Get the free LIC. 3 - dpi nsw gov

Show details

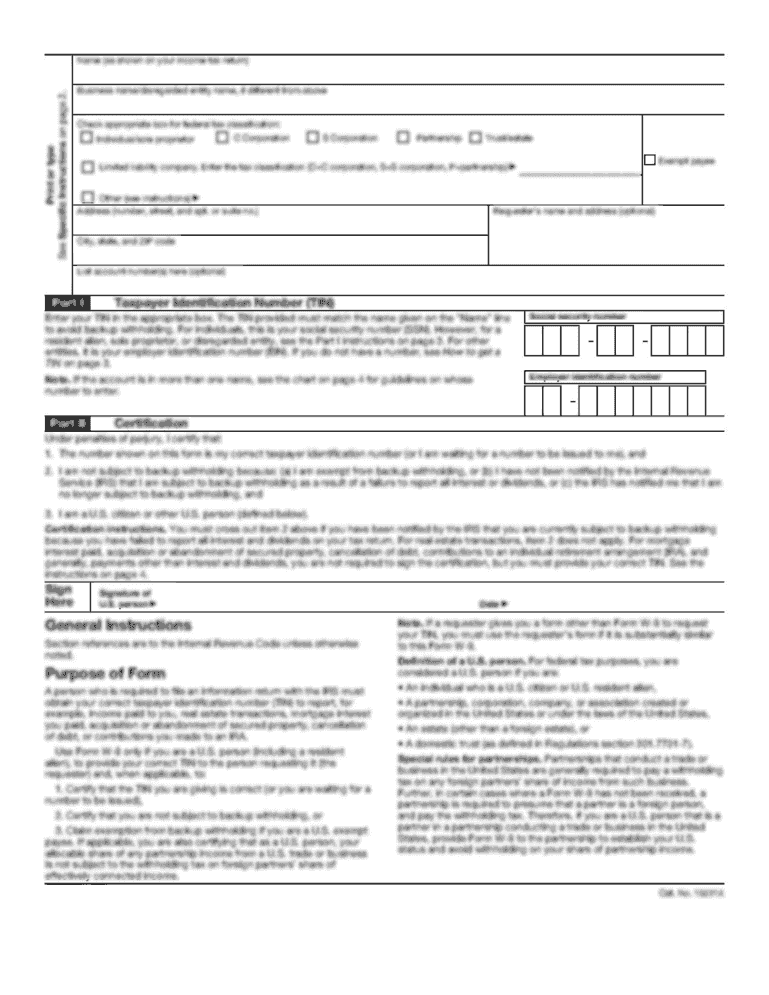

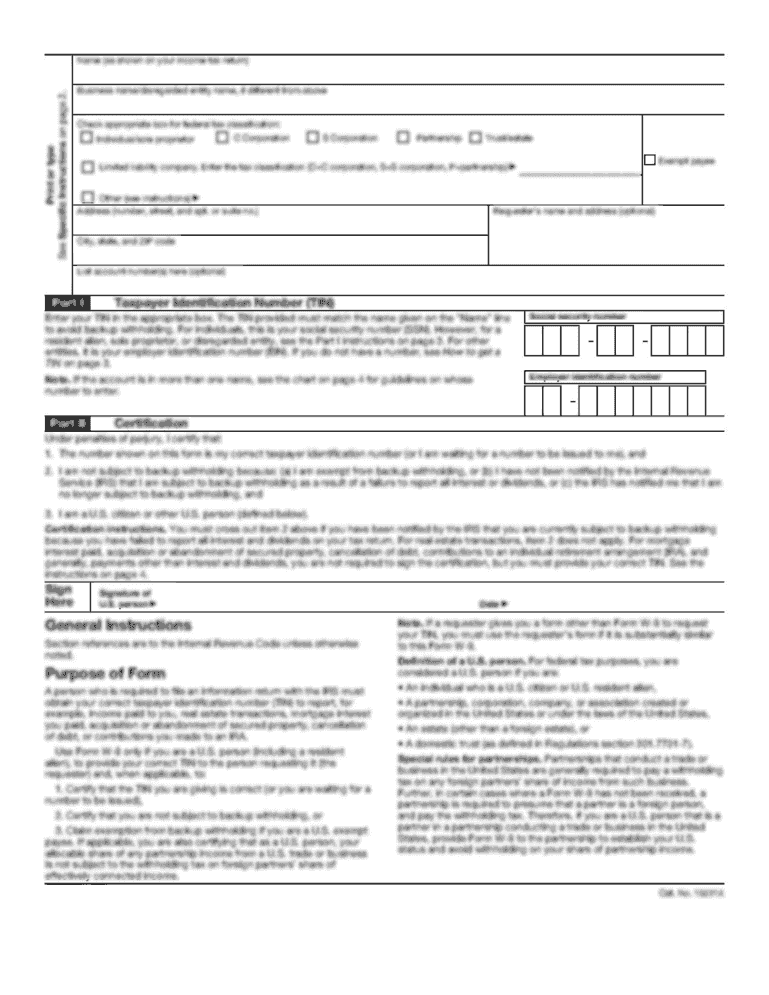

This application form is intended for individuals, partnerships, or companies to replace the physical boat recorded on a fishing boat licence, change identifying particulars, or place a fishing boat

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lic 3 - dpi

Edit your lic 3 - dpi form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lic 3 - dpi form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lic 3 - dpi online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lic 3 - dpi. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lic 3 - dpi

How to fill out LIC. 3

01

Gather all necessary documents such as ID proof and address proof.

