Get the free RWT reconciliation statement - ird govt

Show details

This document is a reconciliation statement for Resident Withholding Tax (RWT) related to specified dividends and Māori authority distributions, including instructions for completing the form and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rwt reconciliation statement

Edit your rwt reconciliation statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rwt reconciliation statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rwt reconciliation statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rwt reconciliation statement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rwt reconciliation statement

How to fill out RWT reconciliation statement

01

Gather all necessary financial documents, including income statements and tax records.

02

Calculate the total revenue for the relevant period.

03

Determine the amount of Revenue Withholding Tax (RWT) that has been deducted.

04

Fill out the reconciliation statement by entering the total revenue and the RWT amounts.

05

Double-check all calculations for accuracy.

06

Submit the completed reconciliation statement to the appropriate tax authority.

Who needs RWT reconciliation statement?

01

Businesses and individuals who are required to report and reconcile their Revenue Withholding Tax obligations.

02

Accountants and tax professionals managing tax compliance for clients.

03

Entities receiving income subject to RWT, such as employers or businesses paying contractors.

Fill

form

: Try Risk Free

People Also Ask about

Why is a tax reconciliation necessary?

Reconciling the accounts is a particularly important activity for businesses and individuals because it's an opportunity to check for fraudulent activity and to prevent financial statement errors. It's typically done at regular intervals such as monthly or quarterly as part of normal accounting procedures.

What is the purpose of the reconciliation statement?

A reconciliation statement helps to identify discrepancies such as missing transactions, typos, or errors; and bank charges that might be missed.

What is a tax reconciliation statement?

Tax Accounting and Reconciliation is a process to ensure that the revenue realised in respect of duty/tax is duly credited to Government Account and properly accounted for without any discrepancy.

What do you mean by tax reconciliation?

It is the explanation of the relationship between the tax expense (income) and your accounting profit. What's the meaning of that? Theoretically, you could calculate the tax expense as your accounting profit before tax multiplied with the tax rate applicable in your country.

What is the purpose of reconciliation?

The process of reconciliation ensures the accuracy and validity of financial information. Also, a proper reconciliation process ensures that unauthorized changes have not occurred to transactions during processing.

What is a reconciliation statement in English?

A bank reconciliation statement is a financial statement that compares two sets of records to ensure that your book balance (the amount in your company's accounting records) matches your bank account balance (the amount in your company's bank account).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

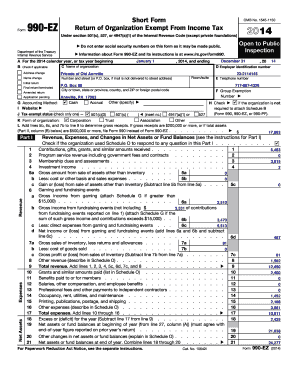

What is RWT reconciliation statement?

The RWT reconciliation statement is a financial document used to reconcile the amounts of Resident Withholding Tax (RWT) that have been withheld by a payer and the amounts that must be reported to the tax authorities.

Who is required to file RWT reconciliation statement?

Any entity or individual who withholds Resident Withholding Tax on payments to residents is required to file an RWT reconciliation statement, including employers, financial institutions, and businesses.

How to fill out RWT reconciliation statement?

To fill out an RWT reconciliation statement, one must gather relevant tax withheld information, ensure all payments and tax withholdings are accounted for, accurately complete all sections of the form, and submit it to the appropriate tax authority by the deadline.

What is the purpose of RWT reconciliation statement?

The purpose of the RWT reconciliation statement is to ensure that the amounts withheld for Resident Withholding Tax are accurately reported to tax authorities, to reconcile any discrepancies, and to comply with tax regulations.

What information must be reported on RWT reconciliation statement?

The RWT reconciliation statement must report total payments made, total RWT withheld, individual recipient details, and any exemptions or adjustments applicable during the tax period.

Fill out your rwt reconciliation statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rwt Reconciliation Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.