Get the free Share Draft Account Agreement - Leo Credit Union

Show details

SHARE DRAFT ACCOUNT AGREEMENT WITH

OVERDRAFT TRANSFER CLAUSE

I/We hereby authorize the

L.E.O. CREDIT UNION, INC.

Credit Union

(the Credit Union) to establish this Share Draft Account for me/us. The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign share draft account agreement

Edit your share draft account agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your share draft account agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing share draft account agreement online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit share draft account agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out share draft account agreement

How to fill out a share draft account agreement?

01

Obtain the share draft account agreement form: Contact your financial institution or visit their website to obtain the share draft account agreement form.

02

Read the agreement carefully: Take the time to thoroughly read through the entire agreement. Pay close attention to any terms, conditions, or fees associated with the account. If you have any questions or need clarification, reach out to your financial institution for further assistance.

03

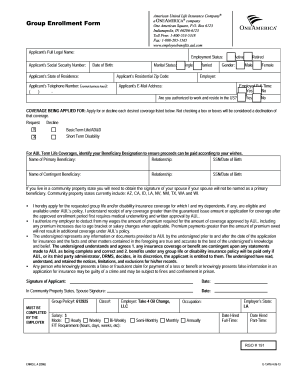

Provide personal information: Fill in your personal information accurately, which may include your full name, address, date of birth, social security number, and contact information. This information is necessary for the financial institution to establish your account.

04

Decide on the type of account: Determine the type of share draft account you want to open. This could be an individual account, joint account, business account, or any other account type offered by your financial institution. Select the appropriate account type and indicate it on the agreement form.

05

Choose additional services: Some share draft accounts offer additional services, such as overdraft protection, online banking, or checkbook ordering. If desired, indicate on the agreement form which additional services you would like to include with your account.

06

Signature(s) and date: Sign the share draft account agreement form at the designated sections. If you are opening a joint account, make sure all account holders sign the document. Additionally, write the date of signing next to your signature.

07

Complete any required disclosures: In some cases, share draft account agreements may require you to sign additional disclosures. These disclosures typically cover topics like electronic funds transfers, overdraft policies, or privacy notice. Carefully review and sign any required disclosures as instructed.

Who needs a share draft account agreement?

01

Individuals: Individuals who want to have a checking account with check-writing privileges can benefit from a share draft account agreement. This is a convenient way to manage personal finances and make payments.

02

Joint Account Holders: If two or more individuals want to open a shared checking account, they will need to complete a share draft account agreement together. This ensures that all account holders are aware of the terms and responsibilities associated with the joint account.

03

Business Owners: Business owners often need a share draft account agreement to establish a business checking account. This allows them to separate personal and business finances and facilitates smooth transactions for their company.

Remember to consult with your financial institution for specific requirements and guidelines when filling out a share draft account agreement, as these may vary slightly based on the institution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find share draft account agreement?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific share draft account agreement and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out the share draft account agreement form on my smartphone?

Use the pdfFiller mobile app to complete and sign share draft account agreement on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit share draft account agreement on an iOS device?

Create, modify, and share share draft account agreement using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is share draft account agreement?

A share draft account agreement is a legal document that outlines the terms and conditions governing a share draft account, which is a type of checking account offered by credit unions.

Who is required to file share draft account agreement?

The account holder is typically required to sign and file the share draft account agreement with the credit union.

How to fill out share draft account agreement?

To fill out a share draft account agreement, the account holder must provide their personal information, agree to the terms and conditions set by the credit union, and sign the document.

What is the purpose of share draft account agreement?

The purpose of a share draft account agreement is to establish the rights and responsibilities of both the account holder and the credit union regarding the use of the share draft account.

What information must be reported on share draft account agreement?

The share draft account agreement must include the account holder's personal information, the terms and conditions of the account, and any fees or charges associated with the account.

Fill out your share draft account agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Share Draft Account Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.