Get the free No Par Value Share Capital, Share Buybacks and

Show details

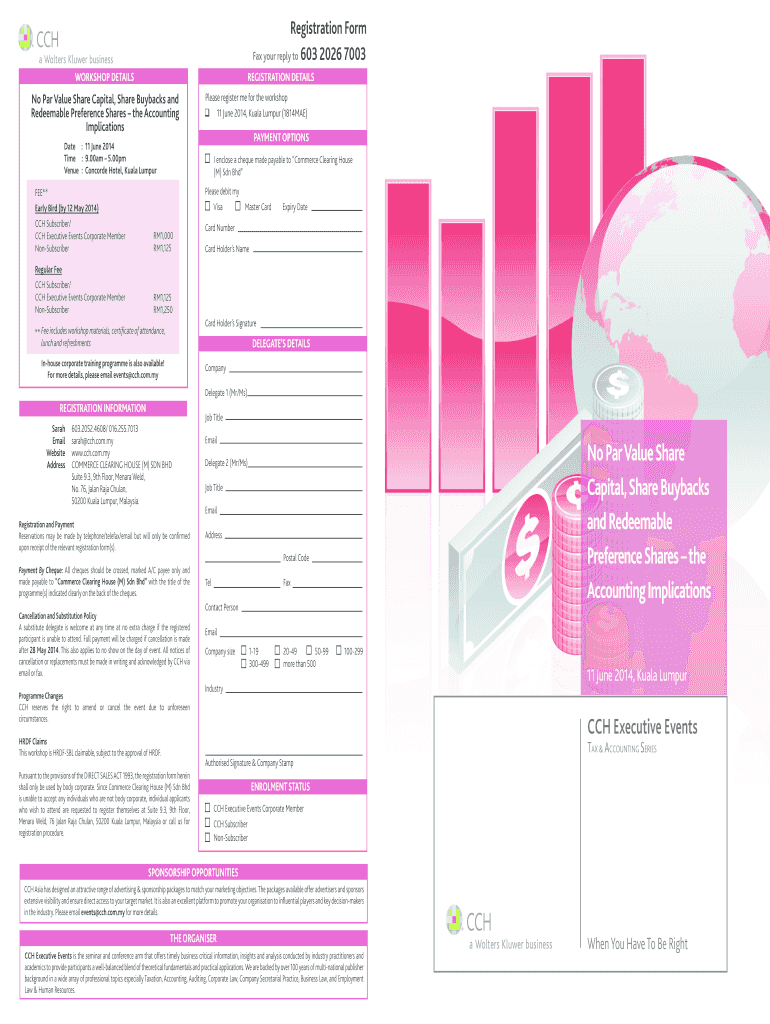

Registration Form Fax your reply to 603 2026 7003 WORKSHOP DETAILS REGISTRATION DETAILS No Par Value Share Capital, Share Buybacks and Redeemable Preference Shares the Accounting Implications Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign no par value share

Edit your no par value share form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your no par value share form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit no par value share online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit no par value share. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out no par value share

How to fill out no par value share:

01

Determine the company's capital structure: Before filling out the no par value share, it is important to understand the company's capital structure. This includes identifying the total number of shares authorized, the classes of shares, and any restrictions or special provisions related to the shares.

02

Identify the purpose of issuing no par value shares: No par value shares are typically issued when a company wants to raise capital without assigning a specific value to each share. Determine the purpose of issuing these shares, whether it is for fundraising, acquisitions, employee stock options, or other business needs.

03

Consult legal and regulatory requirements: Research the relevant laws and regulations regarding the issuance of no par value shares in your jurisdiction. Different countries and states may have specific rules and guidelines that need to be followed. It is important to comply with all legal requirements to avoid any legal complications in the future.

04

Prepare the necessary documentation: Generally, filling out no par value shares requires the preparation of various legal documents. These may include articles of incorporation, share issuance resolutions, share certificates, and shareholder agreements. Consult legal professionals or company officials to ensure all the necessary documentation is prepared accurately.

05

Determine the number of shares to be issued: Decide on the number of no par value shares to be issued based on the company's financing needs and the purpose of the share issuance. This decision should be made in consultation with the company's board of directors and shareholders.

Who needs no par value share?

01

Start-up companies: No par value shares are often preferred by start-up companies as it allows them to attract investors without assigning a specific value to each share. This flexibility can be beneficial when negotiating with potential investors or when assessing the company's valuation.

02

Companies looking to raise capital: Issuing no par value shares can be an effective way for companies to raise capital. Since the value of each share is not fixed, it provides flexibility in pricing the shares and attracting investors.

03

Companies planning acquisitions or mergers: No par value shares can be used to facilitate acquisitions or mergers, as they allow for easier valuation calculations and the issuance of shares as part of the deal. This flexibility can make the transaction process smoother and more efficient.

04

Companies considering employee stock options: Offering no par value shares as part of an employee stock option plan can be advantageous. Employees can be granted a certain number of shares without having to worry about the value of each share. This can incentivize employees and align their interests with the company's success.

Overall, no par value shares can be beneficial to a wide range of companies for various reasons. It is important to carefully consider the specific needs and objectives of the company before deciding to fill out no par value shares. Consulting legal and financial professionals can help ensure compliance with relevant regulations and optimal utilization of these shares.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit no par value share from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including no par value share, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find no par value share?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the no par value share in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for signing my no par value share in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your no par value share right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is no par value share?

No par value share is a type of share that does not have a specific monetary value assigned to it.

Who is required to file no par value share?

Companies issuing shares without a par value are required to file information about these shares.

How to fill out no par value share?

To fill out a no par value share, companies must provide detailed information about the shares being issued, including the number of shares and any additional terms or conditions.

What is the purpose of no par value share?

The purpose of no par value share is to give companies flexibility in setting the value of their shares and to simplify the process of issuing shares.

What information must be reported on no par value share?

Companies must report the number of shares being issued, any rights or restrictions attached to the shares, and any other relevant details about the shares.

Fill out your no par value share online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

No Par Value Share is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.