Get the free Funding retirement

Show details

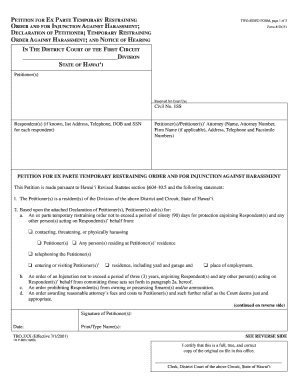

3 co On NF ed her an en y CE +V AT 99 10th annual pensions conference Church House, London 3 December 2015 Funding retirement Freedom, choice and risk How long will you live for? Without an answer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign funding retirement

Edit your funding retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your funding retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit funding retirement online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit funding retirement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out funding retirement

How to fill out funding retirement:

01

Start by evaluating your current financial situation and determining how much money you will need in retirement. Take into account factors such as your desired retirement age, expected expenses, and any existing savings or investments.

02

Create a retirement budget to understand how much you will need to save each year in order to reach your retirement goals. Consider factors such as inflation, healthcare costs, and potential sources of retirement income, such as social security or pensions.

03

Explore different retirement savings options, such as employer-sponsored retirement plans (e.g., 401(k), 403(b)), individual retirement accounts (IRAs), or annuities. Research and compare the features, fees, and potential returns of these accounts to choose the most suitable ones for your needs.

04

Contribute regularly to your retirement accounts, aiming to maximize any employer matches offered and taking advantage of any tax benefits associated with these accounts. Consider automating your contributions to ensure consistent savings.

05

Diversify your investment portfolio to mitigate risks and increase potential returns. Consult with a financial advisor or do thorough research to understand the various investment options available, such as stocks, bonds, mutual funds, or real estate. Consider your risk tolerance and time horizon when making investment decisions.

06

Regularly review and adjust your retirement plan as your circumstances change. Reassess your financial goals, update your retirement budget, and make any necessary modifications to your investment strategy.

07

Monitor your progress toward your retirement savings goals. Keep track of the growth in your retirement accounts, evaluate your investment performance, and make adjustments if needed.

08

Continuously educate yourself about retirement planning and the changing financial landscape. Stay informed about any updates to retirement laws or regulations that may affect your savings strategy.

Who needs funding retirement?

01

Individuals who aspire to maintain their current lifestyle during retirement and avoid financial hardships in their later years.

02

People who do not have access to a pension or other post-employment benefits provided by their employer.

03

Self-employed individuals or workers in industries with limited retirement benefits, who need to independently save and invest for their retirement.

04

Individuals who anticipate living longer due to improved healthcare and medical advancements, thus requiring more financial resources to support a longer retirement period.

05

Anyone who desires to have the freedom to pursue personal interests, travel, or engage in hobbies during retirement without financial constraints.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get funding retirement?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the funding retirement in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit funding retirement straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing funding retirement right away.

How can I fill out funding retirement on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your funding retirement. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is funding retirement?

Funding retirement refers to setting aside money or investing in financial instruments to provide income or funds for retirement.

Who is required to file funding retirement?

Individuals who are planning for retirement and want to ensure they have enough funds to support their lifestyle during retirement are required to file funding retirement.

How to fill out funding retirement?

To fill out funding retirement, individuals should calculate their expected retirement expenses, estimate their retirement income sources, analyze their current financial situation, and make a plan to save or invest accordingly.

What is the purpose of funding retirement?

The purpose of funding retirement is to ensure individuals have enough financial resources to cover expenses and maintain their standard of living during retirement.

What information must be reported on funding retirement?

Information such as retirement savings account balances, retirement income projections, investment strategies, and retirement goals must be reported on funding retirement.

Fill out your funding retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Funding Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.