Get the free TAX INSTALLMENT PAYMENT PLAN TIPP INFORMATION CHANGE REQUEST

Show details

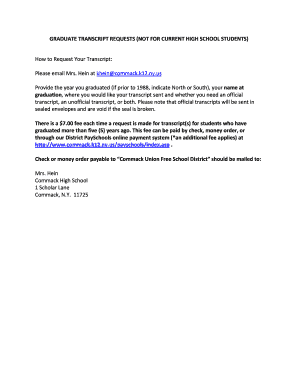

TAX INSTALLMENT PAYMENT PLAN (TIPP) INFORMATION CHANGE REQUEST Please forward the completed form to: Email: property taxes educ.ca Fax: 7809807127 Phone: 7809807105 Mail: #1 Alexandra Park, Educ AB

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax installment payment plan

Edit your tax installment payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax installment payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax installment payment plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax installment payment plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax installment payment plan

How to fill out tax installment payment plan:

01

Determine your eligibility: Check if you meet the eligibility requirements set by the tax authorities for requesting an installment payment plan. These requirements may include factors such as the amount of tax owed and your filing history.

02

Gather necessary documents: Collect all relevant documents, such as tax returns, notices from the tax authorities, and financial statements. These documents will help you accurately determine your outstanding tax liability and complete the necessary paperwork.

03

Contact the tax authorities: Get in touch with the appropriate tax authority or department to discuss your situation and request an installment payment plan. They can provide guidance on the specific forms or procedures required in your jurisdiction.

04

Complete the necessary forms: Fill out the installment agreement form provided by the tax authorities. This form will typically require information regarding your personal details, tax liability, proposed payment schedule, and any supporting documents requested.

05

Determine a reasonable payment schedule: Analyze your financial situation and determine a payment schedule that you can realistically adhere to. Consider your income, expenses, and other financial obligations to propose a reasonable installment plan.

06

Submit your application: Once you have completed the necessary forms and determined your proposed payment schedule, submit your application and any supporting documents to the tax authorities. Ensure that you provide all required information accurately to avoid delays or misunderstandings.

07

Await a response: After submitting your application, patiently wait for a response from the tax authorities. They will review your request and may contact you for additional information or clarification if needed.

08

Implement the approved payment plan: If your installment payment plan is approved, carefully review the terms and conditions outlined by the tax authorities. Make sure you understand the payment amounts, due dates, and any penalties or interest that may apply. Begin making payments according to the agreed-upon schedule.

Who needs tax installment payment plan:

01

Individuals with large tax liabilities: Those who owe a significant amount of tax and are unable to pay it in full at once may need a tax installment payment plan. This option allows them to spread out their payments over a period of time.

02

Self-employed individuals or small business owners: Entrepreneurs and self-employed individuals who have irregular income or face financial challenges may find it helpful to utilize a tax installment payment plan. This allows them to manage their cash flow and meet their tax obligations without causing undue financial strain.

03

Individuals facing unexpected financial hardships: Anyone who experiences a sudden financial setback, such as a job loss, medical emergency, or natural disaster, may struggle to pay their taxes in a lump sum. In such cases, a tax installment payment plan provides breathing room and allows them to fulfill their tax obligations over time.

04

Taxpayers with limited savings or assets: Individuals who have limited savings or assets that they can liquidate to pay their taxes may benefit from a tax installment payment plan. It provides them with a structured payment schedule that aligns with their financial abilities without causing severe financial hardship.

Note: It is important to consult with a tax professional or seek guidance from the appropriate tax authority to ensure that you fully understand the requirements and implications of a tax installment payment plan in your specific jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax installment payment plan?

A tax installment payment plan is a method by which taxpayers can pay their taxes in multiple installments rather than in one lump sum.

Who is required to file tax installment payment plan?

Taxpayers who meet certain criteria, such as owing a large amount of taxes or not being able to pay the full amount by the due date, may be required to file a tax installment payment plan.

How to fill out tax installment payment plan?

Taxpayers can fill out a tax installment payment plan by contacting their tax authority and requesting the necessary forms to be completed.

What is the purpose of tax installment payment plan?

The purpose of a tax installment payment plan is to allow taxpayers to spread out the payment of their taxes over a period of time, making it easier to manage their financial obligations.

What information must be reported on tax installment payment plan?

Taxpayers must report their personal information, income details, tax owed, and proposed installment payment schedule on the tax installment payment plan.

How do I edit tax installment payment plan online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your tax installment payment plan to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I edit tax installment payment plan on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tax installment payment plan, you need to install and log in to the app.

How do I edit tax installment payment plan on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tax installment payment plan on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your tax installment payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Installment Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.