Get the free Fidelity Guarantee Insurance Proposal Form - WALAA

Show details

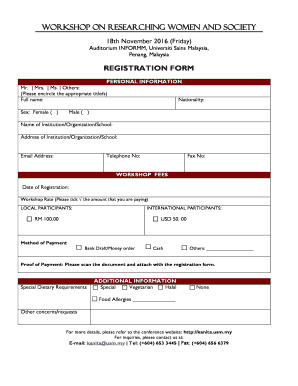

Saudi United Cooperative Insurance Company (Walk) Fidelity Guarantee Insurance Proposal Form Full name of Insured Entity (please attach a list of all subsidiary companies to be covered by this policy):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity guarantee insurance proposal

Edit your fidelity guarantee insurance proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity guarantee insurance proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fidelity guarantee insurance proposal online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fidelity guarantee insurance proposal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity guarantee insurance proposal

How to fill out a fidelity guarantee insurance proposal:

01

Start by gathering all relevant information: Begin by collecting all necessary details such as personal information, contact information, and relevant financial information of the individual or organization seeking coverage. This may include details on the size of the organization, the nature of its operations, and the number of employees.

02

Identify the scope of coverage: Determine the specific risks and potential losses that the fidelity guarantee insurance proposal should cover. This could include fraud, theft, embezzlement, or any other form of dishonesty that may occur within the organization. Clearly define the limits of coverage and any exclusions that may apply.

03

Assess the value of coverage required: Evaluate the financial loss that the organization could potentially face in the event of fraudulent or dishonest activities. Consider the value of assets, the potential impact on cash flow, and any additional expenses that may be incurred. It is important to accurately determine the coverage limit to ensure adequate protection.

04

Provide complete and accurate information: Fill out the fidelity guarantee insurance proposal form with complete and accurate information. Ensure that all fields are correctly filled out, providing necessary explanations where required. Any discrepancies or missing information could lead to delays or complications in the underwriting process.

05

Understand policy terms and conditions: Familiarize yourself with the terms and conditions outlined in the fidelity guarantee insurance proposal. Pay close attention to coverage limitations, exclusions, deductibles, and any other details that may impact the scope and extent of coverage. Seek clarification from the insurance provider if necessary to ensure a comprehensive understanding.

06

Seek professional advice if needed: If unsure about any aspect of the fidelity guarantee insurance proposal, consider consulting with an insurance broker or professional who specializes in fidelity guarantee insurance. They can provide guidance and ensure that the proposal is properly completed to meet all requirements.

Who needs fidelity guarantee insurance proposal:

01

Businesses of all sizes: Whether it is a small startup or a large corporation, any organization that handles finances or deals with employee fidelity risks should consider fidelity guarantee insurance. This can help protect against losses caused by fraudulent activities of employees or third parties.

02

Financial institutions: Banks, credit unions, and other financial institutions that handle substantial amounts of money on a daily basis are particularly exposed to fidelity risks. Fidelity guarantee insurance can offer added protection against potential losses due to employee dishonesty or fraud.

03

Non-profit organizations: Even non-profit organizations can be vulnerable to fidelity risks. Those that handle donations or have employees responsible for financial management should consider fidelity guarantee insurance to safeguard against potential losses resulting from fraudulent activities.

Overall, fidelity guarantee insurance is not limited to specific industries or organizations, but rather anyone who seeks protection against the potential financial losses resulting from fraudulent acts or dishonesty.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fidelity guarantee insurance proposal?

Fidelity guarantee insurance proposal is a type of insurance that protects a company from financial losses due to acts of fraud or dishonesty by its employees.

Who is required to file fidelity guarantee insurance proposal?

Companies or organizations that want to safeguard themselves against financial losses caused by employee dishonesty are required to file a fidelity guarantee insurance proposal.

How to fill out fidelity guarantee insurance proposal?

To fill out a fidelity guarantee insurance proposal, the company needs to provide detailed information about their employees, their positions, and the coverage amount they are seeking.

What is the purpose of fidelity guarantee insurance proposal?

The purpose of fidelity guarantee insurance proposal is to offer financial protection to companies in case of employee dishonesty, fraud, or theft.

What information must be reported on fidelity guarantee insurance proposal?

The fidelity guarantee insurance proposal must include information about the company, its employees, their positions, the coverage amount, and any previous claims or losses related to employee dishonesty.

How can I modify fidelity guarantee insurance proposal without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like fidelity guarantee insurance proposal, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send fidelity guarantee insurance proposal for eSignature?

When you're ready to share your fidelity guarantee insurance proposal, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete fidelity guarantee insurance proposal online?

Completing and signing fidelity guarantee insurance proposal online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Fill out your fidelity guarantee insurance proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Guarantee Insurance Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.