Get the free Business Property Assessment Return - muni

Show details

This document serves as the business property assessment return form for the Municipality of Anchorage, requiring business owners to report personal property information for taxation purposes. It

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business property assessment return

Edit your business property assessment return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business property assessment return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business property assessment return online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business property assessment return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business property assessment return

How to fill out Business Property Assessment Return

01

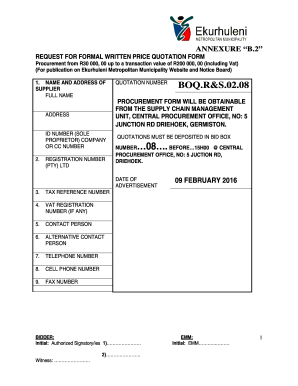

Obtain the Business Property Assessment Return form from your local assessment office or download it from their website.

02

Enter your business name and address at the top of the form.

03

Provide your business identification number, if applicable.

04

List all business personal property you own, including furniture, equipment, and inventory.

05

Record the purchase dates and original costs of each item listed.

06

Calculate the total value of your business property by summing up the individual values.

07

Complete any additional sections required by your local assessment office, such as exemptions or special considerations.

08

Review the completed form for accuracy and make any necessary corrections.

09

Sign and date the form before submitting it by the due date, either online or via mail as instructed.

Who needs Business Property Assessment Return?

01

All business owners who possess tangible personal property for commercial purposes within the jurisdiction that requires a Business Property Assessment Return.

Fill

form

: Try Risk Free

People Also Ask about

What is considered business Personal Property in California?

Business Personal Property includes all supplies, equipment and any fixtures used in the operation of a business. Exempt from reporting are business inventory, application software and licensed vehicles (except Special Equipment (SE) tagged and off-road vehicles).

Do I have to file a business property statement in California?

An annual filing of a Business Property Statement (PDF) is a requirement of section 441(d) of the California Revenue and Taxation Code. Statements are sent in order to gather the most up to date information on the business property so that an accurate value can be determined.

How much is business property tax in California?

FAQ: Understanding Commercial Property Tax & Revenue in California. How Are Commercial and Industrial Properties Taxed Today? The general property tax rate for California commercial and industrial properties has been capped at 1% of assessed value since voters approved Prop. 13 in 1978.

What is personal property coverage in California?

Personal property coverage helps pay to repair or replace your clothing, furniture, sporting gear, appliances, and other belongings that get stolen or damaged by a peril that's listed in your home, condo, or rental insurance policy.

What is considered private property in California?

The term PRIVATE PROPERTY shall mean any real property, including but not limited to, buildings, structures, yards, open spaces, walkways, courtyards, driveways, carports, parking areas and vacant lots, except land which is used exclusively for agricultural purposes, owned by any person or legal entity other than the

What is an example of personal property in California?

Under California's Civil Code, personal property is broadly defined to include “everything that is the subject of ownership, not forming part of any parcel of real property” (Civ. Code § 663). Types of Personal Property: Tangible personal property (e.g., furniture, vehicles)

What is considered commercial property in California?

Commercial property refers to any real estate specifically intended to generate profit or facilitate business operations. This includes office spaces, retail locations, industrial facilities, warehouses, and multifamily apartment complexes with five or more units.

What is business Personal Property tax SC?

Business Personal Property Tax (BPP) is a tax on the furniture, fixtures, and equipment that are owned and used in a business. Any assets that are claimed on the business' income taxes should be reported on the BPP tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Property Assessment Return?

The Business Property Assessment Return is a document that businesses are required to file to report their personal property holdings for tax assessment purposes.

Who is required to file Business Property Assessment Return?

Typically, businesses that own or lease personal property used in their operations, such as equipment, furniture, and inventory, are required to file the Business Property Assessment Return.

How to fill out Business Property Assessment Return?

To fill out the Business Property Assessment Return, businesses should provide details about their personal property, including descriptions, acquisition dates, and estimated values, as well as any other required information based on local regulations.

What is the purpose of Business Property Assessment Return?

The purpose of the Business Property Assessment Return is to ensure that local governments have accurate information to assess property taxes on personal property owned or used by businesses.

What information must be reported on Business Property Assessment Return?

The information that must be reported includes the type and description of personal property, its location, the date of acquisition, original cost, and any depreciation allowances, as well as any other specifics required by the local assessment authority.

Fill out your business property assessment return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Property Assessment Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.