Get the free Is a charitable trust right

Show details

Page 1 of 2Is a charitable trust right

for you?

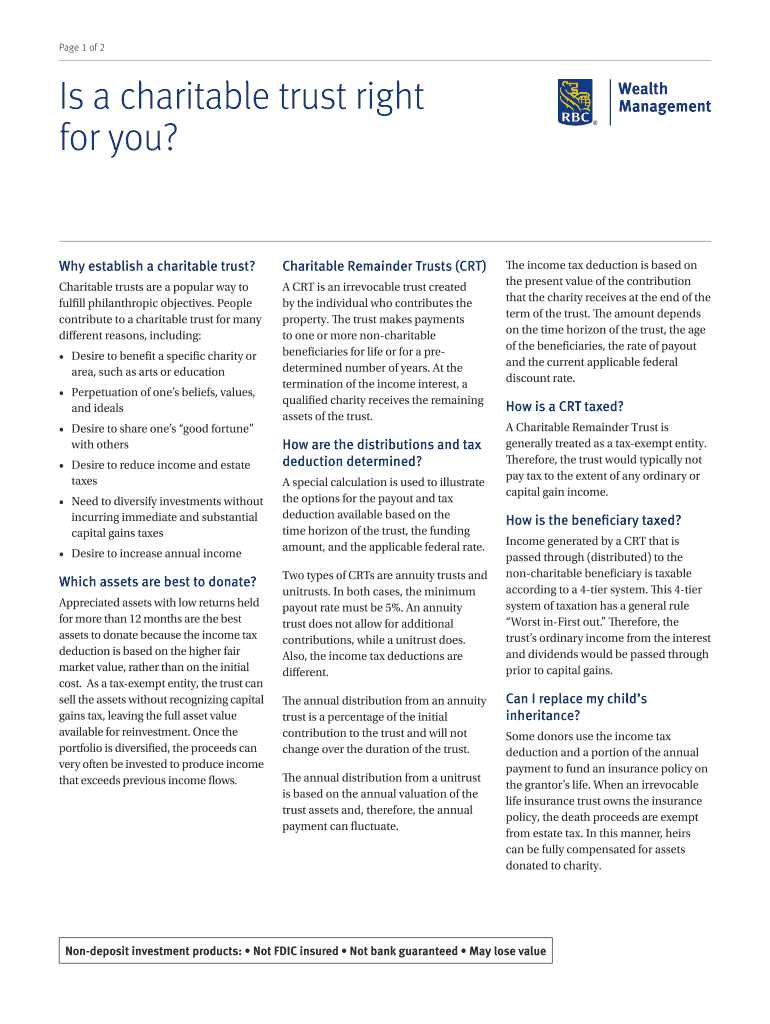

Why establish a charitable trust? Charitable Remainder Trusts (CRT)Charitable trusts are a popular way to

fulfill philanthropic objectives. People

contribute

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign is a charitable trust

Edit your is a charitable trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your is a charitable trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit is a charitable trust online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit is a charitable trust. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out is a charitable trust

How to fill out a charitable trust:

01

Research the requirements: Start by understanding the specific legal requirements for a charitable trust in your jurisdiction. This may involve consulting with an attorney or referring to relevant laws and regulations.

02

Determine the purpose: Clearly define the charitable purpose or mission of the trust. This could be supporting a specific cause, providing educational scholarships, promoting arts and culture, or any other charitable activity. Clearly articulate the intended impact and beneficiaries of the trust.

03

Choose trustees: Select trustworthy individuals or organizations to serve as trustees. Trustees have the responsibility of managing the trust assets, making investment decisions, and ensuring the charitable goals are met. Consider their expertise, experience, and commitment to the charitable mission.

04

Draft the trust document: Prepare a comprehensive trust document that outlines the trust's purpose, beneficiaries, powers, and any specific instructions or restrictions. This legal document serves as the foundation for the charitable trust and should be carefully drafted to ensure clarity and compliance with relevant laws.

05

Fund the trust: Transfer assets to the charitable trust based on the provisions outlined in the trust document. This could be in the form of cash, stocks, real estate, or any other type of asset that aligns with the trust's purpose. Consult with financial professionals to ensure the assets are properly valued and transferred to the trust.

06

Adhere to legal formalities: Fulfill all the legal requirements for creating a charitable trust, which may include notarizing the trust document, filing necessary paperwork with government authorities, and obtaining any required approvals or licenses.

Who needs a charitable trust?

01

Individuals with philanthropic goals: People who have a desire to give back to society and create a lasting impact often choose to set up a charitable trust. It allows them to support causes that are important to them and extend their charitable legacy beyond their lifetime.

02

High-net-worth individuals and families: Charitable trusts can be a valuable tool for high-net-worth individuals looking to optimize their estate planning. Establishing a charitable trust can help minimize tax liabilities, provide flexibility in charitable giving, and involve family members in philanthropy.

03

Nonprofit organizations: Nonprofit organizations themselves can establish charitable trusts to support their own mission or specific programs. This allows them to create a sustainable source of funding and ensure the longevity of their charitable efforts.

04

Businesses and corporations: Some businesses may choose to create a charitable trust as part of their corporate social responsibility initiatives. This can be a way for companies to give back to the communities they serve and contribute to important causes.

Overall, charitable trusts provide a structured and long-lasting avenue for individuals, families, nonprofits, and businesses to support charitable causes and make a positive impact on society.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in is a charitable trust without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your is a charitable trust, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit is a charitable trust straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing is a charitable trust, you need to install and log in to the app.

How do I fill out is a charitable trust on an Android device?

Use the pdfFiller app for Android to finish your is a charitable trust. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is is a charitable trust?

A charitable trust is a legal entity set up to hold funds or assets for charitable purposes.

Who is required to file is a charitable trust?

Charitable trusts are required to file with the relevant authorities in the jurisdiction they operate in.

How to fill out is a charitable trust?

Charitable trusts can be filled out by providing information about the trust, its purposes, trustees, and financial activities.

What is the purpose of is a charitable trust?

The purpose of a charitable trust is to hold funds or assets for charitable purposes and to distribute them to charitable causes.

What information must be reported on is a charitable trust?

Information such as trust assets, financial activities, beneficiaries, and charitable activities must be reported on a charitable trust.

Fill out your is a charitable trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Is A Charitable Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.