Get the free SENIOR CITIZEN EXEMPTION - www2 borough kenai ak

Show details

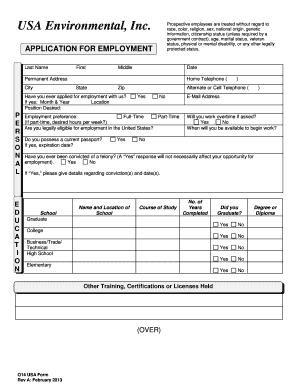

This document is an application for the Senior Citizen Exemption, which includes the $20,000 residential exemption. It outlines eligibility requirements, such as age verification and property details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senior citizen exemption

Edit your senior citizen exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senior citizen exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit senior citizen exemption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit senior citizen exemption. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out senior citizen exemption

How to fill out SENIOR CITIZEN EXEMPTION

01

Determine if you meet the age requirement (typically, you must be 65 years or older).

02

Gather necessary documentation such as proof of age and income statements.

03

Obtain the Senior Citizen Exemption application form from your local tax office or website.

04

Fill out the application form with accurate personal information including name, address, date of birth, and income details.

05

Attach the required documents to your application.

06

Review the application to ensure all information is correct.

07

Submit the completed application to the appropriate local tax authority before the deadline.

08

Keep a copy of the submitted application and any supporting documents for your records.

Who needs SENIOR CITIZEN EXEMPTION?

01

Seniors aged 65 and older who own property and wish to reduce their property tax burden.

02

Homeowners who may have a limited income and need financial assistance through tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

What classifies you as a senior citizen?

In the United States it is generally considered that a senior citizen is anyone of retirement age, or a person that has reached age 62 or older.

What are the common conditions in seniors?

Aging increases the risk of chronic diseases like dementia, heart disease, type 2 diabetes, arthritis, and cancer. Older adults are also more vulnerable to severe illness from infections, including flu and pneumonia.

What is the senior citizen exemption in Florida?

Senior Citizen Exemption for Persons Age 65 and Over There is an additional $50,000 homestead exemption (FLORIDA STATUTE 196.075) for person 65 and older. This $50,000 applies to non-school taxes.

What is the condition of senior citizen?

According to the law, a "senior citizen" means any person being a citizen of India, who has attained the age of sixty years or above.

What is the age limit for senior citizens?

Senior citizen (Age 60 years or more but less than 80 years): A senior citizen is granted a higher exemption limit compared to non-senior citizens. The exemption limit under the old tax regime is Rs. 3,00,000 and in the new tax regime is Rs 2,50,000.

What is the senior citizen condition?

According to the law, a "senior citizen" means any person being a citizen of India, who has attained the age of sixty years or above.

Is senior citizen exempted?

A senior citizen who derives taxable (fixed) compensation income from only one employer in an amount not exceeding P60,000 per annum shall be exempt from income tax and consequently from the withholding tax prescribed under section 72 Chapter 10, Title II of the National Internal Code, as amended.

Who qualifies to be a senior citizen?

A senior citizen is typically defined as an individual who is 65 years or older, though this definition can vary depending on context. Age-based classifications are often limiting, as studies emphasize the importance of managing attitudes toward people of different ages and avoiding stereotypes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SENIOR CITIZEN EXEMPTION?

The Senior Citizen Exemption is a tax relief program that allows senior citizens to reduce the amount of property taxes they owe based on age and income criteria.

Who is required to file SENIOR CITIZEN EXEMPTION?

To qualify for the Senior Citizen Exemption, individuals typically must be 65 years of age or older, and in some jurisdictions, they may also need to meet specific income requirements.

How to fill out SENIOR CITIZEN EXEMPTION?

To fill out the Senior Citizen Exemption application, eligible seniors must complete the designated form provided by their local tax authority, including details such as age, income, and ownership status of the property.

What is the purpose of SENIOR CITIZEN EXEMPTION?

The purpose of the Senior Citizen Exemption is to provide financial relief to eligible seniors by lowering their property tax burden, thus helping them maintain their homes and quality of life.

What information must be reported on SENIOR CITIZEN EXEMPTION?

When applying for the Senior Citizen Exemption, individuals must report information such as their age, income, property ownership details, and any other documentation requested by the tax authority.

Fill out your senior citizen exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senior Citizen Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.