Get the free AUM Client Information - PPCLOAN

Show details

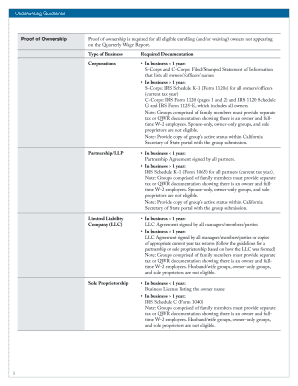

Investment Advisor Firm Information Report As of (date): Company Information Company Name: Form of Ownership (LLC, S Corp, Sole Prop, etc.): Business Address: Number of Owners/Partners: Number of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aum client information

Edit your aum client information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aum client information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aum client information online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit aum client information. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aum client information

How to fill out AUM client information:

01

Start by gathering all the necessary documents and information required to fill out the AUM client information form. This may include personal details such as full name, contact information, date of birth, and social security number.

02

Begin by entering the client's basic information, such as their full legal name and any aliases they may have used in the past.

03

Provide accurate contact information, including phone numbers and email addresses, so that the client can be easily reached if needed.

04

Include the client's date of birth to verify their identity and age.

05

Enter the client's social security number, which is crucial for regulatory and compliance purposes.

06

Continue by filling in the client's financial information, such as their occupation, employer's name, and annual income. This helps to assess the client's financial status and investment capabilities.

07

Specify the client's investment objectives and risk tolerance. It is essential to understand the client's financial goals and their willingness to take on investment risks.

08

Provide information about the client's investment experience and knowledge. This helps the advisor determine the appropriate investment strategies and products suitable for the client.

09

Disclose any existing investments or accounts held by the client, including retirement accounts, mutual funds, or real estate holdings. This information assists in evaluating the client's investment portfolio.

10

Finally, ensure that all the information provided is accurate and up-to-date. Double-check for any errors before submitting the AUM client information form.

Who needs AUM client information:

01

Financial advisors or wealth managers require AUM client information to understand their clients' financial profiles, investment objectives, and risk tolerance.

02

Investment firms and brokerage houses need AUM client information to comply with regulatory requirements and to provide appropriate investment advice.

03

Compliance departments within financial institutions utilize AUM client information to monitor transactions and ensure adherence to legal and regulatory guidelines.

04

Government regulatory bodies, such as the Securities and Exchange Commission (SEC), may request AUM client information as part of their oversight and surveillance activities.

05

Insurance companies might require AUM client information for evaluating and offering suitable insurance products to clients.

06

In some cases, potential business partners or investors may request AUM client information as part of their due diligence process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is aum client information?

AUM client information refers to the details and data about a firm's assets under management (AUM) that a financial or investment company must report.

Who is required to file aum client information?

Financial and investment companies that manage assets are required to file AUM client information.

How to fill out aum client information?

AUM client information can be filled out by providing accurate details of the firm's AUM, client portfolios, and any other required financial data.

What is the purpose of aum client information?

The purpose of AUM client information is to provide transparency and regulatory oversight of a firm's management of assets and client portfolios.

What information must be reported on aum client information?

AUM client information typically includes the total value of assets under management, client account holdings, investment strategies, and performance metrics.

How can I edit aum client information from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your aum client information into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I execute aum client information online?

pdfFiller makes it easy to finish and sign aum client information online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit aum client information in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your aum client information, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Fill out your aum client information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aum Client Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.