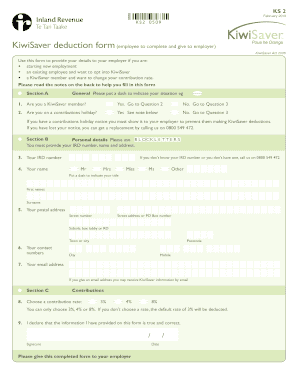

NZ IR330 2013 free printable template

Show details

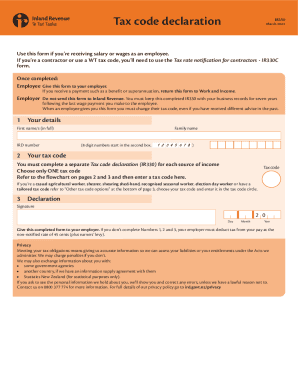

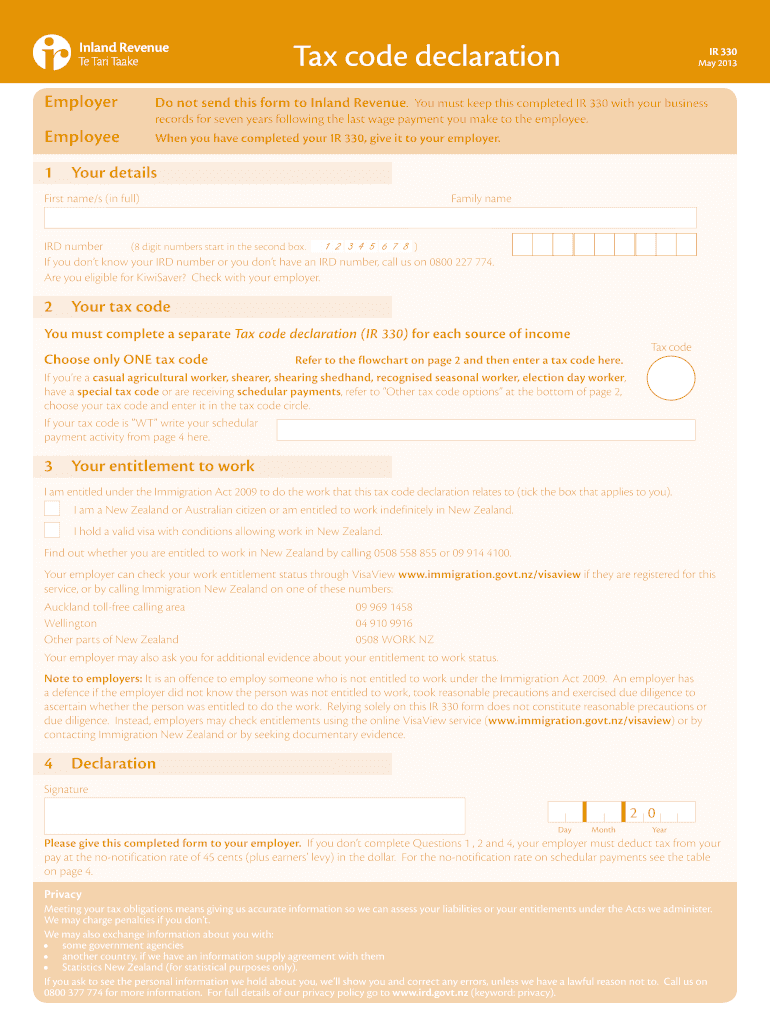

Tax code declaration Employer IR 330 May 2013 Do not send this form to Inland Revenue. You must keep this completed IR 330 with your business records for seven years following the last wage payment you make to the employee. When you have completed your IR 330 give it to your employer. 1 Your details First name/s in full Family name IRD number 8 digit numbers start in the second box. Relying solely on this IR 330 form does not constitute reasonable precautions or due diligence. Instead...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NZ IR330

Edit your NZ IR330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ IR330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NZ IR330 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NZ IR330. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ IR330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NZ IR330

How to fill out NZ IR330

01

Obtain the NZ IR330 form from the New Zealand Inland Revenue website or your employer.

02

Fill out your personal details such as name, address, and tax code.

03

Indicate your residency status for tax purposes.

04

Complete the section regarding sources of income if applicable.

05

Review the form for accuracy before submitting.

06

Submit the completed form to your employer or the Inland Revenue Department.

Who needs NZ IR330?

01

Individuals starting new employment in New Zealand.

02

Existing employees who need to update their tax code.

03

Any individual who has changes in their tax circumstances.

Fill

form

: Try Risk Free

What is ir 330?

What is an IR330? If you are an employee earning a salary or wage then you'll need to fill out this form. ... This form specifies what tax code will apply so your employers know what tax rate to apply to your wages.

People Also Ask about

What is form and meaning examples?

Form is the physical structure of something, while meaning is the interpretation or concept that is attached to that form. For example, the form of a chair is its physical structure – four legs, a seat, and a back. The meaning of a chair is that it is something you can sit on.

What is example of form?

What are Examples of Forms? Forms are documents that collect information from one's clients, customers, and respondents. Some common examples of forms include forms for purchases, incident reports, hazards, quality control, contact tracing, and feedback gathering.

How do you spell form in English?

form noun (SHAPE)

What do you mean by form in computer?

A form in Access is a database object that you can use to create a user interface for a database application. A "bound" form is one that is directly connected to a data source such as a table or query, and can be used to enter, edit, or display data from that data source.

What do you mean by a form?

Form is the shape, visual appearance, or configuration of an object. In a wider sense, the form is the way something happens. Form may also refer to: Form (document), a document (printed or electronic) with spaces in which to write or enter data.

What does form mean in writing?

FORM - is the name of the text type that the writer uses. For example, scripts, sonnets, novels etc. All of these are different text types that a writer can use. The form of a text is important because it indicates the writer's intentions, characters or key themes.

What is a form example?

What are Examples of Forms? Forms are documents that collect information from one's clients, customers, and respondents. Some common examples of forms include forms for purchases, incident reports, hazards, quality control, contact tracing, and feedback gathering.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NZ IR330 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing NZ IR330 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the NZ IR330 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your NZ IR330 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete NZ IR330 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your NZ IR330. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is NZ IR330?

NZ IR330 is a tax form used in New Zealand for employees to provide their tax code to their employer. It helps determine the correct amount of tax to be deducted from their wages.

Who is required to file NZ IR330?

All new employees in New Zealand are required to file NZ IR330 with their employer to ensure the correct tax code is applied.

How to fill out NZ IR330?

To fill out NZ IR330, you need to provide personal information such as your name, address, date of birth, and tax code information. Follow the instructions on the form to ensure all sections are completed accurately.

What is the purpose of NZ IR330?

The purpose of NZ IR330 is to inform the employer of the employee's tax code, ensuring the correct amount of tax is withheld from their earnings.

What information must be reported on NZ IR330?

The information that must be reported on NZ IR330 includes the employee's name, IRD number, date of birth, address, and selected tax code.

Fill out your NZ IR330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ ir330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.