Get the free Form 61 - qirc qld gov

Show details

This form is used to file a statement answering a notice of objection under the Industrial Relations Regulation 2000, sections 76, 77 or 78.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 61 - qirc

Edit your form 61 - qirc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 61 - qirc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 61 - qirc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 61 - qirc. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

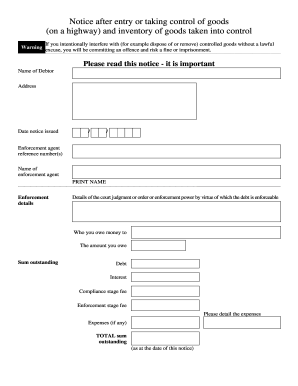

How to fill out form 61 - qirc

How to fill out Form 61

01

Obtain Form 61 from the official website or relevant authority.

02

Begin filling out your personal details in the designated sections.

03

Provide your full name as it appears on your identification documents.

04

Enter your contact information, including your address and phone number.

05

Indicate your date of birth and place of origin.

06

Fill out any required sections related to your nationality and citizenship status.

07

Complete any additional questions regarding your financial status or purpose of the form.

08

Review all information for accuracy and completeness.

09

Sign and date the form in the specified area.

10

Submit the completed form as instructed, either online or in person.

Who needs Form 61?

01

Individuals applying for certain types of visas or immigration matters in Australia.

02

Persons seeking to establish their identity for government processes.

03

Those needing to declare their financial circumstances for legal or administrative purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the use of Form 61?

Form 61 is a declaration form used by individuals who earn income exclusively from agriculture and do not receive taxable income from other sources. As per Rule 114B of the Income Tax Rules, these individuals must not possess a PAN (Permanent Account Number).

What is the difference between Form 60 and 61?

Difference between Form 60 and 61 Form 60 will be a valid alternative to PAN if the applicant has income that comes under the taxable income category. Form 61 will be a valid alternative to PAN if the applicant has only agricultural income and does not have any other sources of income which is taxable.

Who needs to fill form 60?

Form 60 is a declaration that should be filed by an individual who does not have a PAN card and who enters into any transaction specified in rule 114B of the Income-tax Rules, 1962. Hence, anyone who does not have a PAN while entering into certain transactions must file Form 60.

How to fill form 60/61?

Information Needed to Fill Form 60 First, middle, and last names. Date of Birth in DDMMYYYY. Father's First, Middle, and Last Name. Official address – Flat/Room No., Floor No., Name of Premises, Block Name/No., Road/ Street/ Lane, Area/ Locality, Town/ City, District, State, Pin code. Telephone and Mobile Numbers.

What is the meaning of Form 61?

Form 61 is a declaration form used by individuals who earn their income from the agricultural department and do not earn any kind of taxable income. Form 61 can be used for the purchase or sale of immovable property worth over ₹5,00,000, purchase or sale of vehicles, opening a bank account, etc.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 61?

Form 61 is a self-declaration form used in India for individuals who do not have a Permanent Account Number (PAN) to facilitate transactions that require PAN.

Who is required to file Form 61?

Individuals who are not assigned a PAN and are required to undertake transactions that mandate PAN submission are required to file Form 61.

How to fill out Form 61?

To fill out Form 61, individuals must provide personal details such as name, address, contact information, and specifics about the transaction for which PAN is not available.

What is the purpose of Form 61?

The purpose of Form 61 is to enable individuals without a PAN to carry out financial transactions while complying with tax regulations and ensuring that their transactions are reported to the tax authorities.

What information must be reported on Form 61?

Form 61 requires reporting personal details like name, address, and contact information, along with details of the specified transactions that necessitate the use of this form.

Fill out your form 61 - qirc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 61 - Qirc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.