Get the free Income tax return - ird govt

Show details

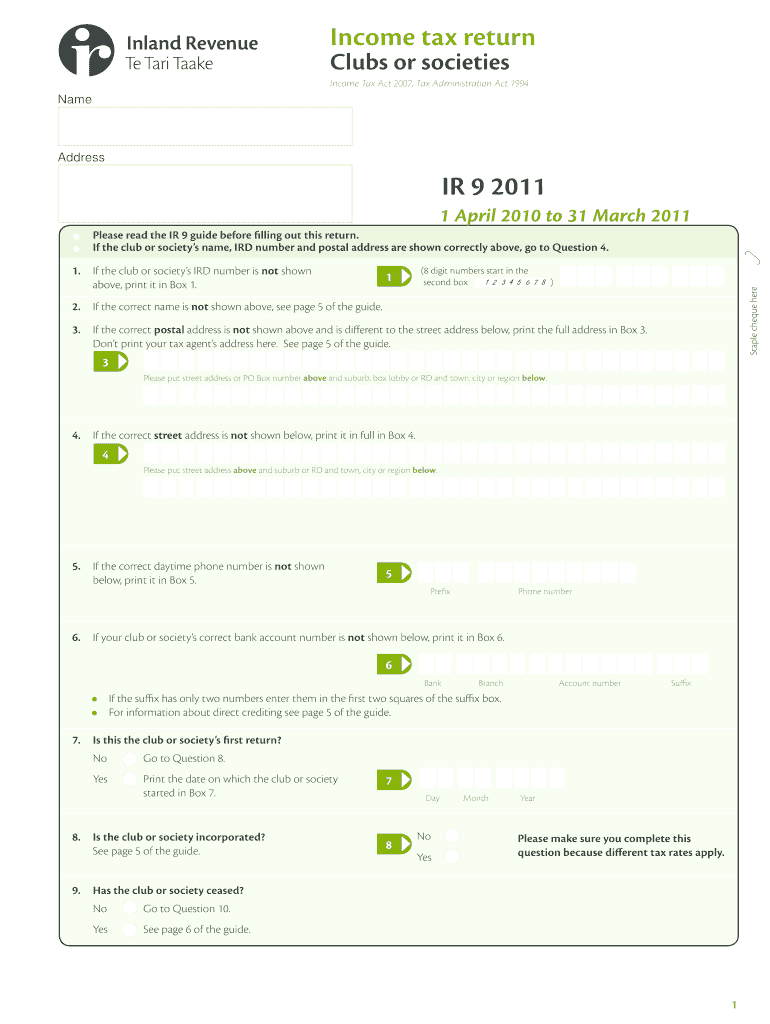

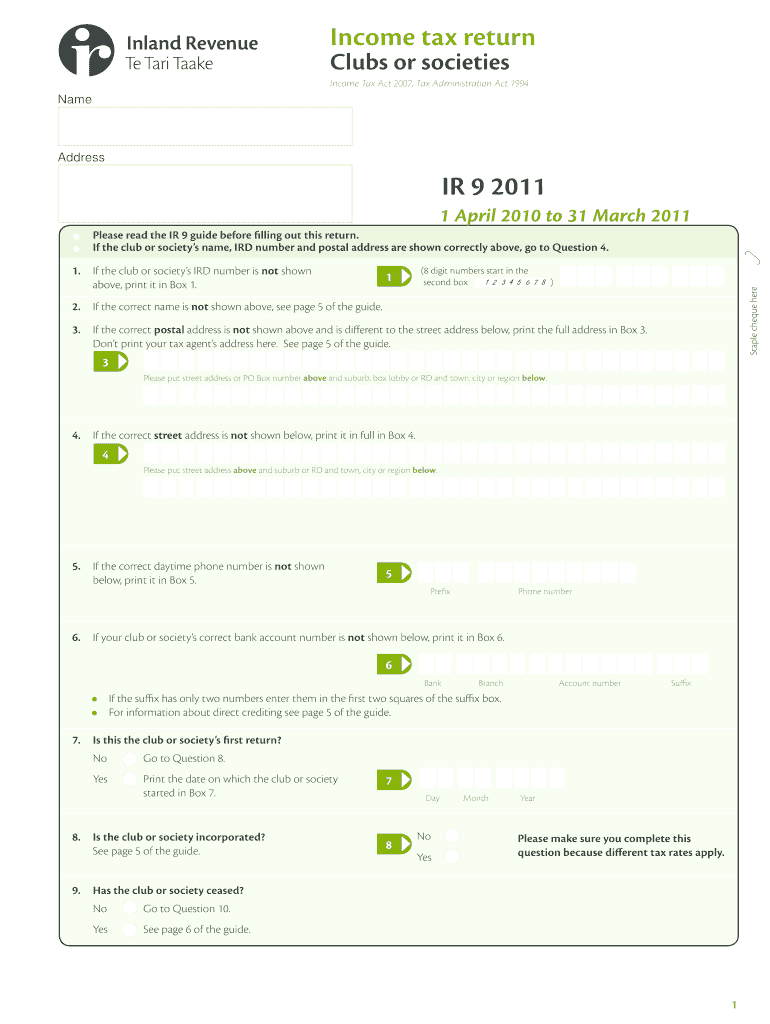

This document is a tax return form specifically designed for clubs or societies to report their income and tax information as required under the Income Tax Act 2007 and the Tax Administration Act

