess insurance policy accurately. This may include personal details, contact information, and relevant policy information from the primary insurance provider.

03

Decide the coverage limit for your excess insurance policy. Evaluate your primary insurance coverage and determine the amount of additional coverage you require to protect against any potential excess costs or liabilities.

04

Fill in the necessary details in the application form. Provide accurate information about yourself, the primary insurance policy, and any additional information requested by the insurance provider. Double-check all the information to ensure its accuracy.

05

Review the excess insurance policy application before submitting it. Make sure all the filled-in information is correct, and there are no errors or omissions. It is crucial to avoid any mistakes that may affect the coverage or claims settlement process.

06

Submit the completed excess insurance policy application to the insurance provider either through their online portal, by mail, or in person, depending on their preferred method. Retain a copy of the filled-out application for your records.

07

Pay the premium for the excess insurance policy as specified by the insurance provider. Ensure that you understand the payment terms and the due date for making any premium payments.

Who needs excess insurance policy:

01

Individuals with primary insurance coverage: Excess insurance policies are usually beneficial for individuals who already have primary insurance coverage but want additional protection against potential excess costs or liabilities that may not be covered by their primary policy.

02

Those with high-risk professions or activities: People involved in high-risk professions or activities, such as extreme sports, may find it useful to have excess insurance. It provides an added layer of financial protection in case of accidents or unforeseen events.

03

Travelers and frequent flyers: Excess insurance policies can be advantageous for those who frequently travel or fly. It offers coverage beyond what is provided by their travel or flight insurance, safeguarding against unexpected expenses or circumstances during their journeys.

04

Property owners: Property owners, such as homeowners or landlords, might consider purchasing excess insurance to protect themselves from potential liability claims that exceed the coverage of their primary property insurance.

05

Business owners: Business owners may opt for excess insurance to shield their businesses from extraordinary expenses that go beyond the coverage provided by their regular commercial insurance policies.

It is important to note that the need for excess insurance policy varies based on individual circumstances, level of risk, and existing insurance coverage. It is advisable to consult with an insurance professional or agent to determine if an excess insurance policy is appropriate for your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the excess insurance policy in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your excess insurance policy and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit excess insurance policy on an iOS device?

You certainly can. You can quickly edit, distribute, and sign excess insurance policy on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit excess insurance policy on an Android device?

With the pdfFiller Android app, you can edit, sign, and share excess insurance policy on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is excess insurance policy?

Excess insurance policy is a type of insurance coverage that provides additional protection above and beyond the limits of a primary insurance policy.

Who is required to file excess insurance policy?

Certain individuals or businesses may be required to file an excess insurance policy, depending on the regulations of the insurance provider or governing body.

How to fill out excess insurance policy?

To fill out an excess insurance policy, one must provide the necessary information requested by the insurance provider, such as coverage limits, premiums, and details of the primary insurance policy.

What is the purpose of excess insurance policy?

The purpose of excess insurance policy is to provide additional coverage in the event that the limits of the primary insurance policy are exceeded.

What information must be reported on excess insurance policy?

Information required on an excess insurance policy may include the policyholder's name, policy number, coverage limits, premiums, and details of the primary insurance policy.

Fill out your excess insurance policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Excess Insurance Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.