Get the free NATIONAL WAR TAX RESISTANCE GATHERING - archives nwtrcc

Show details

NATIONAL WAR TAX RESISTANCE GATHERING AND COORDINATING COMMITTEE MEETING May 4 6, 2007 The Peace Abbey, Serbian, MA From individual acts. . . Refusing to pay for war starts with the individual, in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign national war tax resistance

Edit your national war tax resistance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your national war tax resistance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit national war tax resistance online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit national war tax resistance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out national war tax resistance

How to fill out national war tax resistance:

01

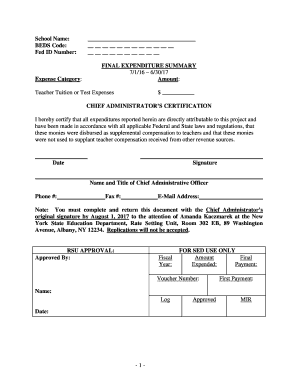

First, gather all necessary information related to your income, deductions, and taxes. This includes income statements, expenses, and any relevant tax forms provided by your employer or financial institution.

02

Determine your eligibility for national war tax resistance. This may involve understanding the criteria set by your government or tax authority. If you oppose funding war efforts with your taxes, you may qualify for this resistance.

03

Consult with tax professionals or seek guidance from organizations specializing in national war tax resistance. They can provide you with valuable insights, legal advice, and assistance in properly filling out the necessary forms and standing by your beliefs.

04

Research and understand the specific forms required for national war tax resistance. These forms may vary depending on your country or jurisdiction. Familiarize yourself with the instructions provided and ensure accurate completion.

05

Complete the necessary forms with the relevant information you have gathered. Be thorough and precise to avoid any misunderstandings or discrepancies that could result in penalties or complications.

06

Review your completed forms and documents before submission. Double-check for any errors, omissions, or inconsistencies. It may be helpful to have someone else proofread your forms for additional assurance.

07

Submit your national war tax resistance forms according to the instructions provided by your tax authority. Be aware of any deadlines or specific procedures that need to be followed. This may include submitting electronically or through traditional mail.

Who needs national war tax resistance:

01

Individuals who hold strong opposition to funding war efforts through their taxes may choose to engage in national war tax resistance. This form of resistance allows individuals to express their conscientious objection to war by withholding or redirecting a portion of their tax payments.

02

Some individuals or organizations may feel that their government's military actions violate their ethical or moral beliefs. National war tax resistance provides a means for these individuals to protest and take a stance against the use of their tax dollars for such purposes.

03

People who support nonviolent methods of conflict resolution, pacifism, or work towards peace initiatives may find national war tax resistance as a way to align their financial contributions with their values and beliefs.

Please note that national war tax resistance should be approached with caution, and individuals should seek legal advice to understand potential consequences or alternatives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is national war tax resistance?

National war tax resistance is a form of civil disobedience in which individuals refuse to pay taxes or part of their taxes that fund military action or war.

Who is required to file national war tax resistance?

Individuals who choose to participate in national war tax resistance are required to file and report their actions to the appropriate government agency.

How to fill out national war tax resistance?

To fill out national war tax resistance, individuals must provide detailed information on their refusal to pay taxes that support military actions, including explanation of beliefs and principles.

What is the purpose of national war tax resistance?

The purpose of national war tax resistance is to protest against military actions or wars that individuals do not support, and to promote peace and non-violent solutions to conflicts.

What information must be reported on national war tax resistance?

Information that must be reported on national war tax resistance includes the amount of taxes withheld, reasons for refusal to pay, and any alternative actions taken to redirect taxes to peaceful causes.

How can I send national war tax resistance for eSignature?

Once your national war tax resistance is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit national war tax resistance straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing national war tax resistance.

How do I fill out national war tax resistance using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign national war tax resistance and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your national war tax resistance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

National War Tax Resistance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.