Get the free Additional Information Form - iran embassy gov

Show details

This document is intended for individuals applying for a visa to Australia, requiring additional information to ensure the processing of their application is efficient and complete. It includes sections

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign additional information form

Edit your additional information form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your additional information form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit additional information form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit additional information form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out additional information form

How to fill out Additional Information Form

01

Start by gathering necessary documents and information required for the form.

02

Read the instructions carefully to understand the requirements for each section.

03

Fill out personal identification details such as name, address, and contact information.

04

Provide any relevant background information requested in the form.

05

Answer all questions honestly and to the best of your ability.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form according to the provided submission instructions.

Who needs Additional Information Form?

01

Individuals applying for certain services or benefits that require additional information.

02

Applicants for specific programs or grants that require detailed clarifications.

03

Anyone requested by an agency or organization to provide further details beyond initial submissions.

Fill

form

: Try Risk Free

People Also Ask about

What is the form for the R&D tax credit?

What is Form 6765? Form 6765 is an IRS Form, under IRS tax code U.S. Code § 280C, that is the “Credit for Increasing Research Activities” - and informally known as the R&D Tax Credit Form. This tax form can help startups save up to $250,000 on their payroll taxes.

How to make an R&D claim?

The R&D claim must be submitted electronically to HMRC with your tax return. Once HMRC receive the claim, it is passed for processing. If issues are identified at this point, the claim will be passed onto specialist inspectors for a detailed review, which can result in an enquiry.

What is the qualified R&D tax credit?

Who qualifies for the R&D credit? Any company engaged in activities to develop or improve products, processes, software, formulas, techniques or inventions in a way that required some level of technical experimentation to determine the most accurate and appropriate design may qualify for the R&D credit.

What is the notional tax charge?

(4)The notional tax charge is the amount of corporation tax that would be chargeable on the initial amount of the expenditure credit if it were an amount of profits for the accounting period on which corporation tax was chargeable at the applicable rate.

What is a CT600L form?

The CT600L is a four-page supplementary form that must be submitted with your Corporation Tax Return when you make your R&D tax credit claim. The form applies to all companies making claims for a payable tax credit under the small and medium-sized enterprise (SME) or RDEC R&D schemes.

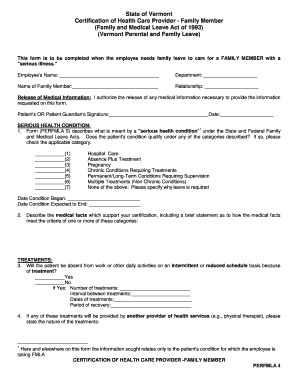

When was AIF introduced for R&D?

For R&D tax relief, the Additional Information Form (AIF) was introduced on 8 August 2023 as HMRC's response to the growing problem of error and fraud. Alongside your R&D claim report, it provides HMRC with the context they need to understand and justify the total qualifying expenditure for the claim period.

How do you account for an R&D tax credit?

It's very straightforward. Your R&D tax credit is not taxable income. It is a below-the-line benefit. It appears on your income statement (or profit-and-loss account) as a credit or a Corporation Tax reduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Additional Information Form?

The Additional Information Form is a document used to provide supplementary information that may not be included in the primary application or form.

Who is required to file Additional Information Form?

Individuals or entities that need to provide additional details to support their application or compliance with regulations are required to file the Additional Information Form.

How to fill out Additional Information Form?

To fill out the Additional Information Form, you should carefully read the instructions, provide all necessary information as requested, ensure accuracy, and submit it along with any required supporting documentation.

What is the purpose of Additional Information Form?

The purpose of the Additional Information Form is to gather more detailed information that can assist in the review process or to fulfill specific regulatory requirements.

What information must be reported on Additional Information Form?

The information that must be reported on the Additional Information Form typically includes identification details, additional context for the application, supporting evidence, and any other relevant data required by the reviewing authority.

Fill out your additional information form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Additional Information Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.