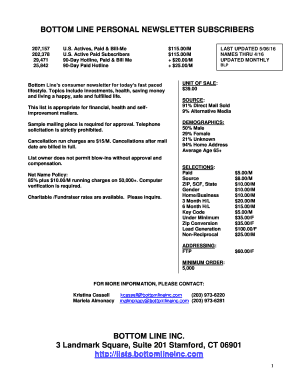

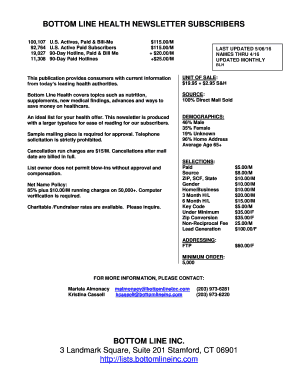

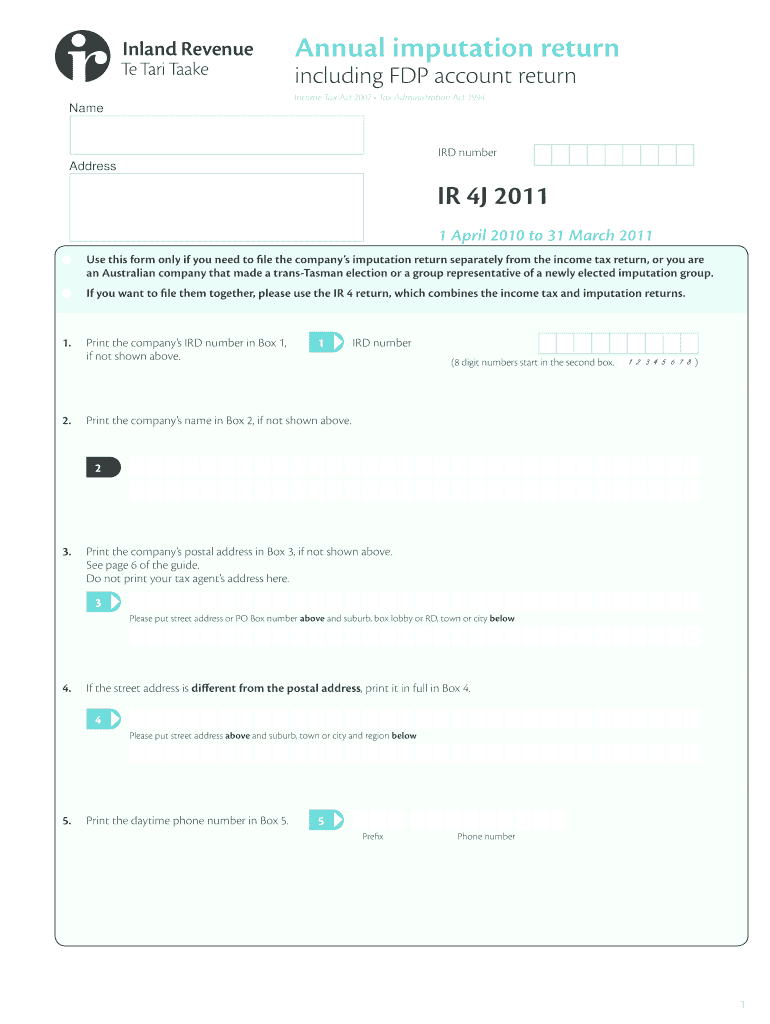

Get the free Annual imputation return including FDP account return - ird govt

Show details

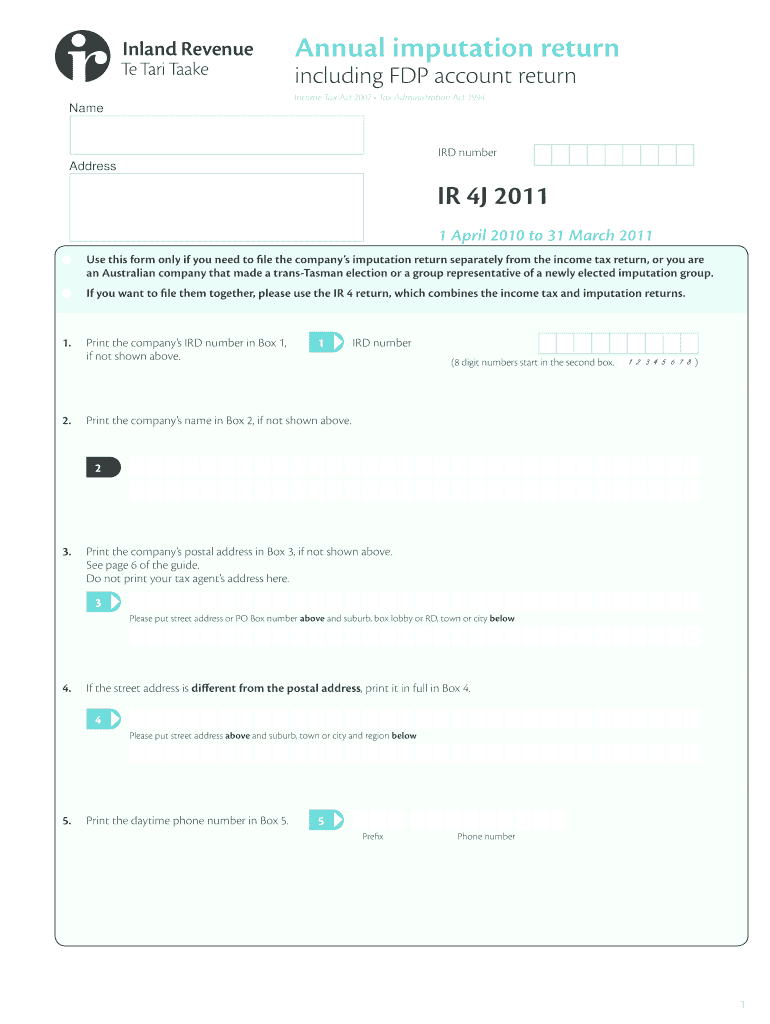

This document is used for filing the company's imputation return separately from the income tax return, or for Australian companies that made a trans-Tasman election, covering the tax year from 1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual imputation return including

Edit your annual imputation return including form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual imputation return including form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual imputation return including online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit annual imputation return including. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual imputation return including

How to fill out Annual imputation return including FDP account return

01

Gather all necessary financial documents including income statements and details of any tax credits.

02

Complete the Annual imputation return form by entering your total income and applicable deductions.

03

Calculate the total imputation credits earned for the financial year.

04

Fill out the FDP account return section by providing details of foreign income and any relevant foreign tax credits.

05

Double-check all entered information for accuracy and completeness.

06

Submit the completed return by the prescribed deadline, ensuring to keep a copy for your records.

Who needs Annual imputation return including FDP account return?

01

Individuals and entities that have received dividend income subject to imputation tax credits.

02

Taxpayers with foreign income or those who have invested in foreign companies requiring reporting on FDP accounts.

03

Businesses that distribute profits to shareholders and need to report these distributions.

Fill

form

: Try Risk Free

People Also Ask about

What does imputation mean in dividends?

It operates on similar principles to the Australian system. A shareholder receiving a dividend from a company is entitled to an "imputation credit", which represents tax paid by the company, and is used to reduce or eliminate the shareholder's income tax liability.

What are total dividend imputation credits?

Understanding Dividends and Withholding Tax To prevent this, imputation credits (ICs) are used to offset part of the tax. These credits reflect tax already paid by the company, passed onto shareholders with dividends, generally at a 28% rate.

What does imputation mean in tax?

The imputation system means that the difference between the tax rate of the shareholder and the tax rate of the company is settled when the shareholder's tax return is assessed.

How do you use imputation credits?

Under the imputation system, a company attaches imputation credits to dividends, representing tax paid at the company level. The shareholders then use those imputation credits to reduce their own tax liability in respect of the company's dividends.