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax return

Edit your income tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income tax return online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit income tax return. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income tax return

How to fill out Income tax return

01

Gather all necessary documents, including W-2 forms, 1099 forms, and any other income statements.

02

Determine your filing status (e.g., single, married filing jointly, head of household).

03

Collect any deductions or credits you may qualify for (e.g., mortgage interest, medical expenses, education credits).

04

Choose your tax form (e.g., Form 1040, 1040A, 1040EZ) based on your situation.

05

Fill out your income section, reporting all sources of income.

06

Apply any deductions to reduce your taxable income.

07

Calculate your tax liability using the tax tables or tax rates applicable for the year.

08

Determine whether you owe taxes or are eligible for a refund.

09

Review your completed return for accuracy.

10

File your tax return electronically or by mail before the deadline.

Who needs Income tax return?

01

Individuals who earn an income, including wages, self-employment earnings, dividends, and interest.

02

Self-employed individuals who report their earnings and expenses.

03

Individuals who may qualify for tax credits or deductions.

04

Residents and non-residents with income from U.S. sources.

05

Individuals who had taxes withheld from their paycheck and want to file for a refund.

Fill

form

: Try Risk Free

People Also Ask about

What is ITR in English?

Income Tax Return or ITR is a form used to show your gross taxable income for the given fiscal year. The form is used by taxpayers to formally declare their income, deductions claimed, exemptions and taxes paid. Therefore, it calculates your net income tax liability in a fiscal year.

What is the other name of ITR?

Glossary Acronym/AbbreviationDescription/Full Form ITR Income Tax Return u/s Under Section DIN Document Identification number FY Financial Year18 more rows

What is the other meaning of ITR?

ITR (Income Tax Return) filing is the annual procedure during which individuals and organizations disclose their income, deductions, and tax obligations to the government. Taxpayers furnish a comprehensive report outlining their income origins and tax payments to tax authorities.

What is an Income Tax Return in the UK?

Under self assessment you submit a tax return to HMRC, giving details of your income and gains for a whole tax year. Not everyone is required to submit an annual tax return – it will depend on whether you meet HMRC's self assessment criteria.

How to file an Income Tax Return online in English?

Follow the below mentioned steps to file ITR via online mode: Login to the Income Tax portal. Go To 'File Income Tax Return' Select 'Assessment Year' Select Filing Status (Individual/ HUF/ Others) Select ITR Type (ITR 1 to ITR-7) Select Reason for filing ITR. Validate the income and other details. E-Verify.

What is an Income Tax Return in the USA?

A federal tax return is a tax return you send to the IRS each year through Form 1040, U.S. Individual Income Tax Return. It shows how much money you earned in a tax year and how much money you paid in taxes. Its purpose is to display that you met your obligation to pay the U.S. government.

What is the meaning of ITR in English?

What is Income Tax Return (ITR) in India? ICICI Prulife. × Get our All-IN-ONE&& Term Life Cover!

What is the ITR Acknowledgement in English?

ITR filing: After a person submits their income tax return (ITR), they receive an income tax return acknowledgement from the tax department. This acknowledgement includes a unique tracking number that can be utilized to monitor the status of the filed Income Tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Income tax return?

An Income Tax Return (ITR) is a legal document that taxpayers submit to the government, detailing their income, expenses, and the amount of tax owed to the government for a specific financial year.

Who is required to file Income tax return?

Individuals, businesses, and entities whose income exceeds the minimum taxable limit set by the government, as well as those who meet specific criteria such as having foreign assets or receiving certain types of income, are required to file an Income Tax Return.

How to fill out Income tax return?

To fill out an Income Tax Return, gather all necessary documents such as income statements, tax deductions, and previous year returns. Then, use the appropriate tax forms provided by the tax authority, fill in all the required fields accurately, and submit the form either online or by mail.

What is the purpose of Income tax return?

The purpose of an Income Tax Return is to report income to the tax authorities, calculate tax liability, claim tax deductions or credits, and provide the government with information for assessing taxes owed based on the taxpayer's financial situation.

What information must be reported on Income tax return?

An Income Tax Return must report information such as total income earned, tax deductions and credits claimed, other sources of income like capital gains or rental income, and details about tax payments made during the year.

Fill out your income tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.