Get the free Non-profit 501c3 Tax ID 55-0849384 APAPA PENINSULA - apapa

Show details

Father Asian Pacific Islander American Public Affairs Association Peninsula Chapter (APAPAPNC) Empowering and Engaging Asian and Pacific Islander Americans Nonprofit 501(c)(3) Tax ID #550849384 www.apapa.org

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-profit 501c3 tax id

Edit your non-profit 501c3 tax id form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-profit 501c3 tax id form via URL. You can also download, print, or export forms to your preferred cloud storage service.

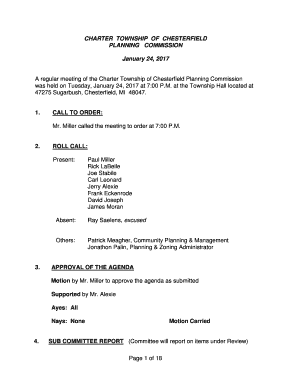

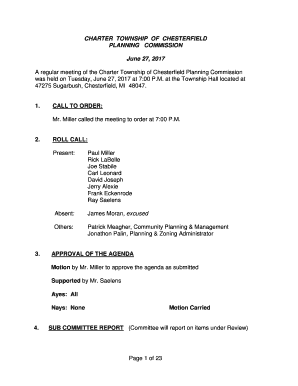

How to edit non-profit 501c3 tax id online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-profit 501c3 tax id. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-profit 501c3 tax id

How to fill out a non-profit 501(c)(3) tax ID:

01

Obtain the necessary forms: To apply for a non-profit 501(c)(3) tax ID, you'll need to fill out Form 1023 or 1023-EZ, which are available on the Internal Revenue Service (IRS) website. These forms can be downloaded and printed for completion.

02

Provide organization details: Begin the form by entering your non-profit organization's basic information, including its legal name, address, and contact information. You will also need to specify the type of non-profit you are, such as a charitable, educational, religious, or scientific organization.

03

Describe the organization's activities: The next step is to describe in detail the activities and programs that your non-profit organization will be engaged in. Provide a comprehensive overview of your organization's purposes, mission, and goals. Be specific and provide examples to illustrate your organization's work.

04

Financial information: You will be required to provide detailed financial information about your non-profit. This includes information on your organization's sources of income, such as donations, grants, and investments. Additionally, you must outline your projected expenses, estimated budget, and how you plan to generate revenue to support your non-profit's activities.

05

Attach supporting documents: Depending on the complexity of your non-profit organization, you may be required to submit additional supporting documents along with the form. This can include articles of incorporation, bylaws, organizational charts, or financial statements. These documents help the IRS evaluate your organization's eligibility for the 501(c)(3) tax-exempt status.

06

Pay the application fee: There is an application fee associated with filing for a non-profit 501(c)(3) tax ID. The fee amount may vary, so it's best to check the current fee schedule on the IRS website. You can enclose the payment with your completed application form.

Who needs a non-profit 501(c)(3) tax ID:

01

Charitable organizations: Non-profit organizations with a charitable purpose, such as those involved in providing assistance to the needy, advancing education, or supporting healthcare initiatives, may require a 501(c)(3) tax ID.

02

Educational institutions: Schools, colleges, universities, and other educational organizations can benefit from obtaining a non-profit 501(c)(3) tax ID to qualify for tax-exempt status and receive donations.

03

Religious organizations: Churches, mosques, temples, and other religious institutions often seek a 501(c)(3) tax ID to gain tax-exempt status and encourage contributions from their members.

04

Scientific and research institutions: Organizations engaged in scientific research, medical advancements, or technological innovation may be eligible for tax-exempt status by obtaining a non-profit 501(c)(3) tax ID. This can help them receive grants and funding for their research efforts.

05

Social welfare organizations: Non-profit organizations focused on the betterment of society, such as those involved in community development, environmental conservation, or animal welfare, can benefit from having a 501(c)(3) tax ID to attract donations and operate tax-free.

In conclusion, anyone involved in a non-profit organization with qualifying purposes can benefit from obtaining a non-profit 501(c)(3) tax ID. By completing the relevant forms and providing the necessary information, organizations can apply for tax-exempt status and enjoy the benefits that come with it.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is non-profit 501c3 tax id?

Non-profit 501c3 tax id is a tax identification number assigned to 501(c)(3) organizations by the IRS.

Who is required to file non-profit 501c3 tax id?

Non-profit organizations that are classified as 501(c)(3) by the IRS are required to file for a non-profit 501c3 tax id.

How to fill out non-profit 501c3 tax id?

You can fill out the non-profit 501c3 tax id form online via the IRS website or by mailing in a completed paper form.

What is the purpose of non-profit 501c3 tax id?

The purpose of the non-profit 501c3 tax id is to identify tax-exempt organizations and track their financial activities.

What information must be reported on non-profit 501c3 tax id?

Non-profit 501c3 tax id form requires information on organization's income, expenses, assets, and activities.

How can I get non-profit 501c3 tax id?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the non-profit 501c3 tax id in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit non-profit 501c3 tax id on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign non-profit 501c3 tax id on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit non-profit 501c3 tax id on an Android device?

You can make any changes to PDF files, like non-profit 501c3 tax id, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your non-profit 501c3 tax id online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Profit 501C3 Tax Id is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.