Get the free Personal Accident Only

Show details

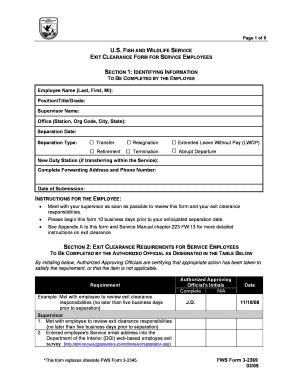

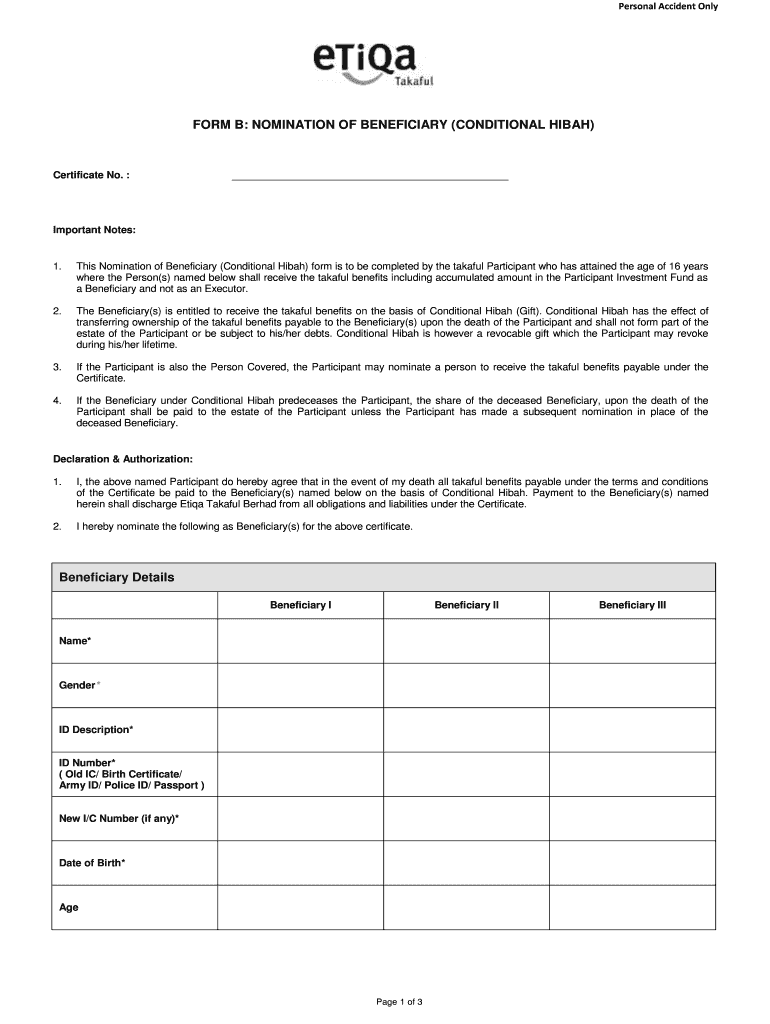

Personal Accident Only FORM B: NOMINATION OF BENEFICIARY (CONDITIONAL HI BAH) Certificate No. Important Notes: 1. This Nomination of Beneficiary (Conditional Hi bah) form is to be completed by the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal accident only

Edit your personal accident only form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal accident only form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal accident only online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit personal accident only. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal accident only

How to Fill Out Personal Accident Only:

01

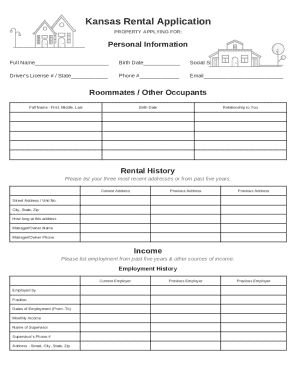

Gather necessary information: Start by collecting all the relevant details needed to fill out the personal accident only form. This may include your personal information such as name, address, contact details, and occupation. Additionally, you might need to provide information about any pre-existing medical conditions or disabilities.

02

Read the instructions: Carefully go through the instructions provided on the form. Make sure you understand each section and the specific details they require.

03

Personal details: Begin by filling out your personal information accurately. Provide your full name, address, phone number, and email address. Double-check the information for any errors before moving on to the next section.

04

Coverage details: Specify the type of coverage you are applying for under the personal accident only plan. This could include options such as accidental death benefit, permanent disability benefit, medical expenses, or daily hospital cash allowance. Select the coverage that suits your needs and preferences.

05

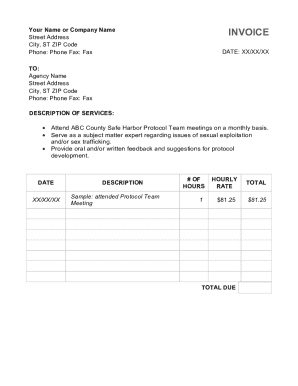

Beneficiary details: If applicable, provide the necessary information regarding the beneficiary who will receive the benefits in case of any accidental event. Include their full name, relationship to you, contact information, and any other required details.

06

Medical history: Some personal accident only forms may ask for information about your pre-existing medical conditions or disability status. Be sure to accurately disclose any relevant details as requested. This information helps insurers assess the level of risk and determines the terms of coverage.

07

Signature and date: Once you have completed filling out the form, review all the information provided and ensure its accuracy. Sign and date the form in the designated area to validate the document.

Who needs personal accident only?

01

Individuals with high-risk occupations: People working in hazardous occupations such as construction workers, miners, or firefighters may benefit from personal accident only coverage. These professions often involve higher risks and the likelihood of accidents at the workplace.

02

Frequent travelers: Individuals who travel extensively for work or leisure may consider personal accident only coverage. While exploring unfamiliar territories or engaging in adventurous activities, accidents can happen unexpectedly. Having this coverage can provide financial protection against unforeseen circumstances.

03

Independent contractors or freelancers: Since self-employed individuals usually lack the benefits provided by traditional employers, they might find personal accident only coverage advantageous. In case of an accident leading to temporary or permanent disability, this coverage can offer financial support during the recovery period.

04

Active individuals engaging in high-risk hobbies: People who participate in extreme sports, adventure activities, or hobbies like skydiving, rock climbing, or racing may find personal accident only coverage beneficial. Such activities come with inherent risks, and a comprehensive accident cover can provide peace of mind and financial protection.

It is important to consult with an insurance professional or agent to determine if personal accident only coverage is the right choice for your individual circumstances and needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the personal accident only form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign personal accident only. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete personal accident only on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your personal accident only. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit personal accident only on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share personal accident only on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is personal accident only?

Personal accident only is a type of insurance policy that provides coverage for accidental injuries or death.

Who is required to file personal accident only?

Individuals who wish to protect themselves or their family members from financial burden in case of accidental injuries or death are required to file personal accident only.

How to fill out personal accident only?

To fill out a personal accident only insurance policy, individuals need to provide personal information, select coverage options, and pay the required premium.

What is the purpose of personal accident only?

The purpose of personal accident only insurance is to provide financial protection in the event of accidental injuries or death.

What information must be reported on personal accident only?

Information such as personal details, beneficiaries, coverage options, and medical history may need to be reported on a personal accident only insurance policy.

Fill out your personal accident only online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Accident Only is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.