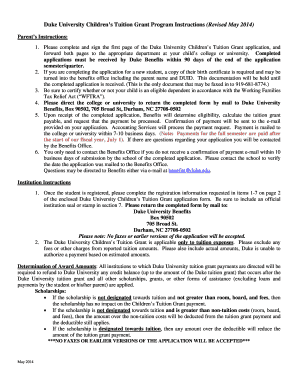

Get the free CREDIT CONTROL AND

Show details

1CREDIT CONTROL AND DEBT COLLECTION POLICY TABLE OF CONTENT ITEM NUMBER DESCRIPTIONPAGE NUMBERPREAMBLE21.PART A CREDIT CONTROL PROCEDURES DEFINITIONS32.PURPOSE53.REGISTRATIONS FOR MUNICIPAL SERVICES54.DEPOSITS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit control and

Edit your credit control and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit control and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit control and online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit control and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit control and

How to fill out credit control and:

01

Review your financial records: Start by gathering all necessary financial records, including income statements, balance sheets, and cash flow statements. Review these records thoroughly to understand your current financial position.

02

Assess creditworthiness: Determine the creditworthiness of potential customers or clients by conducting a credit check. This involves evaluating their credit history, payment patterns, and financial stability. Use reliable credit rating agencies or tools to gather this information.

03

Set credit limits: Based on the creditworthiness assessment, establish appropriate credit limits for each customer. These credit limits should align with the customer's financial standing and ability to make timely payments.

04

Create credit control policies: Develop effective credit control policies that outline the terms and conditions for extending credit, payment due dates, interest rates on outstanding balances, and penalties for late payments. Ensure these policies comply with local regulations and industry standards.

05

Implement credit monitoring systems: Utilize credit monitoring systems or software to keep track of customer transactions and payment patterns. This will help you identify any potential credit risks or late payments.

06

Establish clear communication channels: Maintain open lines of communication with customers regarding their credit agreements. Clearly communicate payment terms, potential penalties, and any changes in credit limits or policies.

07

Regularly review and evaluate credit control: Continuously review and evaluate the effectiveness of your credit control processes. Analyze your accounts receivable reports, debtor aging analysis, and cash flow statements to identify any areas of improvement or potential issues.

Who needs credit control and:

01

Small businesses: Small businesses often extend credit to customers to maintain cash flow, so credit control is essential to ensure timely payments and manage any credit risks.

02

Financial institutions: Banks, credit unions, and other financial institutions require credit control practices to assess loan applicants' creditworthiness and monitor borrowers' repayment patterns.

03

Wholesale and manufacturing companies: These industries often offer credit terms to their customers. Effective credit control helps minimize the risk of unpaid invoices and maintains healthy cash flow.

04

Service-based businesses: Professionals offering services like consultancy, legal advice, or freelancers who work on a project basis may need credit control methods to manage their billing cycles and ensure prompt payment.

05

Retail businesses: Retailers who offer store credit or installment options to customers require credit control practices to manage these payment plans effectively.

Overall, credit control is beneficial for any business that extends credit to customers or clients, as it helps manage financial risks, optimize cash flow, and maintain healthy customer relationships.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit control and on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing credit control and.

Can I edit credit control and on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as credit control and. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete credit control and on an Android device?

On an Android device, use the pdfFiller mobile app to finish your credit control and. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is credit control and?

Credit control is the process of monitoring and managing the credit extended to customers to ensure timely payment and minimize the risk of bad debts.

Who is required to file credit control and?

Businesses that extend credit to customers are required to file credit control.

How to fill out credit control and?

Credit control can be filled out by providing information on customer credit limits, payment terms, outstanding balances, and credit history.

What is the purpose of credit control and?

The purpose of credit control is to manage and minimize the risk of bad debts by monitoring and controlling the credit extended to customers.

What information must be reported on credit control and?

Information such as customer credit limits, payment terms, outstanding balances, and credit history must be reported on credit control.

Fill out your credit control and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Control And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.