Get the free Credit Application for Contractors - Berco Redwood

Show details

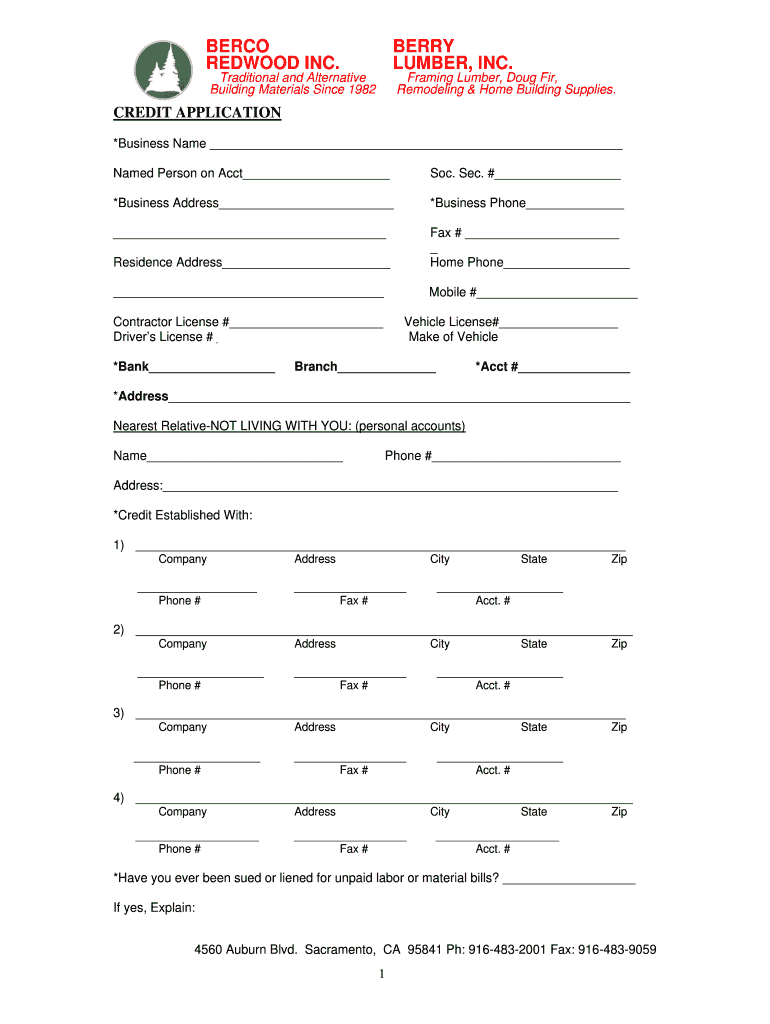

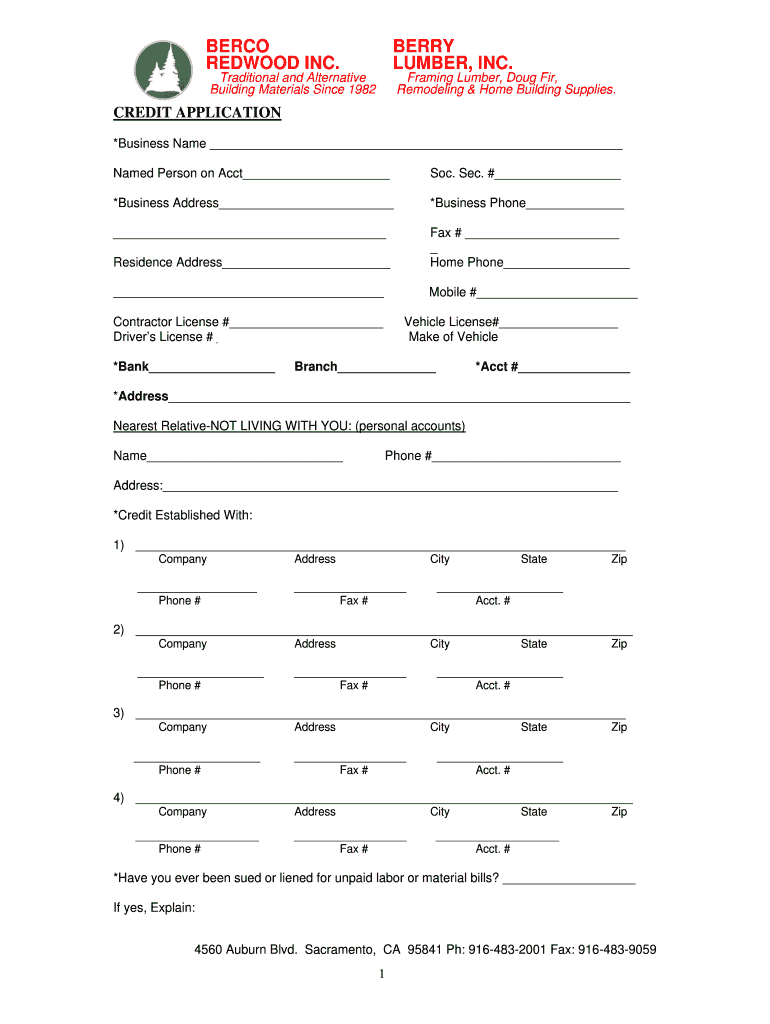

PERCO REDWOOD INC. BERRY LUMBER, INC. Traditional and Alternative Building Materials Since 1982 Framing Lumber, Doug Fir, Remodeling & Home Building Supplies. CREDIT APPLICATION *Business Name Named

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application for contractors

Edit your credit application for contractors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application for contractors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit application for contractors online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit application for contractors. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application for contractors

How to fill out a credit application for contractors:

01

Gather all necessary information: Before starting the application, make sure you have all the required information on hand. This may include personal and business details, such as contact information, business name, tax ID number, financial statements, and references.

02

Read the instructions carefully: Carefully review the instructions provided with the credit application. Pay attention to any specific requirements or additional documents that need to be submitted along with the application.

03

Provide accurate and complete information: While filling out the application form, ensure that all the information you provide is accurate and up to date. Double-check the spelling of your name, address, and other details to avoid any errors that could delay the approval process.

04

Include relevant financial information: Credit applications often require financial information, such as income statements, balance sheets, and tax records. Make sure to include these documents when submitting the application, as they help lenders assess your creditworthiness.

05

Provide references or testimonials: Some credit applications may ask for references from other contractors, suppliers, or customers. Include references that can vouch for your reliability and ability to repay debts.

06

Understand the terms and conditions: Familiarize yourself with the terms and conditions of the credit application, including interest rates, payment terms, and any penalties for late payments. Ensure that you are comfortable with the terms before signing and submitting the application.

Who needs a credit application for contractors?

01

Independent contractors: Any individual working as an independent contractor, such as a freelance construction worker or consultant, may need to fill out a credit application. This allows them to access credit when needed, such as purchasing supplies or equipment.