02

Choose the type of LIC policy suited to your needs.

03

Fill out the LIC application form with accurate personal details.

04

Provide information about the sum assured and payment frequency.

05

Include nominee details as required.

06

Review the form for any errors or missing information.

07

Submit the completed form along with the required documents and premium payment.

Who needs LIC. 3?

01

Individuals looking for life insurance coverage.

02

People planning for financial security for their family.

03

Those who want to save for future expenses such as education or retirement.

Fill

form

: Try Risk Free

People Also Ask about

What is LIC 936 plan in English?

936, UIN No. 512N304V02) is a standard, non-linked, with-profit insurance and investment plan. This policy not only gives financial assistance to the insured's family in the event of an emergency, but it also covers the family's future financial needs even if the insured individual is not present.

How to download LIC pdf?

To download LIC receipts without logging in, visit the LIC website and navigate to the "Quick Pay". Select "View/Download Receipts," provide the required policy-related information, and submit. The portal will then display the receipts, which you can download directly by clicking on the Receipts Number.

What is LIC 934 plan in English?

LIC Jeevan Tarun (Plan No. 934, UIN No. 512N299V02) is a Non-linked, Participating, Individual, Life Assurance savings plan that is specially designed for the children to safeguard their health as well as future events in your absence.

What is LIC policy 934 plan?

LIC Jeevan Tarun (Plan No. 934, UIN No. 512N299V02) is a Non-linked, Participating, Individual, Life Assurance savings plan that is specially designed for the children to safeguard their health as well as future events in your absence.

What is the difference between LIC plan 836 and 936?

The main differences between LIC Jeevan Labh 836 and LIC Jeevan Labh 936 are death benefit, payout options, available riders, and loan eligibility. Both plans are now withdrawn; however, LIC Plan 936 offered more benefits as it was a newer version of the 836 LIC plan.

What is LIC in English?

The Life Insurance Corporation of India (LIC) is an Indian public sector life insurance company headquartered in Mumbai.

What are the disadvantages of Jeevan Labh?

Limitations of LIC Jeevan Labh Policy The policy does not acquire any surrender value for the first two years of the policy term. Should you choose to close the policy in these two years, LIC is not liable to offer any benefits.

What are the benefits of LIC policy 936?

The death benefit will not be less than 105 % premiums paid as of the death date. Maturity Benefit: The policyholder will receive the amount assured on maturity as a lump sum at the policy's maturity, which is equal to the 'Basic Sum Assured' plus any vested 'Simple Reversionary Bonuses' and 'Final Additional Bonuses'.

Which LIC policy is best for high return?

Which LIC policy is best for High Returns? LIC PoliciesEntry AgeMaximum Maturity Age LIC Jeevan Umang 90days - 55years 15/20/25/30 years LIC Jeevan Utsav 90 days -65 years NA LIC New Pension Plus 25 years-75 years 85 years LIC New Jeevan Shanti 30 years-79 years 80 years2 more rows

What is the bonus rate for LIC plan 936?

LIC Bonus Rates As Per the Evaluation on 31st March 2021 - Active Plans Sl No.PlanBonus Rates (Per 1000/- SA)** 8 LIC Jeevan Labh - 936 40 44 4727 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

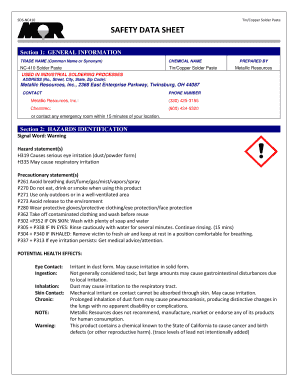

What is LIC. 3?

LIC. 3 is a specific form used for reporting certain information to the state authorities regarding insurance coverages and policies held, typically used in insurance and financial contexts.

Who is required to file LIC. 3?

Entities or individuals that hold specific types of insurance policies and are mandated by regulatory authorities to report their coverage details must file LIC. 3.

How to fill out LIC. 3?

To fill out LIC. 3, users should carefully read the instructions provided with the form, include all required information pertaining to their insurance policies, and submit it to the relevant authority by the designated deadline.

What is the purpose of LIC. 3?

The purpose of LIC. 3 is to ensure compliance with insurance regulations by collecting essential data about insurance coverages, allowing regulators to monitor and oversee insurance practices.

What information must be reported on LIC. 3?

LIC. 3 typically requires information such as the type of insurance policy, coverage details, policy numbers, the insured entity's details, and any other relevant data as specified in the form's guidelines.

Fill out your lic 3 - dpi online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lic 3 - Dpi is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.