Get the free Health Savings Account (HSA) Enrollment Verification Form Section 1: HSA Owner Infor...

Show details

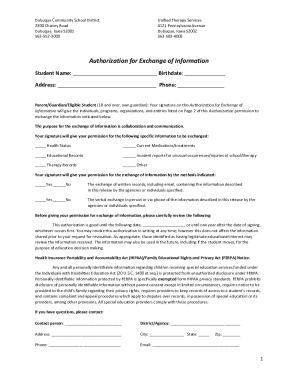

Health Savings Account (HSA) Enrollment Verification Form Section 1: HSA Owner Information PLEASE PRINT First Name MI Social Security Number (Last 4 Digits) Last Name Telephone Number (Day) Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account hsa

Edit your health savings account hsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account hsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health savings account hsa online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit health savings account hsa. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account hsa

How to fill out a health savings account (HSA)?

01

First, determine if you are eligible for an HSA. To be eligible, you must have a high-deductible health insurance plan and not be enrolled in Medicare.

02

Open an HSA with a qualified provider. This can be a bank, credit union, insurance company, or other approved institution. Make sure to compare fees and benefits before choosing a provider.

03

Complete the application form provided by the HSA provider. You will need to provide personal information such as your name, address, social security number, and employment details.

04

Designate a beneficiary for your HSA. This is important in the event of your death, as the funds can be transferred to the designated beneficiary without going through probate.

05

Determine how much you want to contribute to your HSA. The maximum contribution limits for 2021 are $3,600 for individuals and $7,200 for families. If you are 55 years or older, you can make an additional catch-up contribution of $1,000.

06

Choose your investment options. Some HSA providers offer the opportunity to invest your funds in mutual funds, stocks, or other investment vehicles. Consider your risk tolerance and investment goals before deciding.

07

Keep track of your HSA contributions and expenses. It's important to maintain accurate records of all contributions and qualified medical expenses. This will help ensure you are maximizing the benefits of your HSA and avoiding any tax penalties.

08

File your taxes correctly. When filing your taxes, report your HSA contributions on IRS Form 8889. This will allow you to deduct your contributions from your taxable income, potentially reducing your tax liability.

09

Understand the rules and regulations of your HSA. Familiarize yourself with the restrictions on qualified medical expenses, the tax implications of non-qualified expenses, and any other guidelines set forth by the IRS or your HSA provider.

Who needs a health savings account (HSA)?

01

Individuals with high-deductible health insurance plans: HSAs are designed to work alongside high-deductible health insurance plans, allowing individuals to save for medical expenses before reaching their plan's deductible.

02

Those looking to save for future medical expenses: HSAs offer a tax-advantaged way to save for healthcare costs, with contributions and earnings being tax-free as long as they are used for qualified medical expenses.

03

People interested in having more control over their healthcare expenses: With an HSA, individuals have more flexibility in choosing how to spend their healthcare dollars. They can shop around for the best prices and negotiate discounts for medical services.

04

Individuals seeking to lower their taxable income: Contributions made to an HSA are tax-deductible, meaning they can reduce your taxable income. This can result in significant tax savings for those in higher tax brackets.

05

Those planning for retirement: HSAs can be an effective retirement savings tool. Once you turn 65, you can use the funds in your HSA for any purpose, not just medical expenses. If used for non-medical expenses, the funds will be subject to income tax but not the usual 20% penalty.

Note: It is recommended to consult with a tax professional or financial advisor to fully understand the rules and regulations of HSAs and how they apply to your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my health savings account hsa in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your health savings account hsa and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out health savings account hsa on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your health savings account hsa. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I edit health savings account hsa on an Android device?

You can edit, sign, and distribute health savings account hsa on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is health savings account hsa?

A health savings account (HSA) is a tax-advantaged account that individuals can contribute to in order to pay for medical expenses.

Who is required to file health savings account hsa?

Individuals who are eligible for an HSA and contribute to it are required to file.

How to fill out health savings account hsa?

To fill out an HSA, individuals need to report their contributions, withdrawals, and any other relevant information on the appropriate IRS forms.

What is the purpose of health savings account hsa?

The purpose of an HSA is to help individuals save for medical expenses and reduce their taxable income.

What information must be reported on health savings account hsa?

Information such as contributions, withdrawals, and qualified medical expenses must be reported on an HSA.

Fill out your health savings account hsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account Hsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.