02

Small contracting businesses: Small businesses operating in industries like construction, renovation, plumbing, or electrical services often need credit to fund their operations. Completing a credit application allows these businesses to establish credit profiles and access financing options.

03

Subcontractors: Subcontractors working on larger construction projects may need to submit credit applications to qualify for credit lines or supplier accounts. This allows them to obtain materials and resources necessary for their work.

Ultimately, anyone in the contracting business who relies on credit for their operations or wants to establish credit should consider filling out a credit application. It is essential for securing financing and building relationships with suppliers and creditors in the industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application for contractors from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your credit application for contractors into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send credit application for contractors for eSignature?

Once you are ready to share your credit application for contractors, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my credit application for contractors in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your credit application for contractors right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is credit application for contractors?

A credit application for contractors is a formal document required by vendors or suppliers to assess the creditworthiness of a contractor before extending credit terms.

Who is required to file credit application for contractors?

Contractors or construction companies seeking to establish credit with vendors or suppliers are required to file a credit application.

How to fill out credit application for contractors?

To fill out a credit application for contractors, the applicant must provide detailed information about their business, financial history, references, and previous credit accounts.

What is the purpose of credit application for contractors?

The purpose of a credit application for contractors is to evaluate the financial stability and creditworthiness of a contractor before allowing them to purchase goods or services on credit.

What information must be reported on credit application for contractors?

The information that must be reported on a credit application for contractors includes business name, address, contact information, tax ID number, financial statements, trade references, and bank accounts.

Fill out your credit application for contractors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application For Contractors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.