Get the free Buy to Let Mortgages Additional property details - pdf precisemortgages co

Show details

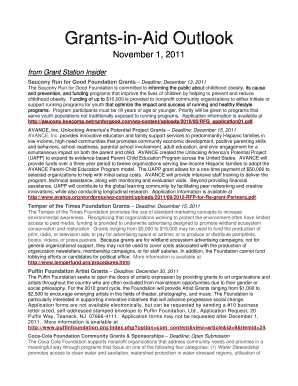

Buy to Let Mortgages Additional property details Please complete if there are more than 2 additional properties and attach with the application. Property number Amount outstanding Lender name Rental

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign buy to let mortgages

Edit your buy to let mortgages form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your buy to let mortgages form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit buy to let mortgages online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit buy to let mortgages. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out buy to let mortgages

How to fill out buy to let mortgages:

01

Start by gathering all the necessary documents such as proof of income, identification, bank statements, tax returns, and any other relevant financial information.

02

Research different lenders and compare their buy to let mortgage products to find the best terms and interest rates that suit your needs.

03

Calculate your affordability and determine how much you can borrow based on your rental income and personal financial situation. This will help you set a budget and narrow down your property options.

04

Consider seeking advice from a mortgage broker who specializes in buy to let mortgages. They can provide guidance on the application process and help you navigate any complexities in securing a favorable loan.

05

Fill out the application form accurately and provide all the necessary details. Make sure to double-check your information before submitting to avoid any mistakes that could delay the approval process.

06

Prepare to provide additional documentation or answer any questions that may arise during the underwriting process. Lenders will carefully assess your financial situation and evaluate the potential rental income from the property to determine your eligibility for the mortgage.

07

Once your application is approved, carefully review the mortgage offer including the terms, interest rates, fees, and any specific conditions. Seek legal advice if needed to ensure you fully understand the terms and obligations associated with the mortgage agreement.

08

If you are satisfied with the offer, proceed to sign the mortgage agreement and complete any remaining paperwork. It's important to read and understand all the clauses and terms before committing to the mortgage.

Who needs buy to let mortgages?

01

Property investors who wish to purchase residential properties for the purpose of renting them out and generating rental income.

02

Individuals looking to expand their property portfolio and take advantage of the potential capital appreciation in the real estate market.

03

People considering alternative investment options that can provide a steady income stream in addition to potential long-term growth.

04

Homeowners who are relocating or upgrading and prefer to keep their existing property as an investment rather than selling it outright.

05

Those who have a detailed understanding of the rental market, property management, and are willing to take on the responsibilities and risks associated with being a landlord.

06

Individuals who have done thorough research and due diligence on potential buy to let investments and have a clear strategy for achieving their financial goals through property rental.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is buy to let mortgages?

Buy to let mortgages are loans specifically designed for people who want to invest in property in order to rent it out to tenants.

Who is required to file buy to let mortgages?

Landlords or property investors who have taken out buy to let mortgages are required to file them.

How to fill out buy to let mortgages?

Buy to let mortgages can be filled out by providing information on the property being financed, rental income, expenses, and personal finances.

What is the purpose of buy to let mortgages?

The purpose of buy to let mortgages is to provide funding for purchasing investment properties to generate rental income.

What information must be reported on buy to let mortgages?

Information such as property details, rental income, expenses, and personal financial information must be reported on buy to let mortgages.

How can I modify buy to let mortgages without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including buy to let mortgages, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit buy to let mortgages online?

The editing procedure is simple with pdfFiller. Open your buy to let mortgages in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the buy to let mortgages in Gmail?

Create your eSignature using pdfFiller and then eSign your buy to let mortgages immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your buy to let mortgages online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Buy To Let Mortgages is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.