Get the free MISSED PAYROLL NOTIFICATION - Decision Hr

Show details

Submit Online MISSED PAYROLL NOTIFICATION To: Decision HR: Payroll Department Fax #: (727) 5721314 or (888) 8027555 Worksite Employer Name: Date: Ref: Missed Payroll This memo serves as notice that

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign missed payroll notification

Edit your missed payroll notification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missed payroll notification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing missed payroll notification online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit missed payroll notification. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out missed payroll notification

How to fill out missed payroll notification:

01

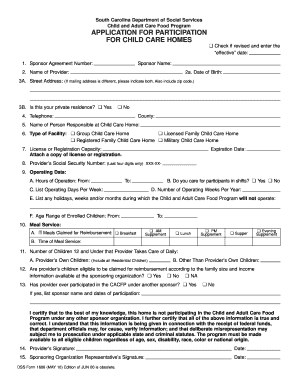

Gather all necessary information: Before filling out the missed payroll notification, gather all the relevant information such as employee details, missed pay period, reason for the missed payroll, and any supporting documentation.

02

Download or obtain the missed payroll notification form: Check with your employer or HR department if there is a specific form to fill out for missed payroll notifications. If there isn't a specific form, you can create a document or use a template that includes all the required information.

03

Fill out employee details: Start by filling out the employee's name, employee ID or social security number, department, and job title. This will help ensure that the notification is correctly linked to the respective employee.

04

Specify the missed pay period: Indicate the specific pay period for which the payroll was missed. This information is usually mentioned in the form or can be provided in the supporting documentation.

05

Explain the reason for the missed payroll: Provide a clear and concise explanation of why the payroll was missed. Common reasons include technical glitches, administrative errors, or delays in processing.

06

Attach supporting documentation: If there is any supporting documentation related to the missed payroll, such as timesheets, leave requests, or emails, make sure to attach them with the notification. This will help provide a comprehensive understanding of the situation.

07

Review and submit the notification: Double-check all the information filled in the missed payroll notification for accuracy and completeness. Once reviewed, submit the notification to your employer, HR department, or any designated individual responsible for handling payroll issues.

Who needs missed payroll notification?

01

Employees: Employees who did not receive their expected wages for a specific pay period need to submit a missed payroll notification to ensure that the issue is addressed promptly.

02

Employers: Employers need missed payroll notifications to be informed about any payroll discrepancies or errors that may have occurred. This allows them to investigate the issue and take corrective action to ensure employees receive their rightful pay.

03

HR departments: Human resources departments need missed payroll notifications to facilitate the resolution of payroll issues and maintain accurate records of any discrepancies or errors.

In conclusion, anyone who has experienced a missed payroll needs to fill out a notification to ensure that the issue is resolved and the correct payment is made. This includes employees, employers, and HR departments who each play a role in addressing and rectifying payroll discrepancies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my missed payroll notification directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your missed payroll notification and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit missed payroll notification straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing missed payroll notification right away.

How can I fill out missed payroll notification on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your missed payroll notification. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is missed payroll notification?

Missed payroll notification is a notification sent to the relevant authorities when a company fails to process or pay its employees on time.

Who is required to file missed payroll notification?

Employers or companies who have missed processing or paying their employees on time are required to file missed payroll notification.

How to fill out missed payroll notification?

Missed payroll notification can be filled out by providing information such as company details, the reason for the missed payroll, number of affected employees, and steps taken to rectify the issue.

What is the purpose of missed payroll notification?

The purpose of missed payroll notification is to inform the authorities about any discrepancies in processing or paying employees on time and to avoid any penalties.

What information must be reported on missed payroll notification?

Information such as company details, reason for missed payroll, number of affected employees, and steps taken to rectify the issue must be reported on missed payroll notification.

Fill out your missed payroll notification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Missed Payroll Notification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.