Get the free first international merchant bank p

Show details

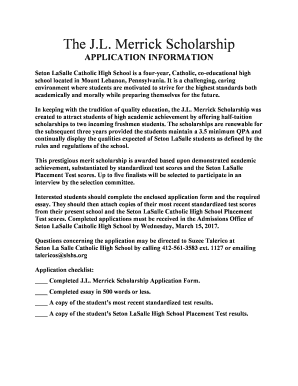

EMBANK first international merchant bank p.l.c. FIRST INTERNATIONAL MERCHANT BANK P.L.C. OFFERING MEMORANDUM dated 16th May 2001 in respect of the ISSUE OF 6,000,000 ORDINARY SHARES OF A NOMINAL VALUE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign first international merchant bank

Edit your first international merchant bank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first international merchant bank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing first international merchant bank online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit first international merchant bank. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out first international merchant bank

How to fill out first international merchant bank:

01

Start by gathering all the necessary documents and information. This may include your personal identification, business information, financial statements, and any relevant legal or regulatory documents.

02

Once you have all the required documents, carefully read through the application form provided by the first international merchant bank. Make sure you understand each section and what information is required.

03

Begin filling out the application form by accurately entering your personal and business information. This may include your name, address, phone number, email, business name, and type of business.

04

Provide relevant financial information such as your annual revenue, assets, liabilities, and any outstanding debts. This will help the bank assess your financial stability and determine your eligibility for their services.

05

If necessary, attach or upload any supporting documents or proof of financial standing requested by the bank. This may include bank statements, tax returns, profit and loss statements, or business licenses.

06

Review your completed application form to ensure that all the information provided is accurate and up to date. Double-check for any errors or missing sections.

07

Submit your application form and supporting documents to the first international merchant bank either online or through their designated submission channels. Follow their specific instructions for submission to ensure that your application is received and processed promptly.

Who needs first international merchant bank:

01

Businesses or individuals involved in international trade or commerce often require the services of a first international merchant bank. This is because such banks specialize in providing financial solutions and services for cross-border transactions and foreign currency exchange.

02

Start-up businesses or entrepreneurs looking to establish a global presence can benefit from the expertise and resources offered by a first international merchant bank. These banks often provide guidance on entering new markets, managing currency risks, and optimizing international payment processes.

03

Companies involved in e-commerce or online businesses that operate in multiple countries may find value in working with a first international merchant bank. This is because these banks offer tailored solutions for handling online payments, mitigating fraud, and optimizing cross-border transactions.

In summary, filling out the application form for a first international merchant bank involves gathering the necessary documents, accurately entering personal and financial information, and submitting the completed form. These banks cater to businesses and individuals involved in international trade and commerce, as well as those looking to establish a global presence or operate online businesses in multiple countries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is first international merchant bank?

The first international merchant bank is a financial institution that provides services to international clients for trading and investments.

Who is required to file first international merchant bank?

Individuals or entities that are engaged in international trade or investment activities and meet certain criteria are required to file a first international merchant bank.

How to fill out first international merchant bank?

To fill out a first international merchant bank report, individuals or entities need to gather all relevant financial information and report it accurately according to the specified format and guidelines.

What is the purpose of first international merchant bank?

The purpose of first international merchant bank is to provide detailed information on international trade and investment activities to regulatory authorities for monitoring and compliance purposes.

What information must be reported on first international merchant bank?

Information such as transaction details, parties involved, payment methods, and other relevant financial data must be reported on a first international merchant bank form.

How can I get first international merchant bank?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the first international merchant bank in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for the first international merchant bank in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your first international merchant bank in seconds.

How can I fill out first international merchant bank on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your first international merchant bank. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your first international merchant bank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

First International Merchant Bank is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.