Are imputation credits refundable?

non-refundable tax credits (which are extinguished if you do not use them in the income year they arise) tax credits for supplementary dividends. imputation credits. R&D tax credits from a previous tax year.

What is imputation return?

Under the imputation system, a company attaches imputation credits to dividends, representing tax paid at the company level. The shareholders then use those imputation credits to reduce their own tax liability in respect of the company's dividends.

What is an imputation return?

Imputation credits The imputation system was designed to eliminate double taxation on company profits. Under the imputation system, a company effectively attaches imputation credits (representing tax paid at the company level) to cash and non-cash dividends and taxable bonus issues distributed to shareholders.

What does imputation mean in finance?

Imputed value, also known as estimated imputation, is an assumed value given to an item when the actual value is not known or available. Imputed values are a logical or implicit value for an item or time set, wherein a "true" value has yet to be ascertained.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual imputation return including FDP account return?

The Annual imputation return including FDP account return is a tax document that reports the imputation credits that residents receive on their investments and provides information about the foreign income that has been taxed in another jurisdiction.

Who is required to file Annual imputation return including FDP account return?

Individuals and entities that receive dividends or distributions which have imputation credits, as well as those with foreign income that has been subjected to withholding tax, are required to file the Annual imputation return including FDP account return.

How to fill out Annual imputation return including FDP account return?

To fill out the Annual imputation return including FDP account return, taxpayers must accurately report their total imputation credits received, foreign income, any foreign taxes paid, and other relevant financial information in the designated sections of the return form as provided by the tax authority.

What is the purpose of Annual imputation return including FDP account return?

The purpose of the Annual imputation return including FDP account return is to ensure accurate reporting of tax obligations related to dividends and foreign income, to allow taxpayers to claim credits for taxes already paid, and to facilitate the proper allocation of tax credits within the tax system.

What information must be reported on Annual imputation return including FDP account return?

The information that must be reported includes total imputation credits received, details of foreign income earned, foreign tax credits, and any additional relevant financial transactions that influence the taxpayer's overall taxable income and tax liabilities.

Fill out your annual imputation return including online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Imputation Return Including is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.