Get the free First Registration Tax Provision of Information on Motor

Show details

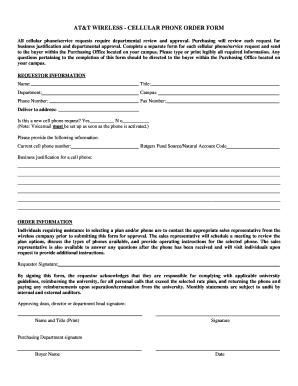

THE GOVERNMENT OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION First Registration Tax Provision of Information on Motor Vehicles For Official Use Only : Serial No. Documents Attached : Invoice Freight

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign first registration tax provision

Edit your first registration tax provision form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first registration tax provision form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing first registration tax provision online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit first registration tax provision. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out first registration tax provision

How to fill out first registration tax provision:

01

Gather all necessary documents: Before starting the process, make sure you have all the required documents, such as proof of purchase or ownership, vehicle information, and identification documents.

02

Determine the applicable tax rate: Depending on the jurisdiction and the type of vehicle, there may be different tax rates for first registration. Check with your local tax authority or department of motor vehicles to determine the specific rate that applies to your situation.

03

Complete the tax form: Obtain the tax form for first registration tax provision from your local tax authority or download it from their website if available. Fill out the form accurately, providing all the necessary information such as your name, address, vehicle details, and any supporting documents required.

04

Calculate the tax amount: Using the applicable tax rate, calculate the total tax amount owed for the first registration. Some jurisdictions may provide a tax calculator or worksheet to help you determine the correct amount.

05

Submit the completed form and pay the tax: Once you have completed the tax form and calculated the amount, submit it along with any required supporting documents to the designated tax office or department. Pay the calculated tax amount using the accepted payment methods, such as cash, check, or electronic payment.

Who needs first registration tax provision?

01

Individuals purchasing a new vehicle: When purchasing a new vehicle, individuals are typically required to pay a first registration tax. This tax helps generate revenue for the government and is based on the price or value of the vehicle.

02

Businesses acquiring new vehicles: Businesses that acquire new vehicles for their operations may also be subject to the first registration tax provision. This includes companies, organizations, and self-employed individuals who use the vehicle for business purposes.

03

Vehicle importers: If you import a new vehicle from another country, you may be required to pay the first registration tax in the destination country. The tax is usually based on the vehicle's value and helps regulate the import of vehicles into the country.

04

Residents moving to another jurisdiction: When residents move to a new jurisdiction or country, they may be required to register their vehicles locally and pay the first registration tax. This ensures that vehicles meet the regulations and standards of the new jurisdiction.

In summary, anyone purchasing a new vehicle, whether as an individual or a business, and individuals importing vehicles or moving to another jurisdiction may need to fill out the first registration tax provision and pay the applicable tax amount. It is important to follow the specific guidelines and procedures set by the local tax authority or department of motor vehicles to ensure compliance and avoid any penalties or delays in vehicle registration.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my first registration tax provision directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your first registration tax provision and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out first registration tax provision using my mobile device?

Use the pdfFiller mobile app to complete and sign first registration tax provision on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete first registration tax provision on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your first registration tax provision. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is first registration tax provision?

The first registration tax provision is a tax imposed on the first registration of a motor vehicle.

Who is required to file first registration tax provision?

Individuals or businesses who are registering a motor vehicle for the first time are required to file the first registration tax provision.

How to fill out first registration tax provision?

To fill out the first registration tax provision, you need to provide information about the vehicle being registered, including its make, model, year, and purchase price.

What is the purpose of first registration tax provision?

The purpose of the first registration tax provision is to generate revenue for the government and ensure that all motor vehicles are properly registered.

What information must be reported on first registration tax provision?

The information that must be reported on the first registration tax provision includes the vehicle's make, model, year, purchase price, and any applicable exemptions or discounts.

Fill out your first registration tax provision online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

First Registration Tax Provision is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.